Private investment drives economic growth by enabling businesses to expand, innovate, and create jobs through capital infusion from individuals or entities outside the public sector. Understanding the different types of private investments, such as venture capital, private equity, and angel investing, can help you diversify your portfolio and maximize returns. Explore the rest of the article to learn how private investment can play a crucial role in your financial strategy.

Table of Comparison

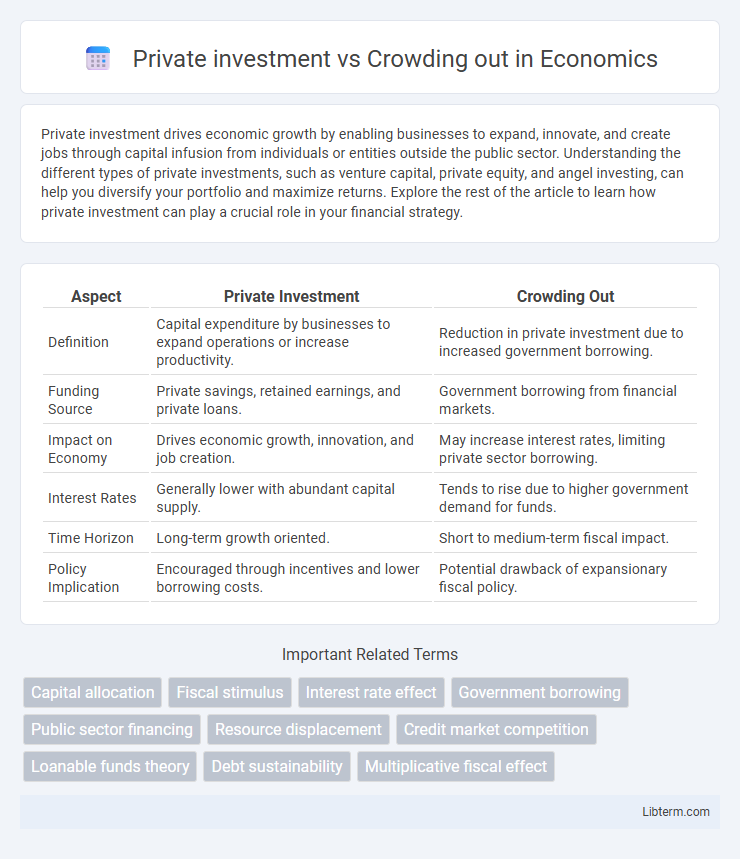

| Aspect | Private Investment | Crowding Out |

|---|---|---|

| Definition | Capital expenditure by businesses to expand operations or increase productivity. | Reduction in private investment due to increased government borrowing. |

| Funding Source | Private savings, retained earnings, and private loans. | Government borrowing from financial markets. |

| Impact on Economy | Drives economic growth, innovation, and job creation. | May increase interest rates, limiting private sector borrowing. |

| Interest Rates | Generally lower with abundant capital supply. | Tends to rise due to higher government demand for funds. |

| Time Horizon | Long-term growth oriented. | Short to medium-term fiscal impact. |

| Policy Implication | Encouraged through incentives and lower borrowing costs. | Potential drawback of expansionary fiscal policy. |

Understanding Private Investment: Key Concepts

Private investment involves capital expenditures by businesses aimed at expanding production capacity, enhancing technology, or improving efficiency, which directly contribute to economic growth. Understanding factors influencing private investment requires analyzing interest rates, expected returns, and overall business confidence, as these elements determine firms' willingness to allocate resources. The crowding out effect occurs when increased government borrowing raises interest rates, potentially reducing private sector investment by making financing more expensive and less attractive.

What Is the Crowding Out Effect?

The crowding out effect occurs when increased government spending leads to a reduction in private investment by raising interest rates, making borrowing more expensive for businesses. This economic phenomenon arises as government demand for loanable funds limits the availability of capital for private entities, ultimately dampening private sector growth. Understanding the crowding out effect is crucial for policymakers aiming to balance fiscal stimulus with maintaining a healthy investment climate.

Private Investment vs. Public Spending

Private investment often decreases when public spending intensifies, a phenomenon known as crowding out, where government borrowing raises interest rates, making capital more expensive for private firms. Empirical studies indicate that high levels of public debt correlate with reduced private investment due to increased competition for financial resources in capital markets. Efficient fiscal policies and balanced budgets can mitigate crowding out effects, promoting sustainable private sector growth alongside necessary public expenditures.

Mechanisms Behind the Crowding Out Phenomenon

Crowding out occurs when increased government borrowing drives up interest rates, reducing private investment by making capital more expensive. The mechanism involves a shift in demand for loanable funds, where government debt issuance competes with private sector financing. Higher interest rates decrease firms' incentive to invest, leading to a decline in private capital formation and economic growth.

Factors Influencing Crowding Out in the Economy

Factors influencing crowding out in the economy include government borrowing levels, interest rates, and the state of private sector confidence. High government deficits increase demand for loanable funds, driving up interest rates and discouraging private investment. Moreover, if private investors anticipate future tax hikes to repay public debt, their willingness to invest diminishes, intensifying the crowding out effect.

Case Studies: Crowding Out Across Different Economies

Case studies from diverse economies reveal varying impacts of crowding out, with advanced nations often experiencing reduced private investment following increased government borrowing, as observed in the United States during the 1980s debt surge. Emerging markets like Brazil demonstrate partial crowding out, where government deficits lead to higher interest rates but private investment adapts through alternative financing. In contrast, developing economies such as India show minimal crowding out effects due to different financial market structures and abundant domestic savings supporting simultaneous public and private investments.

The Role of Interest Rates in Private Investment

Interest rates play a critical role in private investment by influencing the cost of borrowing for businesses and individuals. Higher interest rates, often resulting from increased government borrowing, can lead to crowding out as private investors find financing more expensive and reduce investment activity. Conversely, lower interest rates encourage private investment by making loans more affordable, thereby stimulating economic growth despite public sector borrowing.

Fiscal Policy Impact on Private Sector Participation

Fiscal policy changes, such as increased government spending or borrowing, can lead to crowding out by raising interest rates, which reduces private sector investment opportunities. When government borrowing absorbs a significant portion of available funds, private firms face higher capital costs, limiting their ability to finance projects. Conversely, well-targeted fiscal policies that enhance infrastructure or provide incentives can stimulate private investment by improving business conditions and reducing risks.

Strategies to Mitigate Crowding Out Effects

Implementing targeted fiscal policies such as government investment in public goods with high social returns can reduce crowding out by complementing rather than competing with private investments. Encouraging public-private partnerships (PPPs) leverages private capital and expertise, minimizing government borrowing needs and easing credit market pressures. Monetary policies that maintain low-interest rates help sustain private investment levels despite increased government borrowing.

Balancing Public Expenditure and Private Investment

Balancing public expenditure and private investment requires careful management to avoid crowding out, where excessive government spending leads to higher interest rates that reduce private sector borrowing. Strategic public investment in infrastructure and innovation can stimulate economic growth without displacing private capital by improving productivity and creating complementary opportunities. Governments must calibrate fiscal policies to maintain optimal interest rates and investor confidence, ensuring public spending supports rather than substitutes private investment.

Private investment Infographic

libterm.com

libterm.com