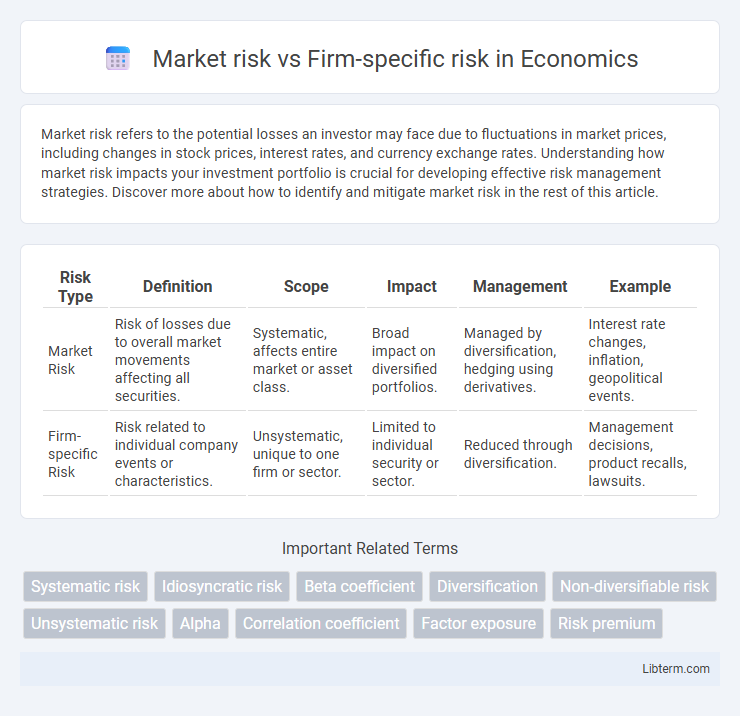

Market risk refers to the potential losses an investor may face due to fluctuations in market prices, including changes in stock prices, interest rates, and currency exchange rates. Understanding how market risk impacts your investment portfolio is crucial for developing effective risk management strategies. Discover more about how to identify and mitigate market risk in the rest of this article.

Table of Comparison

| Risk Type | Definition | Scope | Impact | Management | Example |

|---|---|---|---|---|---|

| Market Risk | Risk of losses due to overall market movements affecting all securities. | Systematic, affects entire market or asset class. | Broad impact on diversified portfolios. | Managed by diversification, hedging using derivatives. | Interest rate changes, inflation, geopolitical events. |

| Firm-specific Risk | Risk related to individual company events or characteristics. | Unsystematic, unique to one firm or sector. | Limited to individual security or sector. | Reduced through diversification. | Management decisions, product recalls, lawsuits. |

Understanding Market Risk: Definition and Examples

Market risk, also known as systematic risk, refers to the potential financial loss due to factors that affect the overall economy or large segments of the market, such as interest rate changes, inflation, recessions, or geopolitical events. Unlike firm-specific risk, which impacts individual companies due to factors like management decisions or product recalls, market risk influences virtually all securities and cannot be eliminated through diversification. Examples include stock market crashes, shifts in monetary policy, and currency fluctuations that impact an entire market or asset class.

Defining Firm-Specific Risk: Key Characteristics

Firm-specific risk, also known as idiosyncratic risk, refers to the uncertainty inherent to a particular company or industry, distinct from broader market movements. Key characteristics include its diversification potential, meaning it can be mitigated through portfolio diversification, and its sources typically stem from factors such as management decisions, product recalls, or regulatory changes impacting the firm alone. Unlike market risk, firm-specific risk does not affect the entire market or economy but can significantly influence the return and volatility of individual stocks.

Main Differences Between Market Risk and Firm-Specific Risk

Market risk, also known as systematic risk, affects the entire market or a broad segment of it, driven by macroeconomic factors like interest rates, inflation, and geopolitical events. Firm-specific risk, or unsystematic risk, arises from factors unique to a particular company such as management decisions, product recalls, or competitive pressures. While market risk cannot be diversified away, firm-specific risk can be mitigated through portfolio diversification strategies.

Sources of Market Risk in Financial Markets

Market risk arises from factors affecting the entire financial market, including interest rate fluctuations, changes in foreign exchange rates, and broad economic recessions. These systemic risks impact all securities and cannot be eliminated through diversification, contrasting with firm-specific risk that pertains to events unique to a single company. Understanding sources like geopolitical instability, inflation volatility, and liquidity constraints is crucial for managing exposure to market risk in portfolio management.

Causes of Firm-Specific Risk in Businesses

Firm-specific risk arises from factors unique to a particular company, such as management decisions, product recalls, labor strikes, or financial mismanagement. Unlike market risk, which affects the entire market or sector, firm-specific risk is caused by internal operational issues, competitive pressures, regulatory changes targeting the firm, or technological disruptions impacting its products or services. Identifying these risks requires thorough analysis of company performance metrics, industry position, and corporate governance.

Measuring Market Risk: Common Metrics and Tools

Market risk is quantified using metrics like Value at Risk (VaR), which estimates potential portfolio losses over a specific time frame at a given confidence level. Beta coefficient measures a stock's sensitivity to overall market movements, indicating systematic risk exposure. Risk managers also use tools such as stress testing and scenario analysis to assess potential impacts under extreme market conditions.

Methods to Assess Firm-Specific Risk

Firm-specific risk is assessed using methods such as fundamental analysis, which examines a company's financial statements, management quality, competitive position, and industry conditions to determine its intrinsic value. Quantitative models like the Altman Z-score evaluate the probability of bankruptcy by analyzing financial ratios, while scenario analysis simulates the impact of various business conditions on firm performance. Tracking abnormal stock returns through event studies also helps isolate firm-specific shocks from overall market movements.

Strategies for Managing Market Risk

Market risk, also known as systematic risk, affects the entire market and cannot be eliminated through diversification, requiring strategies such as asset allocation, hedging with derivatives, and using stop-loss orders to manage potential losses. Firm-specific risk, or unsystematic risk, pertains to individual companies and can be mitigated through diversification of investment portfolios. Effective market risk management incorporates assessing market volatility indices, employing risk limits, and utilizing financial instruments like options and futures to protect against broad economic and geopolitical fluctuations.

Mitigating Firm-Specific Risk: Best Practices

Mitigating firm-specific risk involves diversifying investments across various assets to reduce exposure to company-specific events. Conducting thorough due diligence, including analyzing financial statements and industry trends, helps identify vulnerabilities unique to individual firms. Implementing stop-loss orders and regularly monitoring portfolio performance further minimizes potential losses from firm-specific risks.

Impact of Market and Firm-Specific Risks on Investment Decisions

Market risk, driven by macroeconomic factors such as interest rate changes, inflation, and geopolitical events, affects the entire market and cannot be diversified away, leading investors to demand higher risk premiums. Firm-specific risk stems from unique company factors like management decisions or product success, which can be mitigated through portfolio diversification. Investment decisions prioritize balancing market risk exposure while minimizing firm-specific risk to optimize returns and reduce overall portfolio volatility.

Market risk Infographic

libterm.com

libterm.com