The forward market allows participants to buy or sell assets at a predetermined price for future delivery, helping to manage price risk and hedge against volatility. It plays a crucial role in commodities, currencies, and financial instruments trading by locking in prices and reducing uncertainty. Explore the rest of this article to understand how the forward market can protect your investments and optimize financial strategies.

Table of Comparison

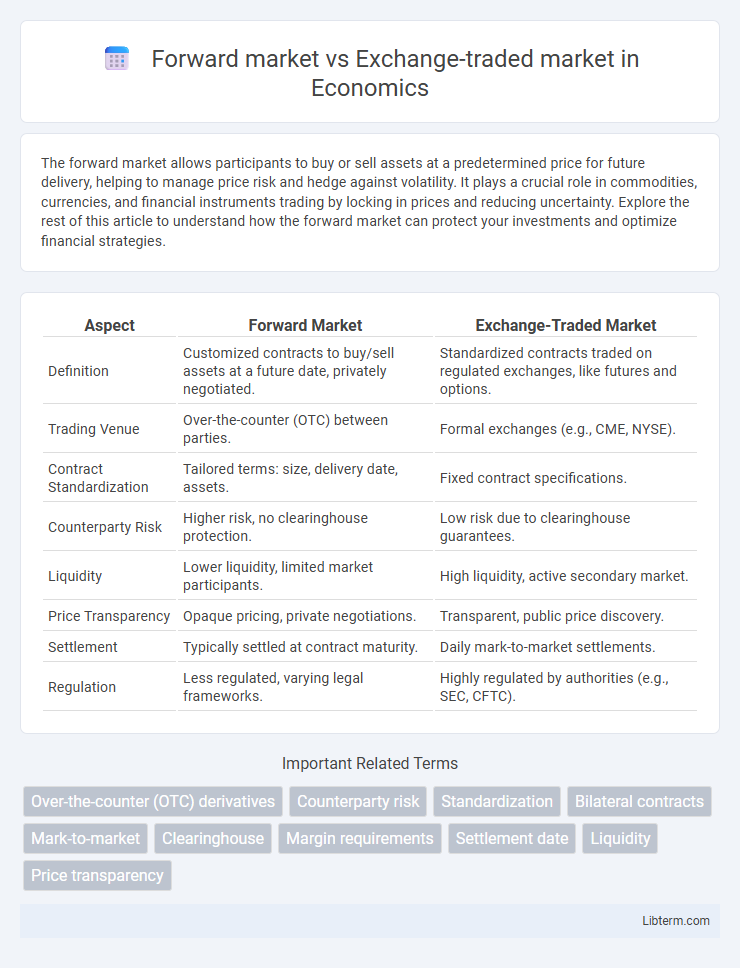

| Aspect | Forward Market | Exchange-Traded Market |

|---|---|---|

| Definition | Customized contracts to buy/sell assets at a future date, privately negotiated. | Standardized contracts traded on regulated exchanges, like futures and options. |

| Trading Venue | Over-the-counter (OTC) between parties. | Formal exchanges (e.g., CME, NYSE). |

| Contract Standardization | Tailored terms: size, delivery date, assets. | Fixed contract specifications. |

| Counterparty Risk | Higher risk, no clearinghouse protection. | Low risk due to clearinghouse guarantees. |

| Liquidity | Lower liquidity, limited market participants. | High liquidity, active secondary market. |

| Price Transparency | Opaque pricing, private negotiations. | Transparent, public price discovery. |

| Settlement | Typically settled at contract maturity. | Daily mark-to-market settlements. |

| Regulation | Less regulated, varying legal frameworks. | Highly regulated by authorities (e.g., SEC, CFTC). |

Introduction to Forward Markets vs Exchange-Traded Markets

Forward markets involve customized contracts traded over-the-counter, allowing parties to negotiate terms directly, enhancing flexibility but increasing counterparty risk. Exchange-traded markets feature standardized contracts traded on regulated exchanges, providing greater liquidity and transparency while minimizing default risk through clearinghouses. These fundamental differences impact pricing, risk management, and regulatory oversight in financial trading.

