Reference dependence explains how people evaluate outcomes relative to a specific baseline or reference point, rather than in absolute terms. This concept is crucial in understanding decision-making processes, especially in fields like behavioral economics and psychology. Explore the rest of this article to learn how reference dependence shapes your choices and perceptions.

Table of Comparison

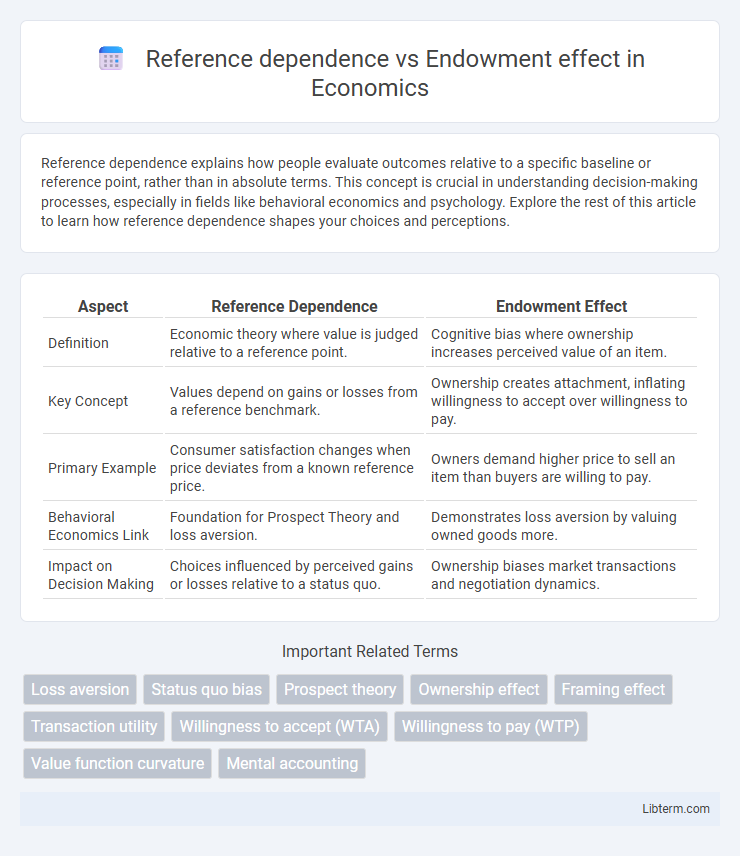

| Aspect | Reference Dependence | Endowment Effect |

|---|---|---|

| Definition | Economic theory where value is judged relative to a reference point. | Cognitive bias where ownership increases perceived value of an item. |

| Key Concept | Values depend on gains or losses from a reference benchmark. | Ownership creates attachment, inflating willingness to accept over willingness to pay. |

| Primary Example | Consumer satisfaction changes when price deviates from a known reference price. | Owners demand higher price to sell an item than buyers are willing to pay. |

| Behavioral Economics Link | Foundation for Prospect Theory and loss aversion. | Demonstrates loss aversion by valuing owned goods more. |

| Impact on Decision Making | Choices influenced by perceived gains or losses relative to a status quo. | Ownership biases market transactions and negotiation dynamics. |

Understanding Reference Dependence

Reference dependence describes how individuals evaluate outcomes based on a comparison to a personal reference point, often their current state or expectations. This concept helps explain why gains and losses are perceived differently, with losses typically felt more acutely than equivalent gains. Understanding reference dependence is crucial for grasping the endowment effect, where ownership shifts the reference point, causing people to overvalue items they possess.

Defining the Endowment Effect

The endowment effect is a cognitive bias where individuals ascribe higher value to objects they own compared to identical items they do not own, reflecting a psychological attachment rather than objective worth. This phenomenon contrasts with reference dependence, which centers on how people evaluate outcomes relative to a reference point, but the endowment effect specifically highlights increased valuation due to ownership. Studies in behavioral economics reveal that ownership changes the reference point, making losses feel more significant than equivalent gains, thereby driving the endowment effect.

