A bailout is a financial rescue provided to a company or government facing severe distress to prevent collapse and stabilize the economy. Such interventions often involve loans, grants, or asset purchases designed to restore liquidity and confidence. Explore this article to understand the types, implications, and controversies surrounding bailouts.

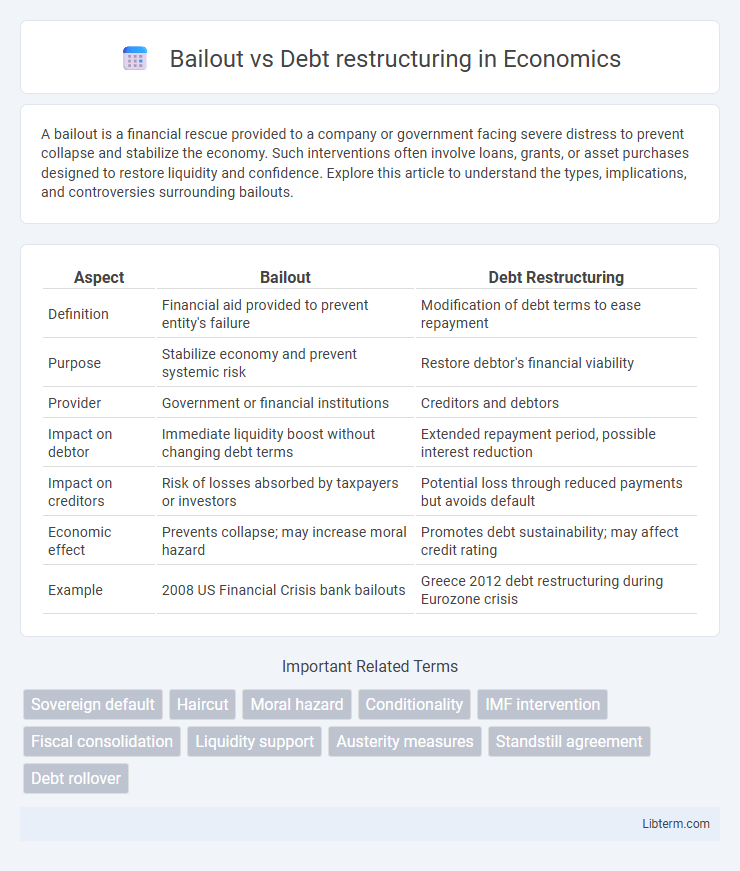

Table of Comparison

| Aspect | Bailout | Debt Restructuring |

|---|---|---|

| Definition | Financial aid provided to prevent entity's failure | Modification of debt terms to ease repayment |

| Purpose | Stabilize economy and prevent systemic risk | Restore debtor's financial viability |

| Provider | Government or financial institutions | Creditors and debtors |

| Impact on debtor | Immediate liquidity boost without changing debt terms | Extended repayment period, possible interest reduction |

| Impact on creditors | Risk of losses absorbed by taxpayers or investors | Potential loss through reduced payments but avoids default |

| Economic effect | Prevents collapse; may increase moral hazard | Promotes debt sustainability; may affect credit rating |

| Example | 2008 US Financial Crisis bank bailouts | Greece 2012 debt restructuring during Eurozone crisis |

Understanding Bailout and Debt Restructuring

Bailouts provide immediate financial support to failing entities, often backed by government funds, to prevent collapse and stabilize the economy. Debt restructuring involves renegotiating existing debt terms to ease repayment burdens and improve financial viability without requiring new external funding. Understanding these mechanisms is essential for assessing their impact on credit markets, fiscal policies, and long-term economic health.

Key Differences Between Bailout and Debt Restructuring

Bailout involves external financial assistance provided to struggling organizations or countries to prevent collapse, typically funded by governments or international institutions, while debt restructuring entails renegotiating existing debt terms between the debtor and creditors to improve repayment conditions without new funding. Bailouts often inject fresh capital to stabilize finances immediately, whereas debt restructuring focuses on modifying interest rates, extending maturities, or reducing principal to restore long-term debt sustainability. The primary distinction lies in bailouts supplying external liquidity support, whereas debt restructuring reorganizes existing obligations to avoid default without direct cash infusions.

