Perfect competition is an economic market structure characterized by numerous small firms, identical products, and unrestricted entry and exit, ensuring no single firm can influence prices. This environment leads to maximum efficiency, where firms produce at the lowest possible cost and consumers benefit from competitive prices. Explore the rest of the article to understand how perfect competition shapes markets and affects your economic decisions.

Table of Comparison

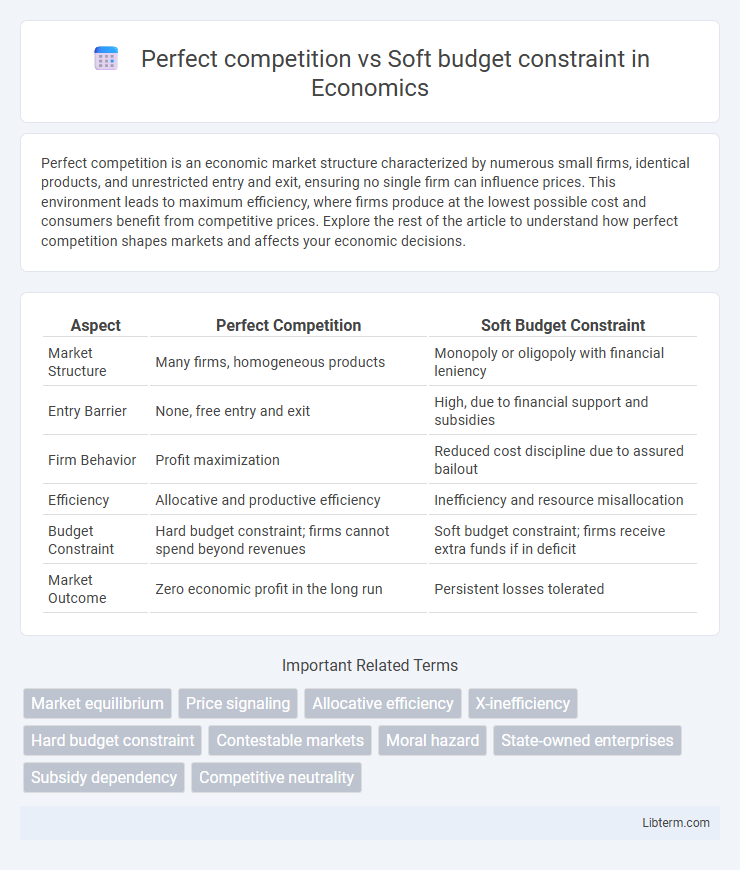

| Aspect | Perfect Competition | Soft Budget Constraint |

|---|---|---|

| Market Structure | Many firms, homogeneous products | Monopoly or oligopoly with financial leniency |

| Entry Barrier | None, free entry and exit | High, due to financial support and subsidies |

| Firm Behavior | Profit maximization | Reduced cost discipline due to assured bailout |

| Efficiency | Allocative and productive efficiency | Inefficiency and resource misallocation |

| Budget Constraint | Hard budget constraint; firms cannot spend beyond revenues | Soft budget constraint; firms receive extra funds if in deficit |

| Market Outcome | Zero economic profit in the long run | Persistent losses tolerated |

Introduction to Perfect Competition and Soft Budget Constraint

Perfect competition is characterized by numerous small firms, homogeneous products, and free market entry and exit, ensuring efficient resource allocation and price determination. In contrast, a soft budget constraint occurs when firms expect external financial support during losses, diminishing incentives for cost control and innovation. Understanding the interplay between perfect competition's strict market discipline and the relaxed financial constraints in a soft budget environment is crucial for analyzing firm behavior and market efficiency.

Key Characteristics of Perfect Competition

Perfect competition features numerous small firms with homogeneous products, allowing for free entry and exit in the market, which leads to price-taking behavior and no single firm influencing market prices. Firms operate under perfect information, ensuring resources are allocated efficiently with zero economic profits in the long run. Contrarily, soft budget constraints arise when firms receive external financial support despite inefficiencies, undermining the competitive pressures fundamental to perfect competition.

