Risk aversion is a crucial concept in finance and decision-making, describing the preference to avoid uncertainty and potential losses over seeking higher, but uncertain, rewards. It affects investment strategies, insurance choices, and personal financial planning by prioritizing safety and reliability. Explore this article to understand how risk aversion shapes your financial decisions and strategies.

Table of Comparison

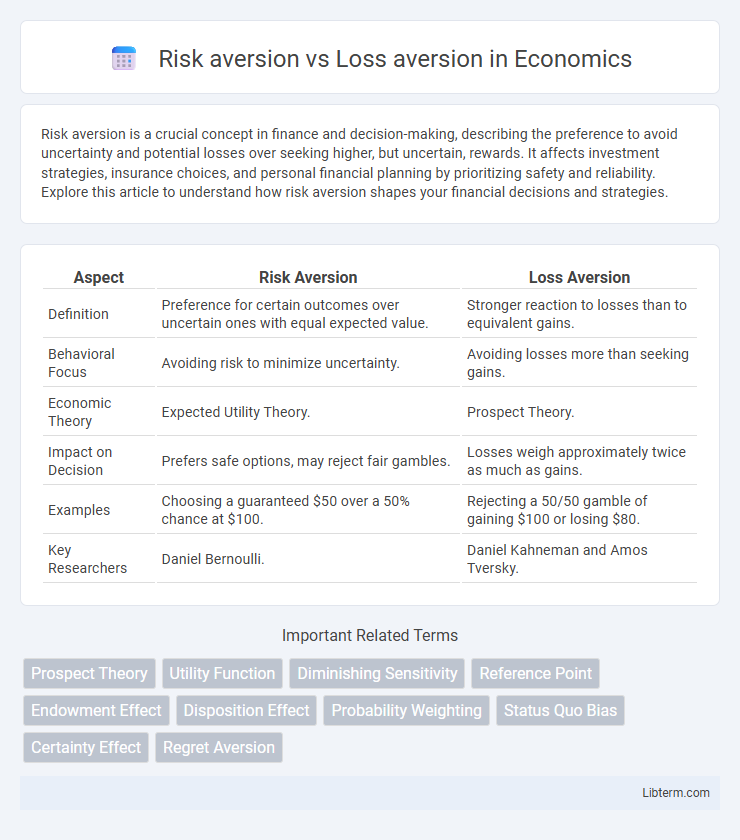

| Aspect | Risk Aversion | Loss Aversion |

|---|---|---|

| Definition | Preference for certain outcomes over uncertain ones with equal expected value. | Stronger reaction to losses than to equivalent gains. |

| Behavioral Focus | Avoiding risk to minimize uncertainty. | Avoiding losses more than seeking gains. |

| Economic Theory | Expected Utility Theory. | Prospect Theory. |

| Impact on Decision | Prefers safe options, may reject fair gambles. | Losses weigh approximately twice as much as gains. |

| Examples | Choosing a guaranteed $50 over a 50% chance at $100. | Rejecting a 50/50 gamble of gaining $100 or losing $80. |

| Key Researchers | Daniel Bernoulli. | Daniel Kahneman and Amos Tversky. |

Introduction to Risk Aversion and Loss Aversion

Risk aversion describes an individual's preference to minimize uncertainty and avoid potential losses when making decisions under risk, often leading to conservative choices. Loss aversion refers to the psychological phenomenon where the pain of losing is perceived as more intense than the pleasure of gaining an equivalent amount, causing people to strongly prefer avoiding losses over acquiring gains. Understanding both concepts is crucial in behavioral economics, as they explain deviations from rational decision-making and influence economic behavior.

Defining Risk Aversion: Concepts and Examples

Risk aversion refers to the preference for certainty over uncertainty, where individuals choose options with lower potential variability even if it means accepting a lower expected return. This concept is often illustrated in finance, where a risk-averse investor favors government bonds over stocks due to the former's predictable returns despite lower yields. Examples include choosing a fixed salary job instead of a commission-based role or opting for insurance policies to mitigate potential losses.

