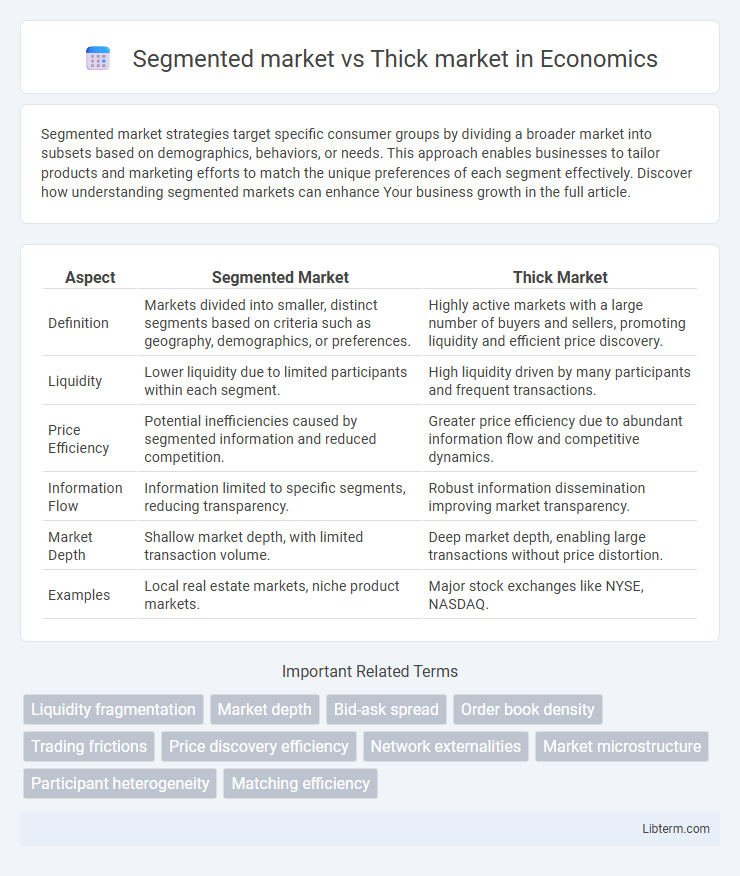

Segmented market strategies target specific consumer groups by dividing a broader market into subsets based on demographics, behaviors, or needs. This approach enables businesses to tailor products and marketing efforts to match the unique preferences of each segment effectively. Discover how understanding segmented markets can enhance Your business growth in the full article.

Table of Comparison

| Aspect | Segmented Market | Thick Market |

|---|---|---|

| Definition | Markets divided into smaller, distinct segments based on criteria such as geography, demographics, or preferences. | Highly active markets with a large number of buyers and sellers, promoting liquidity and efficient price discovery. |

| Liquidity | Lower liquidity due to limited participants within each segment. | High liquidity driven by many participants and frequent transactions. |

| Price Efficiency | Potential inefficiencies caused by segmented information and reduced competition. | Greater price efficiency due to abundant information flow and competitive dynamics. |

| Information Flow | Information limited to specific segments, reducing transparency. | Robust information dissemination improving market transparency. |

| Market Depth | Shallow market depth, with limited transaction volume. | Deep market depth, enabling large transactions without price distortion. |

| Examples | Local real estate markets, niche product markets. | Major stock exchanges like NYSE, NASDAQ. |

Understanding Segmented and Thick Markets

Segmented markets consist of distinct customer groups with unique needs, allowing businesses to tailor products and marketing strategies for each segment to maximize relevance and engagement. Thick markets feature a high density of buyers and sellers, enhancing liquidity and reducing transaction costs by enabling quicker matches between supply and demand. Understanding the dynamics of segmented and thick markets is crucial for optimizing market efficiency and targeting strategies.

Key Characteristics of Segmented Markets

Segmented markets are characterized by the division of a larger market into smaller groups of consumers with distinct preferences, needs, or behaviors, enabling targeted marketing strategies. These markets often exhibit diverse product offerings tailored to specific segments, enhanced customer satisfaction, and higher price sensitivity among buyers. In contrast to thick markets, segmented markets typically involve less frequent transactions within each segment due to the specialized nature of products and services.

