Traditional accounting relies on manual bookkeeping processes and paper-based records to track financial transactions, emphasizing accuracy and compliance with established standards. This method often involves ledger entries, journalizing, and reconciliations performed by accountants to maintain clear financial statements. Explore the rest of the article to understand how traditional accounting compares with modern digital solutions and which approach suits your business needs.

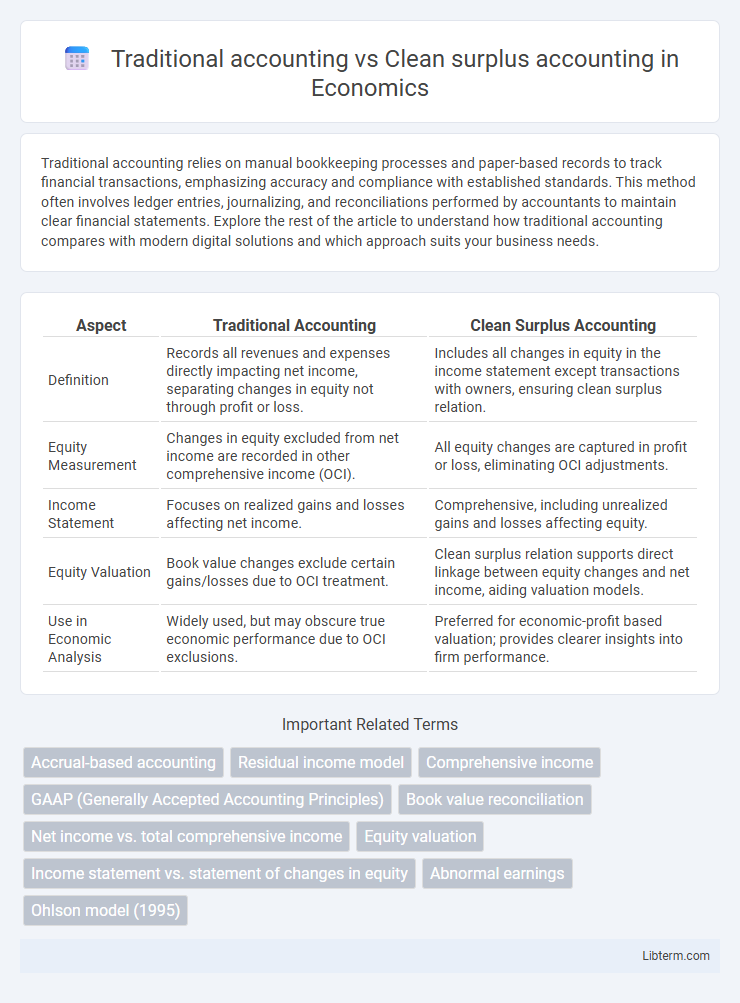

Table of Comparison

| Aspect | Traditional Accounting | Clean Surplus Accounting |

|---|---|---|

| Definition | Records all revenues and expenses directly impacting net income, separating changes in equity not through profit or loss. | Includes all changes in equity in the income statement except transactions with owners, ensuring clean surplus relation. |

| Equity Measurement | Changes in equity excluded from net income are recorded in other comprehensive income (OCI). | All equity changes are captured in profit or loss, eliminating OCI adjustments. |

| Income Statement | Focuses on realized gains and losses affecting net income. | Comprehensive, including unrealized gains and losses affecting equity. |

| Equity Valuation | Book value changes exclude certain gains/losses due to OCI treatment. | Clean surplus relation supports direct linkage between equity changes and net income, aiding valuation models. |

| Use in Economic Analysis | Widely used, but may obscure true economic performance due to OCI exclusions. | Preferred for economic-profit based valuation; provides clearer insights into firm performance. |

Introduction to Accounting Methods

Traditional accounting focuses on recognizing revenues and expenses based on cash flows and realized transactions, emphasizing historical cost and accrual principles. Clean surplus accounting extends this approach by incorporating changes in equity that bypass the income statement, capturing comprehensive income including unrealized gains and losses. This method enhances financial analysis by providing a more complete view of a company's economic performance and equity changes.

