Deflation is the sustained decrease in the general price level of goods and services, which increases the purchasing power of your money but can also signal weak demand in the economy. It often leads to reduced consumer spending and can cause businesses to cut back on production and wages, potentially triggering a recession. Explore the full article to understand the causes, effects, and strategies to manage deflation effectively.

Table of Comparison

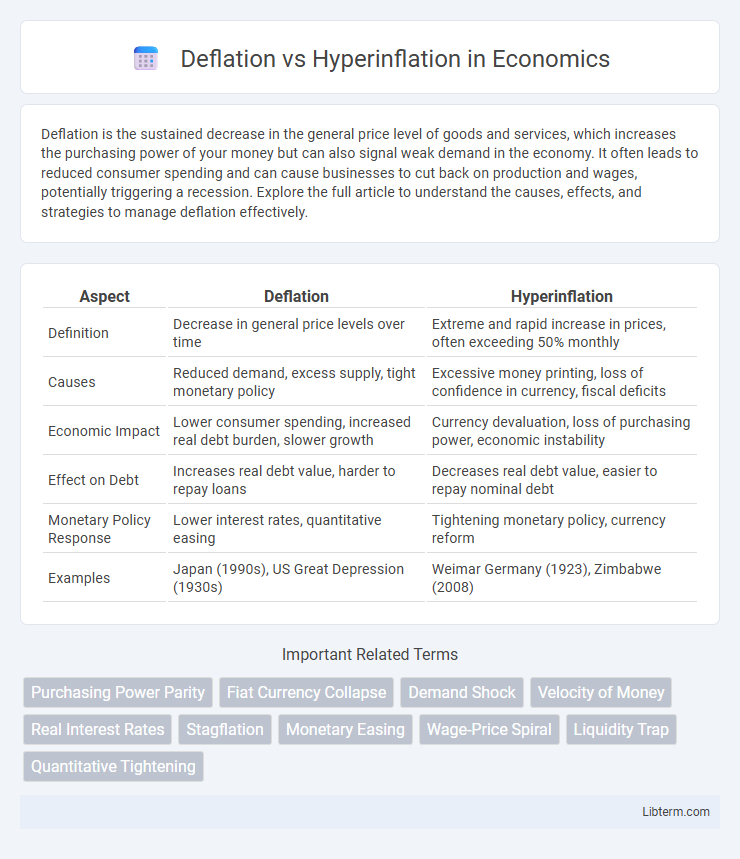

| Aspect | Deflation | Hyperinflation |

|---|---|---|

| Definition | Decrease in general price levels over time | Extreme and rapid increase in prices, often exceeding 50% monthly |

| Causes | Reduced demand, excess supply, tight monetary policy | Excessive money printing, loss of confidence in currency, fiscal deficits |

| Economic Impact | Lower consumer spending, increased real debt burden, slower growth | Currency devaluation, loss of purchasing power, economic instability |

| Effect on Debt | Increases real debt value, harder to repay loans | Decreases real debt value, easier to repay nominal debt |

| Monetary Policy Response | Lower interest rates, quantitative easing | Tightening monetary policy, currency reform |

| Examples | Japan (1990s), US Great Depression (1930s) | Weimar Germany (1923), Zimbabwe (2008) |

Understanding Deflation and Hyperinflation

Deflation occurs when the general price levels in an economy decline, increasing the purchasing power of money but potentially leading to reduced consumer spending and economic slowdown. Hyperinflation is characterized by an extremely rapid and uncontrollable rise in prices, often exceeding 50% per month, which severely devalues the currency and disrupts economic stability. Understanding these contrasting phenomena is crucial for policymakers to implement effective monetary and fiscal strategies that maintain price stability and economic growth.

Causes of Deflation

Deflation primarily results from a significant drop in consumer demand, often triggered by economic recessions, high unemployment rates, or reduced government spending. Excess supply of goods and services combined with tight credit conditions further exacerbate falling prices. Persistent deflation can lead to decreased business revenues, layoffs, and a prolonged downward economic spiral.

Causes of Hyperinflation

Hyperinflation primarily results from excessive money supply growth where governments print currency at unsustainable rates to finance large budget deficits. Loss of confidence in a currency combined with collapsing fiscal and monetary policies accelerates demand-pull and cost-push inflation dynamics. External shocks, such as war or political instability, can exacerbate hyperinflation by disrupting production and currency stability.

Historical Examples: Deflation

Deflation has historically occurred during severe economic downturns, notably the Great Depression of the 1930s, where US consumer prices dropped by nearly 10% between 1930 and 1933. Japan experienced a prolonged deflationary period from the 1990s through the 2010s, known as the "Lost Decade," characterized by stagnant growth and falling prices. These historical examples highlight how deflation is often linked with reduced consumer demand, declining wages, and increased debt burdens that can exacerbate economic recessions.

Historical Examples: Hyperinflation

The Weimar Republic in Germany during the early 1920s experienced one of the most severe cases of hyperinflation, where prices doubled every few days, devastating the economy and wiping out savings. Zimbabwe's hyperinflation in the late 2000s saw the inflation rate peak at 79.6 billion percent month-on-month, leading to the abandonment of its currency. More recently, Venezuela's hyperinflation since 2016 has caused massive economic contraction, driven by political instability and collapsing oil revenues.

Economic Impacts of Deflation

Deflation leads to decreased consumer spending as prices fall, causing businesses to reduce production and lay off workers, which can deepen economic recessions. It increases the real value of debt, burdening borrowers and limiting investment, slowing economic growth. Persistent deflation often results in lower wages and higher unemployment, exacerbating economic instability and reducing overall demand.

Economic Impacts of Hyperinflation

Hyperinflation severely erodes purchasing power, causing prices to skyrocket uncontrollably and destabilizing the economy. It disrupts normal business operations, leading to reduced investment, soaring unemployment rates, and a collapse in consumer confidence. Governments often struggle to maintain fiscal stability, resulting in the erosion of savings, distorted interest rates, and increased poverty levels.

Central Bank Responses to Deflation

Central banks respond to deflation by lowering interest rates to stimulate borrowing and spending, aiming to increase aggregate demand and raise price levels. Quantitative easing programs are often implemented to inject liquidity directly into the financial system, encouraging lending and investment. These measures contrast with hyperinflation management, where central banks may raise interest rates and tighten monetary policy to curb excessive money supply growth.

Central Bank Responses to Hyperinflation

Central banks combat hyperinflation by implementing tight monetary policies, including raising interest rates sharply to restrict money supply growth and restore confidence in the currency. They often introduce currency reforms or establish new currency systems to stabilize prices and anchor expectations. Coordinated fiscal discipline and transparent communication strategies are critical in reinforcing these measures and preventing further spiraling inflation.

Deflation vs Hyperinflation: Key Takeaways

Deflation is characterized by a sustained decrease in general price levels, leading to increased purchasing power but risks of reduced consumer spending and economic stagnation. Hyperinflation involves an extremely rapid and uncontrollable rise in prices, causing severe currency devaluation and loss of public confidence in the economy. Key takeaways include that deflation can stall economic growth by discouraging investment, whereas hyperinflation erodes savings and disrupts economic stability, both requiring distinct monetary policy interventions.

Deflation Infographic

libterm.com

libterm.com