The Lewis model categorizes cultures based on communication styles and social behavior into linear-active, multi-active, and reactive types, helping businesses navigate international interactions more effectively. Understanding these distinctions can enhance your cross-cultural communication and improve teamwork in global environments. Explore the full article to discover how applying the Lewis model can transform your approach to cultural diversity.

Table of Comparison

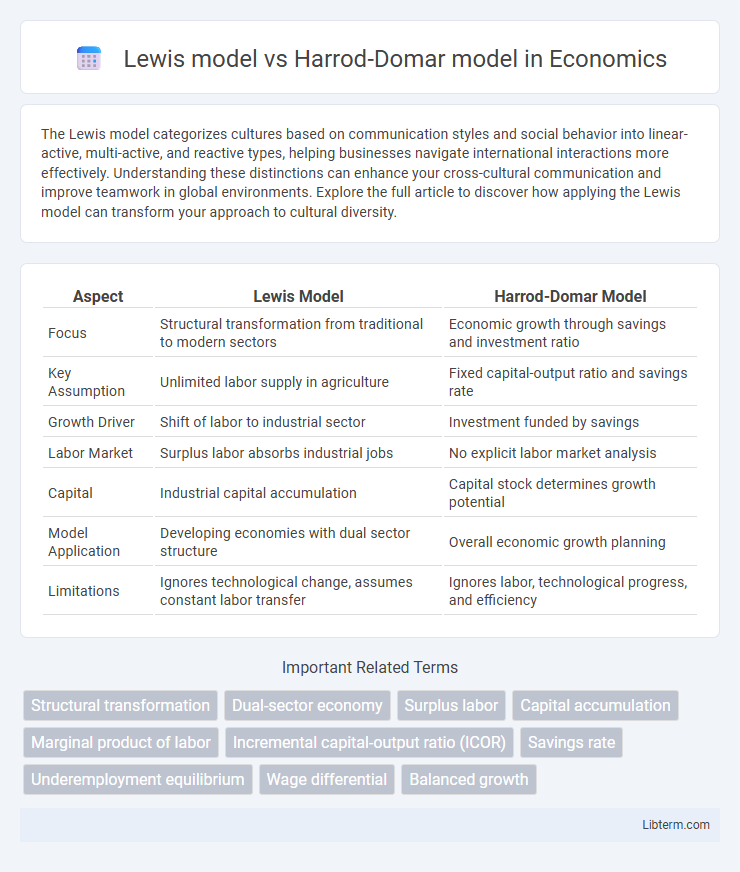

| Aspect | Lewis Model | Harrod-Domar Model |

|---|---|---|

| Focus | Structural transformation from traditional to modern sectors | Economic growth through savings and investment ratio |

| Key Assumption | Unlimited labor supply in agriculture | Fixed capital-output ratio and savings rate |

| Growth Driver | Shift of labor to industrial sector | Investment funded by savings |

| Labor Market | Surplus labor absorbs industrial jobs | No explicit labor market analysis |

| Capital | Industrial capital accumulation | Capital stock determines growth potential |

| Model Application | Developing economies with dual sector structure | Overall economic growth planning |

| Limitations | Ignores technological change, assumes constant labor transfer | Ignores labor, technological progress, and efficiency |

Introduction to Economic Growth Theories

The Lewis model emphasizes dual-sector development, highlighting the transformation of surplus labor from traditional agriculture to modern industry as a driver of economic growth. In contrast, the Harrod-Domar model focuses on the importance of savings and investment rates in determining the growth trajectory of an economy. Both models contribute foundational insights to economic growth theories by addressing structural change and capital accumulation, respectively.

Overview of the Lewis Two-Sector Model

The Lewis Two-Sector Model explains economic development by dividing the economy into a traditional agricultural sector and a modern industrial sector, emphasizing the transfer of surplus labor from agriculture to industry to drive growth. This model highlights the role of labor surplus and capital accumulation in transforming underdeveloped economies. In contrast, the Harrod-Domar Model focuses on the relationship between savings, investment, and economic growth without sectoral distinction.