Defining the Soft Budget Constraint Concept

Soft budget constraint refers to a situation where firms or organizations receive external financial support that prevents them from facing the full consequences of their budget deficits, often leading to inefficient resource allocation. In contrast to perfect competition, which assumes firms bear the full cost of their decisions and operate under hard budget constraints, a soft budget constraint reduces the pressure on firms to be economically efficient. This concept is critical in understanding how state-owned enterprises or organizations in transitional economies may survive despite operating at losses due to anticipated subsidies or bailouts.

Market Structure Comparison: Competition vs. Constraint

Perfect competition features numerous firms, homogeneous products, and free market entry and exit, which drive prices to equal marginal costs and maximize consumer welfare. In contrast, a soft budget constraint occurs when firms, typically in regulated or state-influenced markets, experience leniency in financial discipline, leading to inefficiencies and reduced competitive pressure. The comparison highlights that while perfect competition fosters optimal resource allocation through intense competition, a soft budget constraint undermines market discipline by allowing persistent losses and distorting market signals.

Price Formation Mechanisms in Both Systems

In perfect competition, price formation is driven by the intersection of aggregate supply and demand, with prices reflecting marginal costs and ensuring allocative efficiency. Soft budget constraints, often observed in state-owned or subsidized firms, distort price signals since prices may not align with true production costs due to implicit financial support. This divergence leads to inefficient resource allocation as prices fail to equilibrate supply and demand, contrasting sharply with the market-clearing prices in perfectly competitive systems.

Efficiency Outcomes: Allocative and Productive Efficiency

Perfect competition achieves allocative efficiency by equating price with marginal cost, ensuring resources are distributed to maximize consumer and producer surplus. Soft budget constraints undermine productive efficiency by allowing firms to operate despite losses, reducing incentives for cost minimization and innovation. Consequently, soft budget constraints distort market signals and resource allocation, leading to inefficiencies absent in perfectly competitive markets.

Impact on Firm Behavior and Decision-Making

Perfect competition drives firms to maximize efficiency and minimize costs due to intense market rivalry and transparent pricing, leading to optimal resource allocation. In contrast, a soft budget constraint reduces firms' incentives to operate efficiently by providing financial bailouts or external support, often resulting in inefficient decision-making and resource misallocation. These contrasting dynamics significantly shape firm behavior, with perfect competition fostering innovation and cost discipline, while soft budget constraints encourage complacency and dependency on external financing.

Government Intervention and Market Discipline

Perfect competition relies on market discipline where numerous firms compete freely, leading to efficient resource allocation without need for government intervention. Soft budget constraints arise when governments intervene by subsidizing or bailing out firms, weakening market discipline and reducing incentives for efficiency. This intervention distorts competition, resulting in persistent inefficiencies and misallocation of resources in the economy.

Real-World Examples and Applications

In perfectly competitive markets, firms face zero economic profits due to free entry and exit, as seen in agriculture where numerous small producers sell homogeneous products like wheat or corn. Soft budget constraints occur when firms, particularly in state-owned enterprises or industries like utilities in transitional economies, receive government bailouts to cover losses, reducing market discipline. Real-world applications highlight how perfectly competitive markets drive efficiency, while soft budget constraints can lead to inefficiency and resource misallocation, as observed in sectors reliant on continuous state support.

Conclusion: Economic Implications and Policy Considerations

Perfect competition drives firms toward allocative and productive efficiency, fostering innovation and consumer welfare through price signals and market discipline. Soft budget constraints weaken these incentives by allowing inefficient firms to survive via external financial support, distorting resource allocation and reducing overall economic productivity. Policymakers should promote competitive market structures and limit bailout mechanisms to enhance market efficiency and sustainable growth.

Perfect competition Infographic

libterm.com

libterm.com