Automatic stabilizers are economic policies and programs designed to offset fluctuations in a nation's economic activity without direct intervention by policymakers. They work by increasing government spending or decreasing taxes automatically during economic downturns, helping to stabilize disposable income and demand. Explore the rest of this article to understand how automatic stabilizers can protect your financial wellbeing during economic shifts.

Table of Comparison

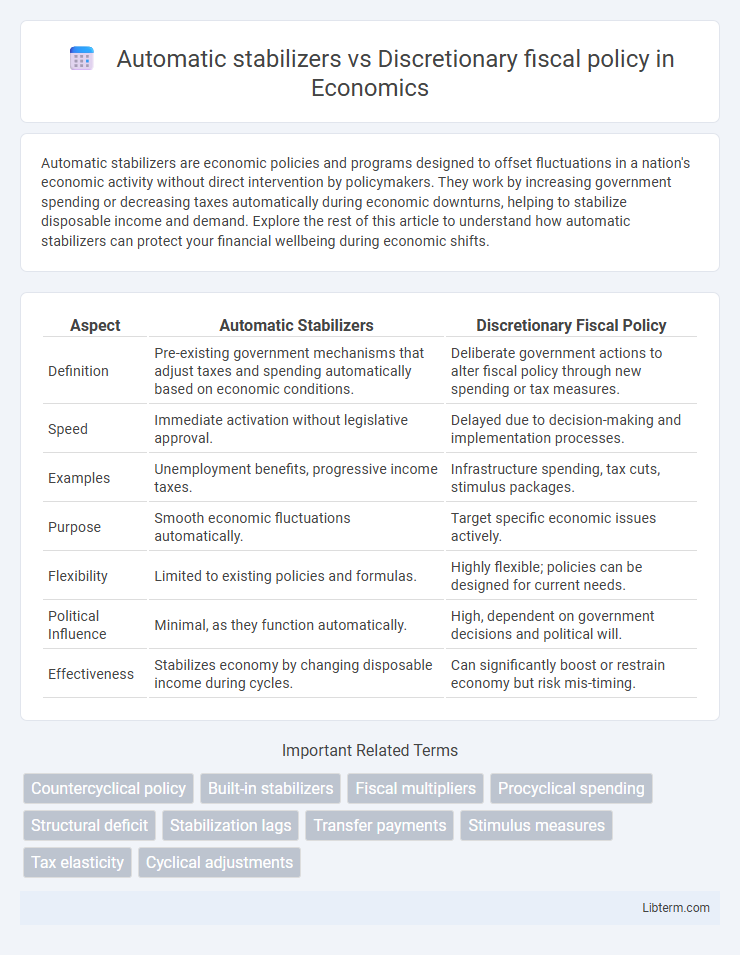

| Aspect | Automatic Stabilizers | Discretionary Fiscal Policy |

|---|---|---|

| Definition | Pre-existing government mechanisms that adjust taxes and spending automatically based on economic conditions. | Deliberate government actions to alter fiscal policy through new spending or tax measures. |

| Speed | Immediate activation without legislative approval. | Delayed due to decision-making and implementation processes. |

| Examples | Unemployment benefits, progressive income taxes. | Infrastructure spending, tax cuts, stimulus packages. |

| Purpose | Smooth economic fluctuations automatically. | Target specific economic issues actively. |

| Flexibility | Limited to existing policies and formulas. | Highly flexible; policies can be designed for current needs. |

| Political Influence | Minimal, as they function automatically. | High, dependent on government decisions and political will. |

| Effectiveness | Stabilizes economy by changing disposable income during cycles. | Can significantly boost or restrain economy but risk mis-timing. |

Introduction to Fiscal Policy Mechanisms

Automatic stabilizers stabilize the economy without direct government intervention by adjusting tax revenues and welfare payments in response to economic fluctuations, smoothing out GDP variations. Discretionary fiscal policy involves deliberate changes in government spending and taxation to influence economic activity, requiring legislative action and timing precision to be effective. Both mechanisms aim to manage economic cycles, but automatic stabilizers provide continuous, predictable fiscal support while discretionary policies offer targeted, flexible responses.

What Are Automatic Stabilizers?

