The endogenous growth model explains economic growth through factors within the economy, such as innovation, knowledge, and human capital, rather than relying on external influences. It emphasizes the role of investments in research and development, education, and technology in generating sustained long-term growth. Explore the full article to understand how this model can impact Your economic policies and growth strategies.

Table of Comparison

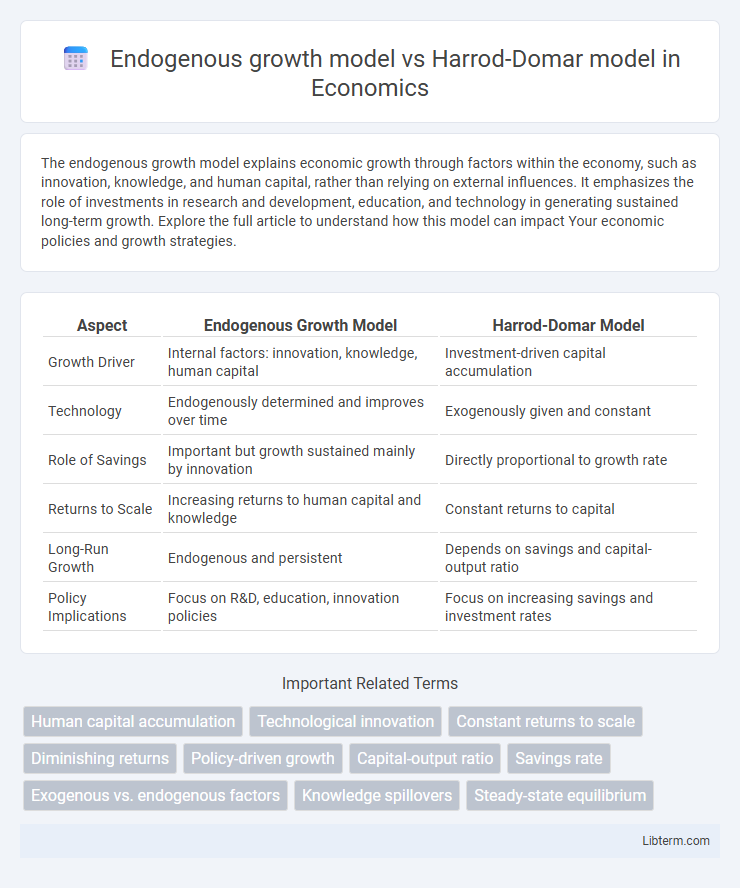

| Aspect | Endogenous Growth Model | Harrod-Domar Model |

|---|---|---|

| Growth Driver | Internal factors: innovation, knowledge, human capital | Investment-driven capital accumulation |

| Technology | Endogenously determined and improves over time | Exogenously given and constant |

| Role of Savings | Important but growth sustained mainly by innovation | Directly proportional to growth rate |

| Returns to Scale | Increasing returns to human capital and knowledge | Constant returns to capital |

| Long-Run Growth | Endogenous and persistent | Depends on savings and capital-output ratio |

| Policy Implications | Focus on R&D, education, innovation policies | Focus on increasing savings and investment rates |

Introduction to Economic Growth Models

The Endogenous growth model emphasizes the role of technological innovation, human capital, and knowledge spillovers as internal drivers of long-term economic growth, contrasting with the Harrod-Domar model, which primarily links growth to savings rates and capital accumulation. While the Harrod-Domar model suggests potential instability due to fixed capital-output ratios and exogenous technological progress, the Endogenous growth framework highlights sustainable growth through policy measures fostering innovation and education. These models collectively shape the foundation for understanding the mechanisms behind economic development and the factors influencing growth rates.

Overview of the Endogenous Growth Model

The Endogenous Growth Model emphasizes that economic growth is primarily driven by internal factors such as human capital, innovation, and knowledge accumulation, rather than external influences like capital investment alone. Unlike the Harrod-Domar model, which links growth to fixed savings rates and capital-output ratios, the Endogenous Growth Model integrates technological progress as a product of purposeful investment in research and development. This framework explains sustained long-term growth by highlighting the role of policies that enhance innovation, education, and knowledge spillovers within the economy.