Understanding Traditional Accounting

Traditional accounting emphasizes recognizing revenues and expenses within a specific period to measure net income, relying heavily on historical cost and matching principles. It focuses on earnings that reflect operational performance while excluding unrealized gains or losses from equity changes not realized through transactions. This approach provides a clear, consistent framework for assessing profitability but may overlook changes in equity value not captured in net income.

Principles of Clean Surplus Accounting

Clean surplus accounting maintains that changes in shareholders' equity are captured exclusively through net income and other comprehensive income, omitting transactions with owners such as dividends and share buybacks. This principle ensures a comprehensive reflection of a firm's financial performance by avoiding equity adjustments outside the income statement, promoting transparency and comparability in financial analysis. Unlike traditional accounting, which records some equity changes directly in equity accounts, clean surplus accounting adheres strictly to income-based measurement of equity changes to enhance the accuracy of valuation models.

Key Differences Between the Two Approaches

Traditional accounting recognizes revenues and expenses when they are realized and incurred, focusing primarily on cash flows and matching principles. Clean surplus accounting, however, bypasses income statement adjustments by incorporating all changes in equity, except transactions with shareholders, directly into comprehensive income, enhancing the accuracy of equity valuation. The key difference lies in clean surplus accounting's ability to reflect unrealized gains and losses in equity, providing a more comprehensive view of a company's financial performance compared to traditional accounting's reliance on realized results.

Income Measurement: Traditional vs Clean Surplus

Traditional accounting measures income by recognizing revenues and expenses when realized, often resulting in income that excludes changes in certain asset values. Clean surplus accounting incorporates all changes in equity, including unrealized gains and losses, directly into income, offering a more comprehensive reflection of financial performance. This approach enhances income measurement accuracy by aligning reported profits with true economic value changes.

Impact on Financial Statements

Traditional accounting records revenues and expenses based on realized transactions, resulting in net income that may exclude certain comprehensive income items, which impacts the completeness of equity changes on the balance sheet. Clean surplus accounting integrates all gains and losses, including unrealized items, directly into equity without bypassing the income statement, providing a more comprehensive reflection of changes in shareholders' equity. This approach enhances the transparency and accuracy of financial statements by aligning reported net income with the actual economic value changes during the period.

Implications for Valuation and Analysis

Traditional accounting relies on net income and book values, which may exclude certain gains or losses, potentially leading to valuation distortions. Clean surplus accounting incorporates all changes in equity, including comprehensive income, offering a more transparent link between accounting data and market values. This approach provides analysts with a more accurate basis for valuation models by aligning reported profits with changes in shareholder wealth.

Advantages and Disadvantages of Each Method

Traditional accounting provides a clear, standardized framework for financial reporting, ensuring consistency and regulatory compliance, but often fails to capture economic reality by ignoring unrealized gains and losses. Clean surplus accounting integrates changes in comprehensive income directly into equity, offering a more accurate reflection of firm value by including unrealized gains, yet it may introduce volatility and complicate financial statement analysis. While traditional accounting excels in comparability and simplicity, clean surplus accounting enhances valuation relevance at the cost of increased complexity and potential earnings management challenges.

Industry Adoption and Practical Applications

Traditional accounting remains widely adopted across industries due to its compliance with established financial reporting standards such as GAAP and IFRS, making it essential for regulatory and auditing purposes. Clean surplus accounting, emphasizing comprehensive income and changes in equity without dividends, finds practical application mainly in valuation and financial analysis within investment firms and academic research. Many industries prioritize traditional accounting for external reporting, while clean surplus accounting supports internal decision-making and advanced financial modeling.

Conclusion: Choosing the Right Accounting Approach

Choosing the right accounting approach depends on the company's focus on transparency and financial performance measurement. Traditional accounting offers a well-established framework emphasizing realized gains and losses, suitable for conservative financial reporting. Clean surplus accounting integrates unrealized gains and losses into equity, providing a comprehensive view of economic value and better aligning book values with market values for investors seeking detailed performance insights.

Traditional accounting Infographic

libterm.com

libterm.com