The permanent income hypothesis suggests that individuals base their consumption decisions on their expected long-term average income rather than their current income fluctuations. This theory helps explain why people may save or borrow in response to temporary changes in income to maintain stable consumption levels. Explore the rest of this article to understand how the permanent income hypothesis impacts economic behavior and policy.

Table of Comparison

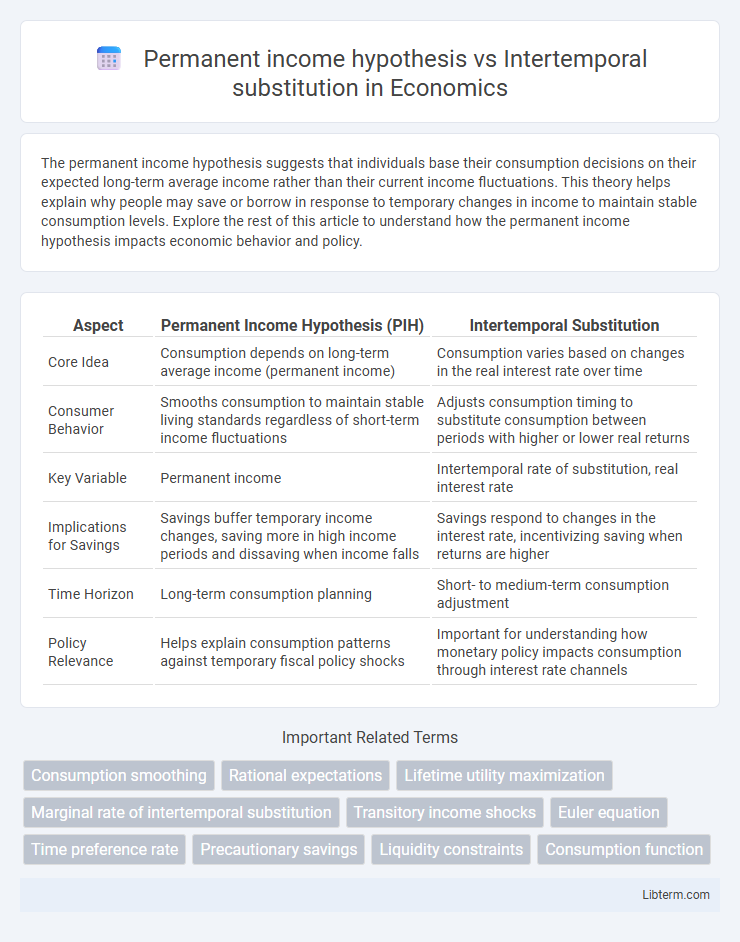

| Aspect | Permanent Income Hypothesis (PIH) | Intertemporal Substitution |

|---|---|---|

| Core Idea | Consumption depends on long-term average income (permanent income) | Consumption varies based on changes in the real interest rate over time |

| Consumer Behavior | Smooths consumption to maintain stable living standards regardless of short-term income fluctuations | Adjusts consumption timing to substitute consumption between periods with higher or lower real returns |

| Key Variable | Permanent income | Intertemporal rate of substitution, real interest rate |

| Implications for Savings | Savings buffer temporary income changes, saving more in high income periods and dissaving when income falls | Savings respond to changes in the interest rate, incentivizing saving when returns are higher |

| Time Horizon | Long-term consumption planning | Short- to medium-term consumption adjustment |

| Policy Relevance | Helps explain consumption patterns against temporary fiscal policy shocks | Important for understanding how monetary policy impacts consumption through interest rate channels |

Introduction to Consumption Theories

Permanent income hypothesis posits that consumers base their spending on an estimate of their long-term average income rather than current income fluctuations, emphasizing consumption smoothing over time. Intertemporal substitution theory focuses on how consumers alter their consumption patterns in response to changes in the relative price of consumption today versus the future, driven by interest rate variations. Both theories provide crucial insights into consumption behavior, influencing the understanding of savings decisions and responses to economic policies.

Overview of the Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH), developed by economist Milton Friedman, posits that individuals base their consumption decisions on an estimate of their long-term average income rather than current income fluctuations. This theory explains consumption smoothing, where temporary income changes have minimal impact on spending patterns, as consumers save or borrow to maintain stable consumption over time. The PIH contrasts with Intertemporal Substitution Theory, which emphasizes consumption changes driven by variations in the real interest rate and the intertemporal allocation of resources.