Defining Features of Thick Markets

Thick markets exhibit high liquidity with numerous buyers and sellers actively trading homogeneous goods, resulting in low transaction costs and efficient price discovery. These markets feature dense trading activity, which leads to narrower bid-ask spreads and greater market depth, enhancing the ease of matching orders. Unlike segmented markets, thick markets reduce information asymmetry due to widespread participation and continuous price updates.

Market Liquidity: Segmented vs Thick

Market liquidity in segmented markets tends to be lower due to a limited number of participants and narrow trading volumes, making price discovery less efficient. Thick markets feature a high concentration of buyers and sellers, enhancing liquidity and enabling smoother execution of large trades without significantly impacting prices. The increased depth and breadth in thick markets reduce bid-ask spreads and facilitate more accurate valuation of assets compared to segmented markets.

Price Discovery Mechanisms in Both Markets

Segmented markets often exhibit less efficient price discovery mechanisms due to limited liquidity and fewer participants, causing wider bid-ask spreads and slower adjustment to new information. Thick markets, characterized by high trading volume and diverse participants, enable rapid and accurate price discovery through continuous interactions between buyers and sellers. These conditions facilitate narrower spreads and more transparent price formation, improving overall market efficiency.

Barriers to Entry in Segmented Markets

Segmented markets often feature higher barriers to entry due to specialized customer needs and targeted marketing strategies, which require firms to tailor products or services precisely for different segments. These barriers include the necessity for niche expertise, brand differentiation, and customized distribution channels, making it challenging for new competitors to gain traction. In contrast, thick markets benefit from standardized products and economies of scale, which lower entry obstacles and facilitate competition.

Efficiency and Trading Volume Comparison

Segmented markets often suffer from lower trading volumes and reduced liquidity due to restrictions or barriers limiting participant access, leading to inefficiencies in price discovery. Thick markets, characterized by high trading volumes and numerous participants, enhance efficiency by facilitating tighter bid-ask spreads and quicker transaction executions. High liquidity in thick markets improves market depth and reduces transaction costs, promoting more accurate and efficient price mechanisms compared to segmented markets.

Practical Examples of Each Market Type

Segmented markets, such as the luxury car industry, cater to distinct customer groups with tailored products like sports cars targeting affluent buyers, while thick markets like the New York Stock Exchange offer high liquidity and numerous buyers and sellers for efficient trading of stocks. In segmented markets, firms focus on niche marketing strategies exemplified by specialized skincare brands that serve specific skin concerns, unlike thick markets where mass-market consumer goods like smartphones dominate due to their broad appeal and large volume of transactions. These practical examples highlight how segmented markets thrive on differentiation and tailored offerings, whereas thick markets rely on extensive participation and high transaction frequency.

Risks and Opportunities: Segmented vs Thick Markets

Segmented markets pose risks such as limited liquidity and higher volatility, which can lead to price inefficiencies and barriers for new entrants, but they offer opportunities for niche targeting and specialized product development. Thick markets, characterized by high liquidity and numerous participants, reduce transaction costs and improve price discovery, yet they face risks like increased competition and potential market manipulation. Understanding the trade-offs between segmented and thick markets enables strategic decisions to optimize risk management and capitalize on market dynamics for sustained growth.

Choosing the Right Market for Your Strategy

Segmented markets divide customers into distinct groups based on specific characteristics, allowing tailored marketing strategies that address unique needs and preferences, which enhances targeting precision and customer engagement. Thick markets feature a large number of buyers and sellers, promoting liquidity, price discovery, and ease of transactions, which benefits businesses seeking high-volume sales and efficient matching. Choosing the right market depends on strategic goals: segmented markets suit companies prioritizing personalized offerings, while thick markets are advantageous for those emphasizing scale and transaction efficiency.

Segmented market Infographic

libterm.com

libterm.com