Understanding the Harrod-Domar Model

The Harrod-Domar model emphasizes the role of savings and investment in driving economic growth, highlighting the importance of capital accumulation and the fixed capital-output ratio. It assumes constant returns to scale in production and focuses on the equilibrium growth rate determined by the savings rate divided by the capital-output ratio. Unlike endogenous growth models, which incorporate technological progress and human capital as internal factors, the Harrod-Domar model treats technological change as exogenous and does not account for innovation's impact on sustained growth.

Key Assumptions Comparison

The Endogenous Growth Model assumes that economic growth is driven by internal factors such as human capital accumulation, innovation, and knowledge spillovers, emphasizing sustained returns to scale in knowledge production. In contrast, the Harrod-Domar Model relies on exogenous factors, particularly savings and investment rates, viewing growth as dependent on capital accumulation with fixed proportions between labor and capital inputs. The Endogenous Growth Model assumes constant returns to reproducible factors and endogenously determined technological progress, while the Harrod-Domar Model assumes fixed capital-output ratios and exogenous technological progress, highlighting different growth dynamics.

Sources of Economic Growth: Innovation vs. Savings

The Endogenous growth model attributes economic growth primarily to innovation, technological progress, and knowledge accumulation driven by investments in human capital and R&D. In contrast, the Harrod-Domar model emphasizes savings and investment rates as the main sources of growth, linking output directly to the capital stock without addressing technological change. Innovation in the Endogenous model provides sustained long-term growth, while the Harrod-Domar framework highlights capital accumulation's role in short-term growth dynamics.

Role of Technology in Both Models

The Endogenous growth model emphasizes technology as a central factor driving long-term economic growth through innovation and knowledge accumulation within the economy. In contrast, the Harrod-Domar model treats technology as an exogenous and fixed element, impacting growth only indirectly via capital-output ratios and savings rates. This fundamental difference highlights the Endogenous model's focus on internal technological progress versus the Harrod-Domar model's reliance on external technological assumptions.

Policy Implications and Recommendations

The Endogenous growth model emphasizes innovation, knowledge accumulation, and human capital as key drivers of sustained economic growth, suggesting policies that invest in education, research and development, and technology adoption to enhance productivity. In contrast, the Harrod-Domar model focuses on capital accumulation and savings rates, recommending policies that boost investment levels and mobilize savings to maintain steady economic expansion. Policymakers should prioritize fostering institutional frameworks supporting innovation ecosystems per the Endogenous model, while ensuring efficient allocation of savings into productive investments as highlighted by the Harrod-Domar model.

Limitations of the Endogenous Growth Model

The Endogenous Growth Model faces limitations such as its reliance on assumptions of constant returns to scale and perfect competition, which may not hold in real economies. It often overlooks external shocks and market imperfections that affect long-term growth rates, unlike the Harrod-Domar model which emphasizes capital accumulation and savings rates. The model's focus on technological progress as an internal factor can also understate the role of institutional, political, and social influences on economic development.

Critiques of the Harrod-Domar Model

The Harrod-Domar model faces criticism for its assumption of fixed capital-output and savings rates, which limits its real-world applicability and flexibility in explaining economic growth. It overlooks technological progress and human capital, key drivers emphasized in the endogenous growth model that promote sustained growth through innovation and knowledge accumulation. The model's instability due to rigid investment and growth rate relationships contrasts with endogenous growth theory's focus on innovation-led, self-sustaining economic expansion.

Conclusion: Choosing the Right Model for Economic Analysis

Selecting the appropriate economic growth model depends on the specific context and variables emphasized: the Endogenous Growth Model highlights innovation and human capital as key drivers of sustained long-term growth, while the Harrod-Domar Model focuses on investment and savings rates to explain growth dynamics and potential instability. Policymakers aiming for innovation-led growth strategies should prioritize the Endogenous Growth Model for its insights into technological progress and knowledge spillovers. In contrast, the Harrod-Domar Model remains valuable for analyzing the impact of fixed capital accumulation and guiding investment-driven development in emerging economies.

Endogenous growth model Infographic

libterm.com

libterm.com