Fundamentals of Intertemporal Substitution

Intertemporal substitution theory explains consumption choices based on changes in the real interest rate, where individuals optimally allocate spending over time to maximize lifetime utility. This contrasts with the Permanent Income Hypothesis, which emphasizes consumption smoothing based on predictable lifetime income rather than interest rate fluctuations. Core fundamentals of intertemporal substitution include the elasticity of intertemporal substitution, reflecting willingness to shift consumption between periods in response to changes in the intertemporal rate of substitution.

Core Assumptions of Both Models

The Permanent Income Hypothesis (PIH) assumes that individuals base consumption on their long-term average income, smoothing consumption despite short-term income fluctuations, with uncertainty about future income shaping saving behavior. Intertemporal substitution theory posits that consumers adjust their consumption over time in response to expected changes in the real interest rate, substituting consumption between periods to maximize lifetime utility. Both models assume rational agents optimizing utility but differ as PIH emphasizes income expectations for consumption smoothing, whereas intertemporal substitution highlights the role of relative price changes across time.

Mathematical Formulation and Consumption Smoothing

The Permanent Income Hypothesis (PIH) mathematically models consumption \(C_t\) as a function of permanent income \(Y^p_t\), formulated as \(C_t = \alpha Y^p_t\), emphasizing stable consumption through smoothing despite transitory income fluctuations. Intertemporal substitution, expressed via the Euler equation \(U'(C_t) = \beta (1 + r) U'(C_{t+1})\), captures consumption choices based on optimizing utility intertemporally by reallocating consumption in response to changes in the real interest rate \(r\). While PIH highlights consumption smoothing by anchoring spending to permanent income, intertemporal substitution focuses on utility maximization over time, leading to consumption adjustments sensitive to interest rate variations.

Short-term vs. Long-term Income Changes

The Permanent Income Hypothesis posits that individuals adjust consumption based on long-term average income rather than short-term fluctuations, smoothing their spending to reflect expected lifetime earnings. In contrast, Intertemporal Substitution emphasizes changes in consumption timing driven by short-term income variations and interest rate fluctuations, where individuals shift consumption across periods to optimize utility. Short-term income changes thus have limited impact under the Permanent Income Hypothesis, whereas they play a crucial role in consumption adjustments according to Intertemporal Substitution.

Empirical Evidence Supporting Each Theory

Empirical evidence for the Permanent Income Hypothesis (PIH) highlights that consumer spending remains stable despite short-term income fluctuations, as shown in longitudinal income and consumption data supporting Milton Friedman's theory. Studies using panel data confirm that individuals base consumption on expected long-term income rather than current earnings, aligning with PIH predictions. Meanwhile, empirical tests of the Intertemporal Substitution Model (ISM) reveal consumption changes in response to interest rate variations, with data from macroeconomic experiments and labor supply shifts demonstrating consumers' tendency to adjust spending by intertemporal trade-offs.

Policy Implications and Behavioral Responses

Permanent income hypothesis suggests that fiscal policies targeting long-term income stability, such as tax reforms or social security enhancements, effectively influence consumer spending by aligning with anticipated lifetime earnings. Intertemporal substitution emphasizes the timing of consumption in response to interest rate changes, indicating that monetary policies altering rates can shift consumption and saving patterns over different periods. Behavioral responses to these theories highlight the need for tailored policy designs that consider both persistent income expectations and consumers' sensitivity to short-term incentives in shaping effective demand management.

Limitations and Critiques of Both Approaches

The Permanent Income Hypothesis faces criticism for its assumption of rational expectations and stable income, which overlooks income volatility and liquidity constraints affecting consumption choices. Intertemporal substitution theory is often challenged due to its reliance on flexible interest rates and perfect foresight, ignoring behavioral biases and imperfect capital markets that limit consumers' ability to adjust consumption over time. Both models struggle to fully capture real-world complexities such as precautionary savings and heterogeneity in preferences, leading to gaps in explaining actual consumer behavior.

Synthesis: Comparative Insights and Future Directions

The Permanent Income Hypothesis emphasizes consumption smoothing based on long-term average income, while Intertemporal Substitution prioritizes consumption changes driven by fluctuating intertemporal rates of return. Comparative analysis reveals that integrating both frameworks enhances predictive accuracy for consumer behavior under varying economic conditions. Future research should focus on hybrid models incorporating behavioral nuances and real-time data to refine consumption forecasting.

Permanent income hypothesis Infographic

libterm.com

libterm.com