Interest rate parity (IRP) is a fundamental financial theory that links the differences in interest rates between two countries to the exchange rate movements of their currencies. It ensures that investors cannot achieve arbitrage profits by borrowing in one currency and investing in another, as exchange rate adjustments offset interest rate discrepancies. Explore the article to understand how IRP influences your international investment decisions and currency risk management.

Table of Comparison

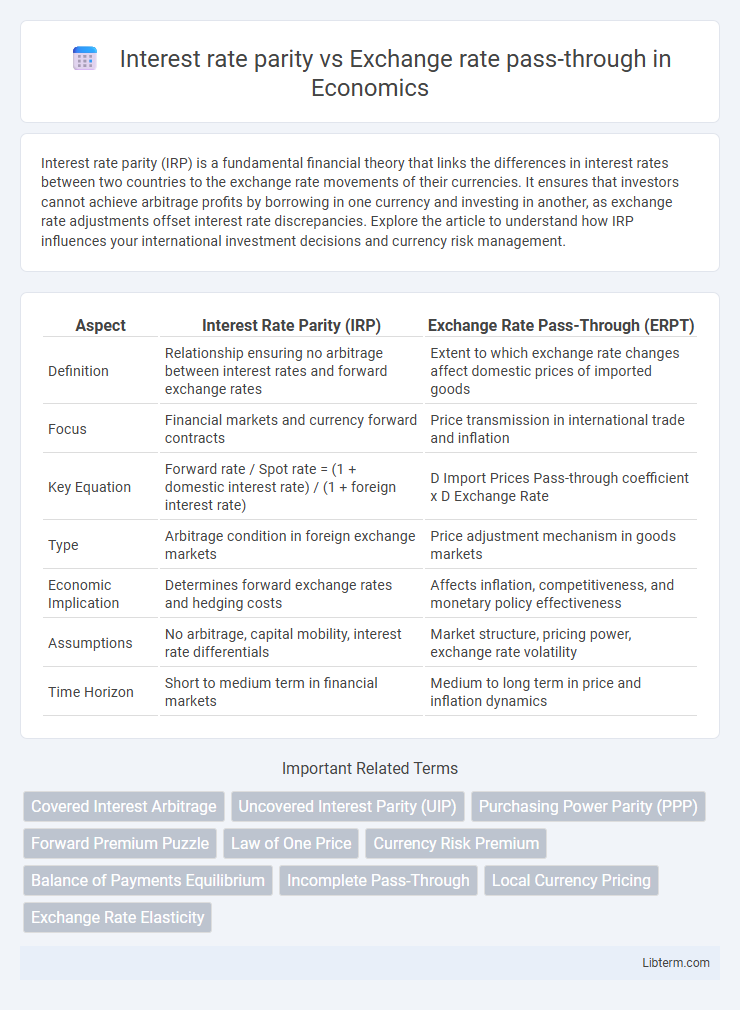

| Aspect | Interest Rate Parity (IRP) | Exchange Rate Pass-Through (ERPT) |

|---|---|---|

| Definition | Relationship ensuring no arbitrage between interest rates and forward exchange rates | Extent to which exchange rate changes affect domestic prices of imported goods |

| Focus | Financial markets and currency forward contracts | Price transmission in international trade and inflation |

| Key Equation | Forward rate / Spot rate = (1 + domestic interest rate) / (1 + foreign interest rate) | D Import Prices Pass-through coefficient x D Exchange Rate |

| Type | Arbitrage condition in foreign exchange markets | Price adjustment mechanism in goods markets |

| Economic Implication | Determines forward exchange rates and hedging costs | Affects inflation, competitiveness, and monetary policy effectiveness |

| Assumptions | No arbitrage, capital mobility, interest rate differentials | Market structure, pricing power, exchange rate volatility |

| Time Horizon | Short to medium term in financial markets | Medium to long term in price and inflation dynamics |

Introduction to Interest Rate Parity (IRP)

Interest Rate Parity (IRP) is a fundamental concept in international finance that explains the relationship between interest rates and exchange rates, ensuring no arbitrage opportunities exist between different currency markets. IRP asserts that the difference in national interest rates for financial instruments of similar risk and maturity should equal the differential between the forward exchange rate and the spot exchange rate. This principle helps predict currency movements and is crucial for understanding exchange rate dynamics and hedging strategies in global markets.

