Real rigidity occurs when prices and wages remain fixed despite changes in economic conditions, preventing markets from adjusting efficiently. This rigidity can lead to unemployment and decreased economic output during downturns because businesses cannot lower wages or prices to stimulate demand. Discover how understanding real rigidity can help you grasp the complexities of labor markets and economic fluctuations further in the article.

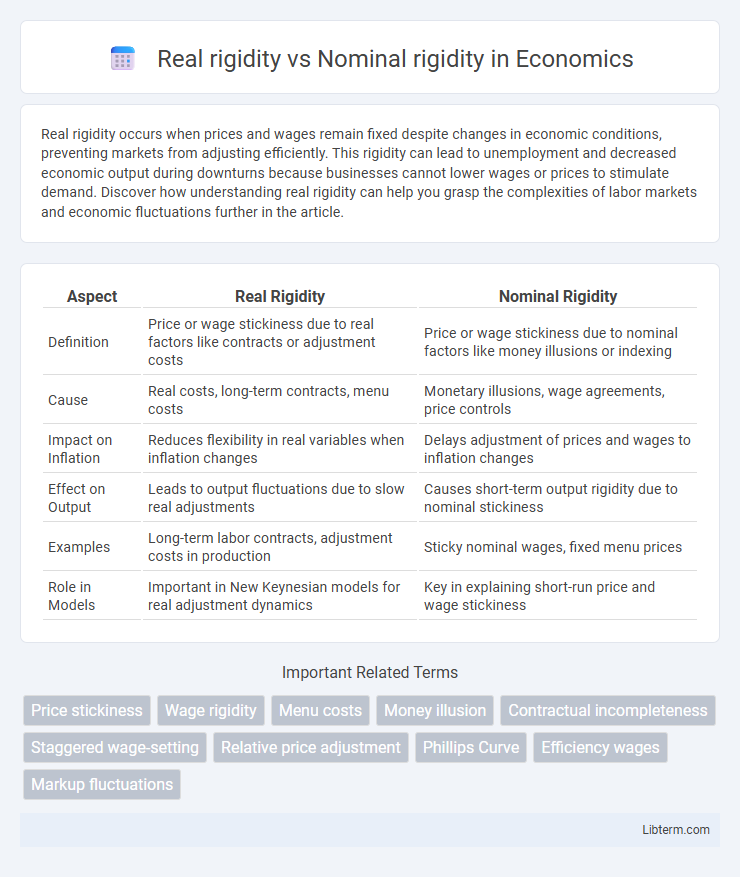

Table of Comparison

| Aspect | Real Rigidity | Nominal Rigidity |

|---|---|---|

| Definition | Price or wage stickiness due to real factors like contracts or adjustment costs | Price or wage stickiness due to nominal factors like money illusions or indexing |

| Cause | Real costs, long-term contracts, menu costs | Monetary illusions, wage agreements, price controls |

| Impact on Inflation | Reduces flexibility in real variables when inflation changes | Delays adjustment of prices and wages to inflation changes |

| Effect on Output | Leads to output fluctuations due to slow real adjustments | Causes short-term output rigidity due to nominal stickiness |

| Examples | Long-term labor contracts, adjustment costs in production | Sticky nominal wages, fixed menu prices |

| Role in Models | Important in New Keynesian models for real adjustment dynamics | Key in explaining short-run price and wage stickiness |

Introduction to Real and Nominal Rigidity

Real rigidity refers to the resistance of quantities such as labor hours or capital services to adjust in response to changes in real wages or prices, affecting production and employment levels. Nominal rigidity involves the slow adjustment of nominal prices and wages due to menu costs, contracts, or informational frictions, causing price stickiness in the short run. Understanding the distinction between real and nominal rigidity is crucial for analyzing how economic agents and markets respond to monetary and real shocks.

Defining Real Rigidity

Real rigidity refers to the resistance of quantities such as output, employment, or real wages to adjust in response to changes in real economic conditions like productivity or preferences. Unlike nominal rigidity, which involves price and wage stickiness in monetary terms, real rigidity emphasizes the limited responsiveness of real factors despite changes in real prices or costs. This concept explains persistent unemployment or output gaps when real adjustments fail to restore equilibrium efficiently.