Fundamentals of the Harrod-Domar Model

The Harrod-Domar model emphasizes the relationship between investment, savings, and economic growth, highlighting the importance of the savings rate and capital-output ratio in determining growth rates. It assumes fixed coefficients in production, where growth depends on the balance between the warranted growth rate and the actual growth rate to maintain economic stability. Unlike the Lewis model, which focuses on structural transformation and labor transfer in dual economies, the Harrod-Domar model provides a foundational framework for understanding the dynamics of investment-driven growth in developing economies.

Key Assumptions: Lewis vs Harrod-Domar

The Lewis model assumes a dual economy with surplus labor in the traditional agricultural sector transferring to the modern industrial sector for sustained economic growth, emphasizing capital accumulation and labor productivity. In contrast, the Harrod-Domar model centers on the relationship between savings, investment, and economic growth, assuming fixed capital-output ratios and the necessity of maintaining steady investment to avoid growth instability. While Lewis highlights structural transformation and labor dynamics, Harrod-Domar focuses on macroeconomic investment requirements and growth rates.

Mechanisms of Capital Accumulation

The Lewis model emphasizes capital accumulation through the transfer of surplus labor from traditional agriculture to modern industrial sectors, driving economic growth by reinvesting profits into expanding industrial capital. In contrast, the Harrod-Domar model links capital accumulation directly to savings and investment rates, highlighting the critical role of the capital-output ratio in determining the growth rate of an economy. Both models underscore capital formation, but while Lewis focuses on structural transformation and labor reallocation, Harrod-Domar centers on macroeconomic savings-investment dynamics.

Role of Labor in Both Models

The Lewis model emphasizes labor as a dual economy feature where surplus rural labor shifts to the industrial sector, driving economic development through increased industrial output. The Harrod-Domar model treats labor as a fixed factor complementing capital in determining growth, focusing on investment and savings rates without explicitly addressing labor market dynamics. Labor in the Lewis model is active in structural transformation, while the Harrod-Domar model assumes labor availability but highlights capital accumulation's role in growth.

Investment and Savings Dynamics

The Lewis model emphasizes structural transformation by reallocating surplus labor from agriculture to industry, where savings and investment drive industrial growth through increased capital accumulation. In contrast, the Harrod-Domar model highlights the direct relationship between investment and growth, asserting that higher savings lead to increased investment, which boosts output based on a fixed capital-output ratio. While the Lewis model integrates labor market dynamics in investment decisions, the Harrod-Domar framework primarily concentrates on the macroeconomic savings-investment nexus influencing economic expansion.

Applicability to Developing Economies

The Lewis model emphasizes structural transformation by shifting labor from traditional agriculture to modern industrial sectors, making it highly relevant for developing economies with surplus rural labor. In contrast, the Harrod-Domar model focuses on savings and investment as key drivers of economic growth, providing a more generalized framework but less emphasis on labor market dynamics. Developing economies benefit from the Lewis model's insight into dual-sector transitions, while the Harrod-Domar model underscores the importance of investment-efficient policies to sustain growth.

Criticisms and Limitations

The Lewis model faces criticism for its oversimplified dual-sector assumption, ignoring complexities like labor market imperfections and income distribution issues in developing economies. The Harrod-Domar model is limited by its assumption of fixed capital-output ratios and neglect of technological progress, which restricts its applicability in dynamic growth environments. Both models often fail to account for institutional factors and external shocks that critically influence real-world economic development.

Comparative Summary and Policy Implications

The Lewis model emphasizes structural transformation through labor transfer from traditional agriculture to modern industry, promoting dual-sector development and industrialization policies, while the Harrod-Domar model highlights savings-driven economic growth focusing on capital accumulation and investment rates. Policy implications of the Lewis model prioritize labor reallocation, skill development, and industrial expansion, whereas the Harrod-Domar model advocates for increasing savings, investment efficiency, and addressing capital-output ratios. Combining insights from both models suggests integrated policies targeting both capital formation and labor productivity to foster sustainable economic growth.

Lewis model Infographic

libterm.com

libterm.com