Understanding Loss Aversion: Key Principles

Loss aversion refers to the psychological phenomenon where individuals experience the pain of losses more intensely than the pleasure of equivalent gains, leading to risk-averse behavior in decision-making. Key principles include the asymmetric evaluation of outcomes, where losses are weighted approximately twice as heavily as gains, influencing choices under uncertainty. This bias impacts economic behaviors, investment decisions, and consumer preferences, emphasizing the importance of framing and reference points in understanding human behavior.

Psychological Foundations of Risk and Loss Aversion

Risk aversion stems from the psychological tendency to prefer certain outcomes over uncertain ones, driven by the desire to minimize potential negative consequences. Loss aversion, a core concept in behavioral economics, highlights that individuals experience losses more intensely than equivalent gains, influencing decision-making under uncertainty. Both phenomena are rooted in cognitive biases such as prospect theory, which explains how people evaluate potential risks and losses psychologically rather than purely rationally.

How Risk Aversion Differs from Loss Aversion

Risk aversion refers to the preference for certain outcomes over uncertain ones with the same expected value, leading individuals to avoid gambles or risky investments. Loss aversion specifically highlights the stronger negative emotional impact of losses compared to equivalent gains, causing people to weigh potential losses more heavily than gains in decision-making. Unlike risk aversion's general dislike of uncertainty, loss aversion centers on the disproportionate sensitivity to losses relative to gains, shaping behavior in scenarios involving potential losses.

Behavioral Economics: Real-World Applications

Risk aversion and loss aversion are central concepts in behavioral economics, influencing decision-making processes in real-world scenarios such as investment choices and consumer behavior. Risk aversion leads individuals to prefer certain outcomes over gambles with higher expected value, while loss aversion causes stronger emotional reactions to losses than to equivalent gains, often resulting in suboptimal financial decisions. Understanding these biases helps design better financial products, improve marketing strategies, and develop policies that promote more rational economic behavior.

Impact on Investment and Financial Decision-Making

Risk aversion influences investment decisions by driving individuals to prefer lower-risk assets, often resulting in more conservative portfolios with stable but potentially lower returns. Loss aversion causes investors to weigh potential losses more heavily than equivalent gains, leading to behaviors such as holding losing stocks too long or avoiding beneficial but risky opportunities. Understanding these biases is crucial for financial advisors to design strategies that balance emotional responses with rational risk assessment, optimizing client portfolio performance.

Cognitive Biases Associated with Aversion

Risk aversion and loss aversion are cognitive biases influencing decision-making under uncertainty, where individuals prefer avoiding losses more intensely than acquiring equivalent gains. Risk aversion leads people to choose options with lower uncertainty despite potentially lower rewards, while loss aversion amplifies the negative emotional impact of losses, skewing choices toward avoiding loss rather than pursuing gain. Both biases are rooted in Prospect Theory and significantly affect financial behavior, investment decisions, and economic outcomes.

Strategies to Overcome Risk and Loss Aversion

Employing diversification across asset classes and geographic regions helps mitigate the impact of individual losses, reducing risk aversion in investment decisions. Implementing systematic decision frameworks such as stop-loss orders and pre-defined rebalancing rules minimizes emotional reactions to losses, addressing loss aversion effectively. Cognitive techniques like reframing potential losses as opportunities for learning or long-term gains support psychological resilience against both biases.

Conclusion: Implications for Individuals and Organizations

Risk aversion and loss aversion distinctly influence decision-making by shaping how individuals and organizations evaluate potential outcomes, with risk aversion emphasizing a preference for certainty and loss aversion highlighting sensitivity to potential losses. Understanding these biases helps formulate strategies that mitigate suboptimal decisions, improve investment choices, and enhance risk management frameworks. Organizations can leverage insights into these behavioral tendencies to design policies, communication, and incentives that align with stakeholder risk profiles and drive more effective decision-making under uncertainty.

Risk aversion Infographic

libterm.com

libterm.com