Understanding Nominal Rigidity

Nominal rigidity refers to the resistance of prices and wages to adjust immediately in response to changes in the economy, causing short-term mismatches in supply and demand. This phenomenon often results from contracts, menu costs, or psychological factors, leading to slower inflation or deflation adjustments. Understanding nominal rigidity helps explain why monetary policy can have real effects on output and employment despite flexible prices in the long run.

Key Differences Between Real and Nominal Rigidity

Real rigidity refers to the inflexibility of quantities like labor hours or goods supplied in response to changes in real variables such as wages or prices, while nominal rigidity involves the resistance of nominal prices or wages to adjust despite shifts in the overall price level. Key differences include that real rigidity affects real economic variables and output, influencing how firms and workers respond to productivity changes, whereas nominal rigidity pertains to price and wage stickiness that can delay market clearing and result in short-term unemployment. Understanding these distinctions is crucial for analyzing monetary policy impacts and macroeconomic fluctuations.

Causes of Real Rigidity in Markets

Real rigidity in markets arises primarily from factors such as long-term contracts, adjustment costs, and customer-supplier relationships that prevent prices and wages from responding swiftly to changes in economic conditions. Institutional factors like labor unions and menu costs also contribute by creating friction in wage and price flexibility. These rigidities result in persistent deviations from equilibrium, amplifying the impact of nominal shocks on real economic variables.

Factors Contributing to Nominal Rigidity

Nominal rigidity arises from factors such as menu costs, wage contracts, and price adjustment costs that prevent immediate changes in nominal prices and wages despite shifts in economic conditions. Firms face menu costs when altering prices, leading to infrequent price adjustments, while wage contracts and implicit agreements create sticky nominal wages in labor markets. These nominal rigidities delay the economy's response to monetary policy and price level changes, causing short-term fluctuations in output and employment.

Real Rigidity: Economic Implications

Real rigidity refers to the persistence of real wages and prices despite changes in economic conditions, limiting the labor market's ability to adjust to shocks. This rigidity can exacerbate unemployment and slow economic recovery by preventing efficient allocation of resources. Real rigidity intensifies the effects of nominal rigidities, contributing to prolonged periods of economic downturns and reducing the effectiveness of monetary policy.

Nominal Rigidity and Inflation Dynamics

Nominal rigidity refers to the slow adjustment of prices and wages in response to changes in economic conditions, which significantly influences inflation dynamics by causing persistent deviations from equilibrium prices. Inflation persistence often arises because firms and workers set prices and wages based on past inflation expectations, leading to gradual price adjustments rather than instantaneous corrections. This stickiness in nominal variables amplifies the effects of monetary policy, making inflation rates more resistant to shocks and prolonging inflationary or deflationary phases.

Policy Responses to Market Rigidities

Real rigidity refers to the resistance of prices and wages to adjust due to structural factors such as contract laws or labor market institutions, while nominal rigidity involves delays in price or wage changes caused by menu costs or information frictions. Policy responses to real rigidity often include structural reforms aimed at enhancing labor market flexibility and reducing regulatory constraints, whereas nominal rigidity is typically addressed through monetary policy actions like adjusting interest rates to influence inflation expectations. Effective mitigation of market rigidities requires coordinated interventions targeting both real and nominal frictions to improve economic responsiveness and stabilize output fluctuations.

Conclusion: Balancing Real and Nominal Rigidities

Effective economic policy requires balancing real rigidity, which involves factors like fixed contracts and slow price adjustments, with nominal rigidity, characterized by sticky wages and prices due to menu costs or informational constraints. Addressing nominal rigidity can enhance the flexibility of prices and wages, while considering real rigidity ensures that adjustments do not disrupt long-term employment and output stability. Combining strategies targeting both rigidities supports smoother economic adjustments and improves policy effectiveness in stabilizing inflation and promoting growth.

Real rigidity Infographic

libterm.com

libterm.com