Situations Calling for Bailouts

Situations calling for bailouts typically involve systemic financial crises where key institutions or industries face imminent collapse, threatening widespread economic stability and jobs. Governments intervene by providing emergency funding to prevent bankruptcies that could trigger cascading failures throughout the financial system. Bailouts prioritize immediate liquidity support to stabilize markets and restore confidence, unlike debt restructuring which focuses on renegotiating terms to manage long-term debt sustainability.

When Debt Restructuring Becomes Necessary

Debt restructuring becomes necessary when borrowers face prolonged financial distress and are unable to meet their debt obligations, risking default and insolvency. Unlike a bailout, which involves external financial support to stabilize the borrower, debt restructuring renegotiates terms such as interest rates, repayment schedules, or principal amounts to restore viability. This process helps companies or countries avoid bankruptcy by aligning debt burdens with their current cash flow and economic conditions.

Pros and Cons of Bailouts

Bailouts provide immediate financial relief to distressed companies or economies, preserving jobs and stabilizing markets but often lead to moral hazard by encouraging risky behavior due to expectations of future rescues. They can maintain short-term economic confidence but risk excessive public debt and political backlash from taxpayers who may bear the cost. While bailouts offer rapid crisis mitigation, their long-term sustainability and impact on market discipline remain contentious.

Advantages and Challenges of Debt Restructuring

Debt restructuring offers the advantage of providing distressed companies or countries with temporary relief by modifying debt terms, which helps avoid bankruptcy and maintain operations. It enhances liquidity and restores creditworthiness, allowing entities to stabilize financially while preserving stakeholder relationships. Challenges include negotiation complexities among creditors, potential negative impacts on credit ratings, and the risk that restructuring efforts may not prevent future financial distress if underlying problems are not addressed.

Impact on Economies and Financial Markets

Bailouts inject immediate liquidity into distressed economies or financial institutions, stabilizing markets and preventing systemic collapse but often increase sovereign debt levels and can create moral hazard. Debt restructuring delays or reduces debt repayments, improving long-term fiscal sustainability and restoring investor confidence, though it may initially trigger market uncertainty and credit rating downgrades. Both approaches significantly influence credit spreads, investor risk appetite, and economic recovery trajectories, shaping overall market stability and growth prospects.

Historical Examples: Bailouts vs Debt Restructuring

Historical examples highlight stark contrasts between bailouts and debt restructuring in addressing financial crises. The 2008 U.S. financial crisis saw massive government bailouts, such as the Troubled Asset Relief Program (TARP), which provided liquidity to stabilize banks without altering debt terms. In contrast, Greece's sovereign debt crisis involved extensive debt restructuring agreements, including significant haircuts and extended maturities, aimed at reducing the country's debt burden to restore fiscal sustainability.

Policy Considerations for Governments and Institutions

Governments and institutions must evaluate fiscal sustainability, market confidence, and long-term economic impact when choosing between bailout and debt restructuring. Bailouts provide immediate liquidity to stabilize financial systems but may encourage moral hazard and increase public debt burdens. Debt restructuring realigns repayment terms to restore borrower viability while potentially triggering short-term market uncertainty and requiring robust legal frameworks to ensure equitable creditor treatment.

Choosing the Right Approach for Financial Crisis

Choosing between a bailout and debt restructuring hinges on the severity of the financial crisis and the long-term viability of the distressed entity. Bailouts involve direct capital injections to restore liquidity and stabilize critical sectors, often favored by governments to prevent systemic collapse. Debt restructuring renegotiates terms such as interest rates or maturities to improve a debtor's capacity for repayment, making it suitable for entities with potential to recover without external capital.

Bailout Infographic

libterm.com

libterm.com