Key Definitions and Concepts

The forward market involves customized contracts traded over-the-counter (OTC), allowing parties to agree on asset prices for future delivery, offering flexibility but higher counterparty risk. Exchange-traded markets consist of standardized contracts traded on centralized exchanges, providing liquidity, transparency, and reduced counterparty risk through clearinghouses. Key concepts include contract customization in forward markets versus standardization and margin requirements in exchange-traded markets.

Market Structure and Organization

The forward market operates through customized, over-the-counter (OTC) contracts between private parties, allowing tailored terms but lacking a centralized exchange, which can increase counterparty risk. Exchange-traded markets feature standardized contracts traded on regulated exchanges, providing transparency, liquidity, and reduced counterparty risk through clearinghouses. Market structure differences influence price discovery, risk management, and accessibility, with exchange-traded markets emphasizing regulation and uniformity compared to the flexible, bilateral nature of forward markets.

Contract Standardization: Forward vs Exchange-Traded

Forward markets feature customized contracts tailored to the specific needs of buyers and sellers, allowing flexibility in terms, quantities, and settlement dates. Exchange-traded markets offer standardized contracts with fixed terms, sizes, and expiration dates, enhancing liquidity and transparency. Standardization in exchange-traded contracts reduces counterparty risk through centralized clearinghouses, unlike individualized forward contracts that carry higher default risk.

Counterparty Risk and Clearing Mechanisms

Forward markets involve customized contracts traded over-the-counter, exposing participants to higher counterparty risk due to the absence of centralized clearing mechanisms. Exchange-traded markets utilize standardized contracts with the support of clearinghouses that act as intermediaries, significantly reducing counterparty risk through margin requirements and daily settlement. The clearing mechanisms in exchange-traded markets provide enhanced transparency, credit risk mitigation, and liquidity compared to forward market transactions.

Pricing, Transparency, and Market Efficiency

Forward markets typically feature customized contracts with pricing negotiated directly between parties, resulting in less price transparency and lower market efficiency due to limited liquidity and counterparty risk. Exchange-traded markets offer standardized contracts with prices determined by open order books, enhancing transparency through real-time price data and promoting higher market efficiency from greater liquidity and reduced counterparty risk via clearinghouses. The clear price discovery and standardized terms in exchange-traded markets provide investors with more reliable benchmarks compared to the opaque and bespoke nature of forward markets.

Flexibility vs Regulation

The forward market offers high flexibility with customized contracts tailored to specific delivery dates and quantities, enabling parties to manage unique risk exposures. Exchange-traded markets enforce strict regulation and standardized contracts, ensuring transparency, liquidity, and reduced counterparty risk for participants. This regulatory framework limits customization but enhances market integrity and facilitates easier trade execution.

Market Participants: Who Trades Where?

Forward markets primarily involve custom contracts between private parties such as corporations, financial institutions, and exporters, enabling tailored agreements for specific goods and settlement dates. Exchange-traded markets attract a diverse group of participants including individual traders, hedgers, arbitrageurs, and institutional investors, all benefiting from standardized contracts, high liquidity, and transparent pricing. The personalized nature of forward markets suits tailored risk management, while exchange-traded markets offer accessibility and reduced counterparty risk through regulated platforms.

Advantages and Disadvantages Comparison

Forward markets offer customized contracts tailored to specific needs, providing flexibility and hedging precision, but they carry higher counterparty risk due to lack of standardization and centralized clearing. Exchange-traded markets feature standardized contracts with greater liquidity and transparency, reducing credit risk via clearinghouses, yet they lack customization and may involve higher transaction costs. The choice depends on the trade-off between flexibility and risk mitigation suited to the investor's objectives.

Use Cases and Real-World Examples

The forward market is primarily used by businesses and investors seeking customized contracts for hedging currency or commodity price risks, such as multinational corporations locking in exchange rates for future transactions. Real-world examples include agricultural firms entering forward contracts to secure selling prices for crops like wheat or corn, while exchange-traded markets, such as futures exchanges like the Chicago Mercantile Exchange (CME), offer standardized contracts with high liquidity for traders and speculators looking to capitalize on price movements. Exchange-traded markets facilitate transparency and price discovery for commodities, indices, and currencies, making them ideal for investors requiring regulated environments and margin trading opportunities.

Forward market Infographic

libterm.com

libterm.com