Automatic stabilizers are government programs and policies designed to offset fluctuations in a nation's economic activity without direct intervention, such as unemployment benefits and progressive tax systems. These mechanisms automatically increase government spending or decrease tax revenues during economic downturns, helping to stabilize disposable income and aggregate demand. Unlike discretionary fiscal policy, which requires active legislative decisions, automatic stabilizers function efficiently and immediately in response to economic changes.

Understanding Discretionary Fiscal Policy

Discretionary fiscal policy involves deliberate government actions, such as changing tax rates or public spending, to influence economic activity and stabilize the economy. Unlike automatic stabilizers, which activate without additional legislation, discretionary policies require legislative approval and are implemented in response to specific economic conditions. This targeted approach allows policymakers to address economic fluctuations more precisely but may face delays and political challenges.

Key Differences: Automatic vs Discretionary Approaches

Automatic stabilizers, such as unemployment benefits and progressive taxes, operate without explicit government intervention, automatically adjusting to economic fluctuations and smoothing income changes. Discretionary fiscal policy requires deliberate decisions by policymakers to alter government spending or taxation in response to economic conditions. The key difference lies in timing and implementation: automatic stabilizers provide immediate, continuous response, whereas discretionary measures involve delays due to legislative processes and political considerations.

Examples of Automatic Stabilizers in Practice

Automatic stabilizers include unemployment insurance, which increases government spending during economic downturns without new legislative action. Progressive income taxes reduce disposable income more as earnings rise, naturally cooling inflation during booms and supporting demand in recessions. Welfare programs like food stamps expand automatically amid rising unemployment, providing immediate economic relief without delays in policy implementation.

Case Studies of Discretionary Fiscal Interventions

Discretionary fiscal policy involves targeted government actions such as stimulus packages, tax cuts, or increased public spending to manage economic fluctuations, exemplified by the 2009 American Recovery and Reinvestment Act (ARRA) which aimed to counter the Great Recession's effects. In contrast, automatic stabilizers like unemployment benefits and progressive taxation operate without explicit government intervention, providing immediate fiscal cushioning by increasing spending or reducing taxes as economic conditions change. Case studies highlight that discretionary fiscal interventions, while potentially more impactful during severe downturns, face implementation lags and political challenges, whereas automatic stabilizers offer timely but less flexible economic support.

Economic Impact: Automatic Stabilizers vs Discretionary Policy

Automatic stabilizers, such as unemployment benefits and progressive taxation, provide immediate economic relief by smoothing fluctuations in disposable income without the need for legislative action. In contrast, discretionary fiscal policy involves deliberate government intervention through spending or tax adjustments, which can be delayed due to political processes but allows targeted responses to specific economic conditions. The economic impact of automatic stabilizers lies in their ability to dampen recessionary shocks swiftly, whereas discretionary policy can stimulate growth more robustly but with potential time lags and political trade-offs.

Advantages and Limitations of Automatic Stabilizers

Automatic stabilizers, such as unemployment benefits and progressive tax systems, provide timely and cost-effective responses to economic fluctuations by automatically increasing government spending or decreasing tax revenue during downturns without new legislative action. These stabilizers reduce the severity of recessions and help maintain consumer demand but may be insufficient in deep or prolonged economic crises, limiting their overall impact. Their effectiveness is constrained by built-in lag effects and lack of targeted intervention compared to discretionary fiscal policy, which allows for deliberate, tailored government spending or tax changes.

Challenges and Criticisms of Discretionary Fiscal Policy

Discretionary fiscal policy faces challenges such as implementation delays, political influences, and difficulties in accurately timing interventions, which often reduce its effectiveness in stabilizing the economy. Critics argue that discretionary measures can lead to increased public debt and uncertainty, as policymakers may react too late or overcorrect economic fluctuations. Unlike automatic stabilizers like unemployment benefits and progressive taxes, discretionary fiscal actions require legislative approval, making them less responsive during economic crises.

Choosing the Right Approach: Policy Implications and Recommendations

Automatic stabilizers such as unemployment benefits and progressive taxes provide immediate economic buffer effects without new legislative action, making them essential for stabilizing GDP and consumption during downturns. Discretionary fiscal policy requires deliberate government intervention through spending or tax changes, offering targeted stimulus but often facing implementation lags and political constraints. Policymakers should balance automatic stabilizers' efficiency in crisis response with discretionary measures for structural adjustments and long-term growth, ensuring timely and flexible fiscal strategies.

Automatic stabilizers Infographic

libterm.com

libterm.com