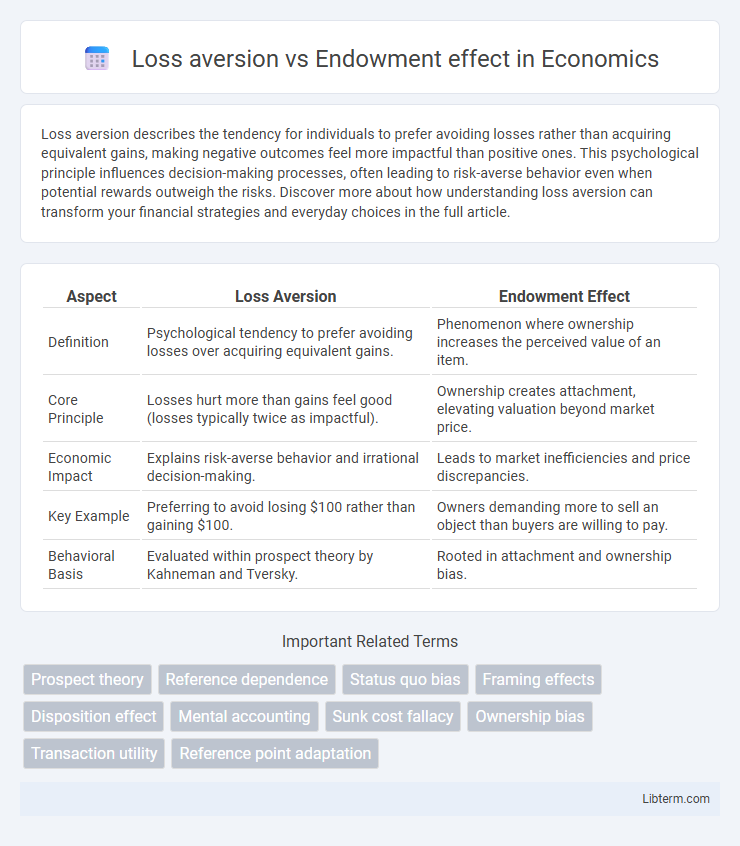

Loss aversion describes the tendency for individuals to prefer avoiding losses rather than acquiring equivalent gains, making negative outcomes feel more impactful than positive ones. This psychological principle influences decision-making processes, often leading to risk-averse behavior even when potential rewards outweigh the risks. Discover more about how understanding loss aversion can transform your financial strategies and everyday choices in the full article.

Table of Comparison

| Aspect | Loss Aversion | Endowment Effect |

|---|---|---|

| Definition | Psychological tendency to prefer avoiding losses over acquiring equivalent gains. | Phenomenon where ownership increases the perceived value of an item. |

| Core Principle | Losses hurt more than gains feel good (losses typically twice as impactful). | Ownership creates attachment, elevating valuation beyond market price. |

| Economic Impact | Explains risk-averse behavior and irrational decision-making. | Leads to market inefficiencies and price discrepancies. |

| Key Example | Preferring to avoid losing $100 rather than gaining $100. | Owners demanding more to sell an object than buyers are willing to pay. |

| Behavioral Basis | Evaluated within prospect theory by Kahneman and Tversky. | Rooted in attachment and ownership bias. |

Introduction to Loss Aversion and Endowment Effect

Loss aversion describes the psychological tendency where individuals experience losses more intensely than equivalent gains, significantly impacting decision-making behavior. The endowment effect occurs when people ascribe higher value to items simply because they own them, highlighting a bias linked to loss aversion. Both concepts are fundamental in behavioral economics, explaining deviations from rational market behavior.

Defining Loss Aversion

Loss aversion describes the psychological tendency for individuals to prefer avoiding losses rather than acquiring equivalent gains, where the pain of losing is psychologically about twice as powerful as the pleasure of gaining. The endowment effect, closely related, manifests as people valuing items they own more highly than identical items they do not possess, often due to loss aversion influencing their perception of ownership. Understanding loss aversion is crucial for explaining behaviors in economics, marketing, and decision-making processes that involve risk and value assessment.

Understanding the Endowment Effect

The endowment effect describes the tendency for individuals to ascribe higher value to objects they own compared to identical items they do not own, often leading to irrational decision-making. This psychological bias is closely related to loss aversion, where the pain of losing an owned item is perceived as more intense than the pleasure of gaining the same item. Understanding the endowment effect is crucial for fields like behavioral economics and marketing, as it influences consumer behavior and market dynamics by affecting willingness to pay and sell.

Psychological Roots of Loss Aversion

Loss aversion originates from the psychological principle that individuals experience the pain of losses more intensely than the pleasure of equivalent gains, deeply rooted in evolutionary survival mechanisms. This asymmetry in emotional response triggers behaviors aimed at avoiding losses, often overriding rational decision-making processes. The endowment effect, closely related to loss aversion, manifests as increased valuation of owned objects, stemming from the psychological discomfort associated with parting from possessions perceived as losses.

Origins of the Endowment Effect

The endowment effect originates from loss aversion, a concept in behavioral economics where individuals perceive the pain of losing an owned item as greater than the pleasure of gaining an equivalent item. This psychological bias causes people to assign higher value to objects simply because they own them, leading to reluctance in parting with possessions. Research in neuroeconomics links the endowment effect to emotional responses triggered in the brain's reward system when ownership is established.

Key Differences Between Loss Aversion and Endowment Effect

Loss aversion refers to the tendency for individuals to prefer avoiding losses rather than acquiring equivalent gains, showing a stronger emotional impact when losing something valuable. The endowment effect specifically describes the phenomenon where people assign higher value to items simply because they own them, leading to reluctance in parting with these possessions. Key differences include loss aversion's broader focus on potential losses in decision-making, while the endowment effect centers on ownership-induced valuation biases.

Real-World Examples of Loss Aversion

Loss aversion is demonstrated when investors hold onto declining stocks to avoid realizing losses, often leading to poorer portfolio performance. Consumers exhibit loss aversion by resisting price increases on familiar products, preferring to switch brands rather than pay more. These behaviors contrast with the endowment effect, where individuals value owned items higher than identical items they do not own, as seen in higher selling prices for personal belongings compared to market value.

Real-World Applications of the Endowment Effect

The endowment effect significantly influences consumer behavior by making individuals value owned goods more than identical items they do not own, leading to higher selling prices than buying prices. In real-world applications, this bias affects marketing strategies, such as free trial offers and product demonstrations, which increase consumers' attachment and perceived value of the product. Companies capitalize on the endowment effect to boost customer retention and willingness to pay by fostering a sense of ownership before purchase.

Implications for Consumer Behavior and Decision-Making

Loss aversion causes consumers to prefer avoiding losses over acquiring equivalent gains, leading to risk-averse choices and reluctance to switch products. The endowment effect increases perceived value of owned goods, resulting in higher selling prices and resistance to exchange or trade. Together, these biases influence consumer decision-making by skewing evaluations of product value, affecting purchase, retention, and pricing strategies.

Strategies to Overcome Loss Aversion and Endowment Bias

Employing cognitive reframing techniques helps mitigate loss aversion by shifting focus from potential losses to prospective gains, enhancing decision-making clarity. Utilizing mental accounting can reduce the endowment effect by separating asset ownership from its perceived subjective value, fostering more objective evaluations. Structured decision-making frameworks and exposure to diverse perspectives encourage rational assessments, diminishing emotional biases linked to loss aversion and endowment effects.

Loss aversion Infographic

libterm.com

libterm.com