Monetary deficit occurs when a government spends more money than it receives in revenue, leading to increased borrowing and potential inflationary pressures. Understanding the causes and consequences of a monetary deficit is crucial for managing economic stability and ensuring sustainable fiscal policies. Explore the rest of this article to learn how monetary deficits impact your economy and what measures can mitigate their effects.

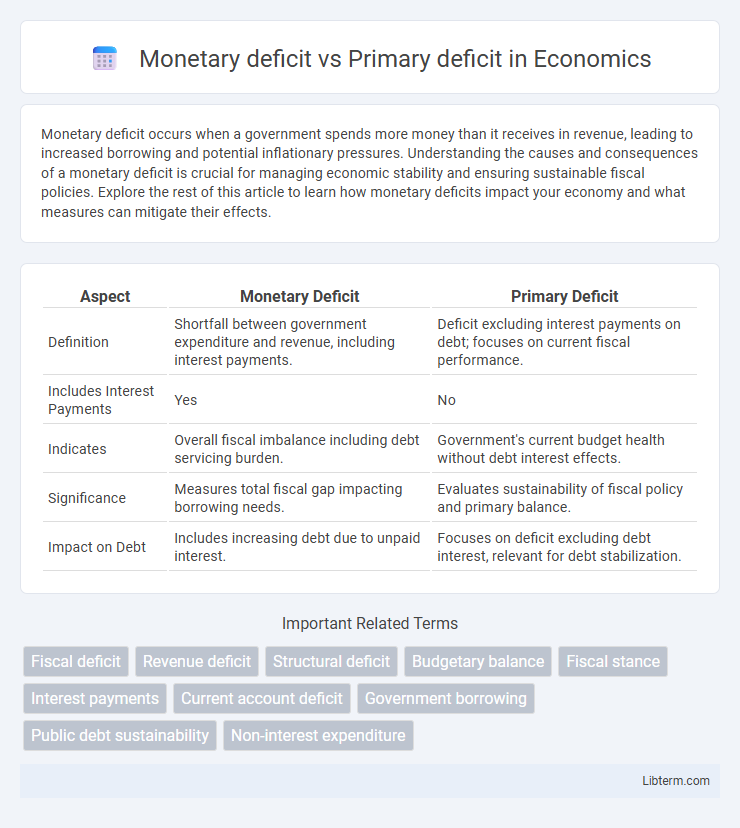

Table of Comparison

| Aspect | Monetary Deficit | Primary Deficit |

|---|---|---|

| Definition | Shortfall between government expenditure and revenue, including interest payments. | Deficit excluding interest payments on debt; focuses on current fiscal performance. |

| Includes Interest Payments | Yes | No |

| Indicates | Overall fiscal imbalance including debt servicing burden. | Government's current budget health without debt interest effects. |

| Significance | Measures total fiscal gap impacting borrowing needs. | Evaluates sustainability of fiscal policy and primary balance. |

| Impact on Debt | Includes increasing debt due to unpaid interest. | Focuses on deficit excluding debt interest, relevant for debt stabilization. |

Introduction to Fiscal Deficits

Monetary deficit occurs when government expenditures exceed revenues leading to increased borrowing or money creation, impacting inflation and economic stability. Primary deficit specifically measures the fiscal gap excluding interest payments on existing debt, highlighting the government's current borrowing needs for non-interest expenses. Understanding both deficits is crucial for evaluating fiscal policy effectiveness and debt sustainability in public finance.

Defining Monetary Deficit

Monetary deficit refers to the shortfall in government revenue compared to its total expenditure, which is financed by printing new money or borrowing from the central bank. This deficit directly impacts the money supply and can lead to inflation if not managed prudently. In contrast, the primary deficit excludes interest payments on past debt, focusing solely on the current fiscal imbalance before servicing debt obligations.

Defining Primary Deficit

Primary deficit refers to the fiscal deficit of a government excluding interest payments on its outstanding debt, highlighting the gap between its current revenues and expenditures on goods and services. Monetary deficit, on the other hand, includes the total fiscal deficit with interest obligations, reflecting overall borrowing needs from the central bank or market. Understanding the primary deficit is crucial for assessing a government's fiscal discipline and sustainability without the influence of debt servicing costs.

Key Differences: Monetary vs Primary Deficit

Monetary deficit refers to the total fiscal gap between government revenue and expenditure, including interest payments on debt, whereas primary deficit excludes these interest obligations, focusing solely on current fiscal policy imbalance. The primary deficit measures the government's borrowing needs to fund non-interest expenses, serving as an indicator of fiscal discipline, while the monetary deficit reflects the overall sustainability of public finances by accounting for debt servicing costs. Understanding these distinctions aids in evaluating fiscal health and the potential impact on economic stability.

Components of Monetary Deficit

Monetary deficit primarily comprises the total government expenditure exceeding its revenue, financed through borrowing from the central bank, including components such as the net RBI credit to the government, net creation of reserve money for the government, and interest payments on past borrowings. The primary deficit measures the fiscal gap excluding interest payments, reflecting the current year's fiscal imbalance without debt servicing costs. Understanding the monetary deficit's components helps assess the extent of fiscal reliance on central bank financing and its inflationary impact.

Components of Primary Deficit

The primary deficit represents the fiscal gap excluding interest payments on existing debt, focusing solely on the government's current fiscal operations. Key components of the primary deficit include revenue expenditure, such as salaries and subsidies, and capital expenditure, which refers to spending on infrastructure and development projects. Understanding the primary deficit helps isolate the government's borrowing needs tied to policy decisions rather than debt servicing costs.

Economic Implications of Monetary Deficit

Monetary deficit occurs when government expenditures exceed revenues including interest payments on debt, leading to increased borrowing and potential inflationary pressures. This deficit signals higher public debt servicing costs that can crowd out private investment, reduce fiscal space, and trigger currency depreciation. Understanding monetary deficit helps policymakers assess risks of unsustainable debt levels and the need for fiscal consolidation to maintain macroeconomic stability.

Economic Implications of Primary Deficit

The primary deficit, which excludes interest payments on outstanding debt, directly reflects the government's fiscal discipline and its ability to manage current expenditures relative to revenue. A persistent primary deficit indicates reliance on borrowing not just for interest servicing but to fund ongoing activities, risking debt accumulation and higher future interest obligations. This scenario can undermine economic stability by increasing borrowing costs, reducing investor confidence, and limiting fiscal space for growth-enhancing investments.

Measuring and Interpreting Fiscal Deficits

Monetary deficit refers to the overall fiscal deficit including interest payments, while primary deficit excludes interest obligations, highlighting the government's borrowing exclusive of debt servicing costs. Measuring fiscal deficits involves assessing these figures to understand the sustainability of public finances and the impact on economic stability. Interpreting primary deficit provides insight into the government's current fiscal policy stance and its ability to manage debt without additional borrowing.

Policy Responses and Fiscal Management

Monetary deficit reflects the total fiscal gap financed by borrowing and money creation, while the primary deficit excludes interest payments, indicating the government's current fiscal stance. Policy responses to a monetary deficit often involve tightening monetary policy and reducing fiscal spending to control inflation and debt accumulation. Effective fiscal management emphasizes reducing the primary deficit through enhanced revenue collection and controlled expenditures, ensuring sustainable debt levels without excessive reliance on central bank financing.

Monetary deficit Infographic

libterm.com

libterm.com