Understanding Exchange Rate Pass-Through (ERPT)

Exchange Rate Pass-Through (ERPT) measures how changes in the exchange rate affect import prices and ultimately domestic inflation, revealing the degree to which currency fluctuations transmit to consumer prices. Unlike Interest Rate Parity, which focuses on the relationship between interest rates and forward exchange rates for arbitrage-free currency returns, ERPT directly links exchange rate movements to price adjustments in the economy. Understanding ERPT is vital for policymakers to gauge the inflationary impact of currency volatility and design effective monetary interventions.

Theoretical Foundations: IRP vs ERPT

Interest rate parity (IRP) establishes a theoretical equilibrium where the difference in interest rates between two countries equals the expected change in exchange rates, preventing arbitrage opportunities in foreign exchange markets. Exchange rate pass-through (ERPT) measures the extent to which changes in exchange rates affect domestic prices of imported goods and services, reflecting price-setting behavior and market structures. While IRP is grounded in arbitrage and financial market efficiency, ERPT is rooted in microeconomic theory related to pricing strategies and inflation transmission mechanisms.

Mechanisms Driving Interest Rate Parity

Interest rate parity (IRP) is driven by the mechanism of arbitrage in international financial markets, ensuring that the differential between domestic and foreign interest rates equals the expected change in exchange rates. This equilibrium prevents investors from earning riskless profits by exploiting differences in interest rates across countries. In contrast, exchange rate pass-through measures how changes in exchange rates influence domestic prices, reflecting transmission in the goods market rather than financial markets.

Transmission Channels of Exchange Rate Pass-Through

Exchange rate pass-through (ERPT) operates through transmission channels such as import prices, domestic inflation, and wage adjustments, which influence the overall cost structure in an economy. Interest rate parity (IRP) affects exchange rates by aligning forward and spot currency prices through differential interest rates, indirectly shaping the ERPT by modifying the cost of foreign currency financing. The interaction between IRP and ERPT determines how shifts in interest rates are transmitted to domestic prices, impacting inflation dynamics and monetary policy effectiveness.

Key Differences Between IRP and ERPT

Interest Rate Parity (IRP) explains the relationship between interest rates and future exchange rates, ensuring no arbitrage opportunities in currency markets by linking spot and forward exchange rates. Exchange Rate Pass-Through (ERPT) measures how changes in exchange rates impact domestic prices of imported and exported goods, influencing inflation and trade balance. Key differences include IRP's foundation on theoretical equilibrium in financial markets versus ERPT's focus on real economy price adjustments, with IRP concerned with interest differentials and forward contracts, whereas ERPT assesses the extent and speed of price transmission from currency fluctuations.

Empirical Evidence on IRP and ERPT

Empirical evidence on Interest Rate Parity (IRP) generally supports the Uncovered Interest Rate Parity condition in the long run, although short-term deviations are common due to risk premia and market frictions. Studies on Exchange Rate Pass-Through (ERPT) reveal a partial and asymmetric transmission of exchange rate changes to domestic prices, with higher pass-through in economies with high inflation or import dependence. Cross-country analyses demonstrate that stronger IRP compliance often correlates with lower ERPT, indicating that well-integrated financial markets dampen exchange rate impacts on inflation.

Macroeconomic Implications of IRP and ERPT

Interest rate parity (IRP) and exchange rate pass-through (ERPT) are critical in understanding currency valuation and inflation dynamics in open economies. IRP ensures that differential interest rates between countries are offset by expected changes in exchange rates, influencing capital flows and monetary policy effectiveness. ERPT affects the degree to which exchange rate fluctuations impact domestic prices, shaping inflation persistence and the real exchange rate dynamics, with significant macroeconomic implications for trade balance adjustment and inflation targeting.

Policy Considerations: IRP vs ERPT

Policymakers must consider that Interest Rate Parity (IRP) emphasizes the alignment of domestic and foreign interest rates to prevent arbitrage opportunities, influencing capital flows and monetary policy effectiveness. Exchange Rate Pass-Through (ERPT) affects inflation dynamics by determining how exchange rate changes translate into domestic prices, impacting inflation targeting and trade competitiveness. Balancing IRP's focus on financial market equilibrium with ERPT's implications for price stability is crucial for designing coherent exchange rate and monetary policies.

Conclusion: Integrating Interest Rate Parity and Exchange Rate Pass-Through

Integrating Interest Rate Parity (IRP) with Exchange Rate Pass-Through (ERPT) reveals a comprehensive framework for understanding currency valuation and price adjustments in international markets. IRP explains the relationship between interest rates and exchange rate movements, while ERPT assesses how these exchange rate changes affect domestic prices. Combining these concepts enhances predictive accuracy for monetary policy impacts and global pricing strategies.

Interest rate parity Infographic

libterm.com

libterm.com