Core Principles of Reference Dependence

Reference dependence centers on how people evaluate outcomes relative to a subjective reference point, often their current status or expectations, rather than absolute values. This principle explains that losses loom larger than gains of the same size, forming the basis for the endowment effect, where ownership increases the perceived value of an item. Core principles of reference dependence include loss aversion, diminishing sensitivity, and the framing of options around a reference point, shaping decision-making and valuation behavior.

Psychological Mechanisms Behind the Endowment Effect

The endowment effect arises from psychological mechanisms such as loss aversion and reference dependence, where individuals value an owned object more because its possession sets a reference point. Reference dependence establishes a mental baseline, making losses from this reference point feel more significant than equivalent gains, which intensifies the reluctance to part with owned goods. These mechanisms drive the disparity in willingness to pay versus accept, explaining why people demand more to give up an item than they would pay to acquire it.

Key Differences Between Reference Dependence and Endowment Effect

Reference dependence describes how individuals evaluate outcomes based on a comparison to a subjective reference point, influencing perceived gains or losses. The endowment effect specifically refers to the increased value people assign to objects they own compared to identical items they do not own, rooted in loss aversion relative to the ownership reference point. Key differences lie in scope: reference dependence is a broader cognitive framework affecting decision-making across varying contexts, while the endowment effect is a particular behavioral phenomenon illustrating reference dependence's impact on ownership valuation.

Real-life Examples Illustrating Reference Dependence

Reference dependence influences consumer behavior by causing people to evaluate outcomes relative to a specific reference point, such as the price they initially expect to pay for a product. For example, a shopper perceiving a $50 sale price on a jacket as a good deal because the original price was $100 demonstrates reference dependence. This contrasts with the endowment effect, where individuals value an owned item more highly than its market value, like refusing to sell a coffee mug they own for its market price simply because they possess it.

Case Studies Demonstrating the Endowment Effect

Case studies on the endowment effect reveal that individuals assign higher value to items they own compared to identical items they do not possess, illustrating reference dependence in consumer behavior. For example, the classic Kahneman, Knetsch, and Thaler experiment demonstrated that participants demanded significantly higher prices to sell a mug they owned than they were willing to pay to acquire it. Similarly, studies involving house sellers show that owners overprice properties relative to market value due to their attachment, confirming the endowment effect's influence on economic decision-making and valuation.

Implications in Behavioral Economics

Reference dependence highlights how individuals evaluate outcomes relative to a subjective benchmark, influencing decision-making under uncertainty. The endowment effect, a manifestation of reference dependence, causes individuals to ascribe higher value to owned goods compared to identical non-owned items, leading to market inefficiencies. Understanding these behaviors aids in designing policies and marketing strategies that account for irrational valuation and resistance to trade, enhancing predictive accuracy in behavioral economics.

Marketing Strategies Leveraging Both Biases

Marketing strategies leveraging reference dependence and the endowment effect enhance consumer engagement by anchoring perceived value to initial price points and emphasizing ownership to boost product desirability. Techniques such as limited-time offers and free trials create reference points that consumers compare against, while personalized experiences and customization foster a sense of ownership, intensifying the endowment effect. These biases drive higher willingness to pay and reduce price sensitivity, optimizing conversion rates and long-term customer loyalty.

Mitigating Reference Dependence and Endowment Bias in Decision Making

Mitigating reference dependence and endowment bias in decision making involves strategies such as reframing choices to reduce emotional attachment and employing objective valuation methods to counteract subjective overvaluation of owned items. Decision-makers benefit from adopting perspective-taking techniques and emphasizing external market prices or expert appraisals to adjust reference points more accurately. Incorporating structured decision frameworks and awareness training can further diminish biases, leading to more rational economic and consumer choices.

Reference dependence Infographic

libterm.com

libterm.com