Real return measures the actual profitability of an investment after accounting for inflation, providing a clearer picture of its true value growth. It reflects how much your purchasing power increases beyond nominal gains, making it crucial for assessing long-term financial goals. Discover how understanding real return can improve your investment decisions by reading the rest of the article.

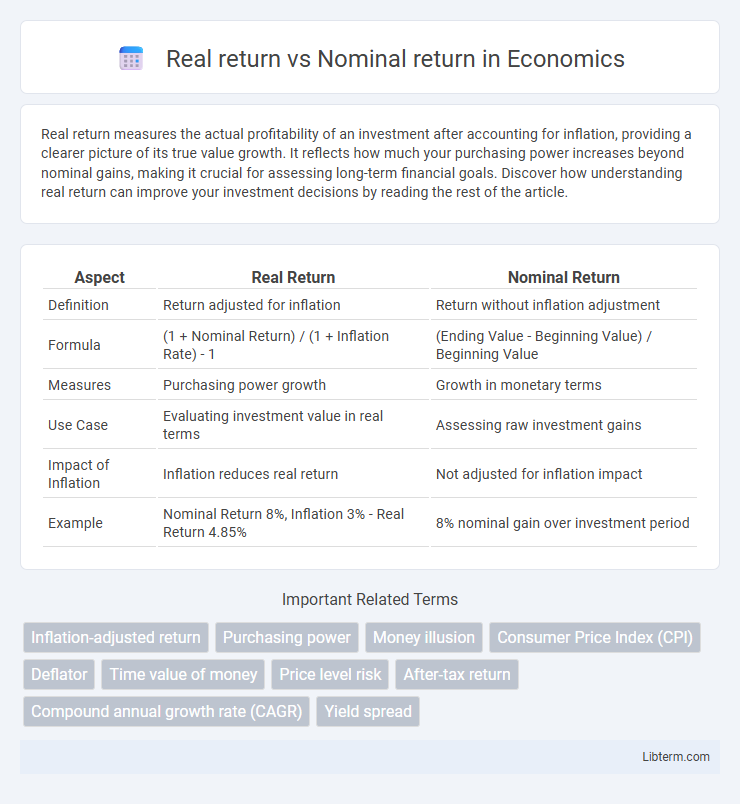

Table of Comparison

| Aspect | Real Return | Nominal Return |

|---|---|---|

| Definition | Return adjusted for inflation | Return without inflation adjustment |

| Formula | (1 + Nominal Return) / (1 + Inflation Rate) - 1 | (Ending Value - Beginning Value) / Beginning Value |

| Measures | Purchasing power growth | Growth in monetary terms |

| Use Case | Evaluating investment value in real terms | Assessing raw investment gains |

| Impact of Inflation | Inflation reduces real return | Not adjusted for inflation impact |

| Example | Nominal Return 8%, Inflation 3% - Real Return 4.85% | 8% nominal gain over investment period |

Understanding Nominal Return

Nominal return represents the percentage increase in money an investment earns over a period without adjusting for inflation, reflecting the raw profit in current dollars. It is essential for comparing investment performance but can be misleading if inflation is high, as it does not account for the decline in purchasing power. Understanding nominal return helps investors evaluate the market value growth before considering real return, which provides a clearer picture of actual financial gain.

What Is Real Return?

Real return measures the investment's actual purchasing power by adjusting the nominal return for inflation, providing a more accurate indicator of profitability. It reflects the true increase in wealth after accounting for the erosion of value caused by rising prices over time. Investors use real return to assess the genuine growth of their assets and make informed financial decisions.

Key Differences Between Real and Nominal Returns

Nominal return represents the percentage increase in money invested without adjusting for inflation, reflecting the raw financial gain. Real return calculates the actual purchasing power gained by subtracting inflation from the nominal return, providing a more accurate measure of investment performance. Understanding the difference between real and nominal returns is crucial for evaluating true investment profitability and making informed financial decisions.

The Impact of Inflation on Investment Returns

Inflation erodes the purchasing power of nominal returns, making real returns a more accurate measure of investment performance over time. For instance, a nominal return of 8% with a 3% inflation rate results in an approximate real return of 5%, reflecting true earnings after adjusting for inflation. Understanding the distinction between real and nominal returns is crucial for investors to assess the actual growth of their wealth and make informed financial decisions.

Why Real Return Matters for Investors

Real return matters because it accounts for inflation's impact on investment gains, providing a true measure of purchasing power growth. Investors who focus solely on nominal returns risk overestimating their actual profit, as inflation can erode the value of their earnings. Understanding real return enables better financial planning and more accurate assessment of investment performance over time.

Calculating Nominal vs. Real Returns

Calculating nominal returns involves measuring the percentage change in investment value without adjusting for inflation, reflecting the raw growth of an asset. Real returns are derived by subtracting the inflation rate from the nominal return, providing a clear picture of the investment's purchasing power gain. Accurate calculation of real returns is crucial for investors seeking to understand the true profitability of their portfolios over time.

Examples of Real and Nominal Returns

A nominal return of 8% on an investment with 3% inflation results in a real return of approximately 5%, reflecting true purchasing power growth. For example, if you earn $108 from a $100 investment under 8% nominal return, but prices rise by 3%, the real value of your money increases by only 5%. Another example is a savings account with a 2% nominal interest rate during 4% inflation, which yields a negative real return of about -2%, indicating a loss in actual value.

Adjusting Investment Strategies for Inflation

Nominal return reflects the percentage increase in money without accounting for inflation, while real return adjusts for inflation to show the true increase in purchasing power. Investors should prioritize real return to safeguard their portfolios against inflation eroding investment gains over time. Adjusting strategies by incorporating assets like Treasury Inflation-Protected Securities (TIPS) and inflation-sensitive equities helps preserve wealth in rising inflation environments.

Common Mistakes in Evaluating Returns

Investors often confuse nominal return with real return by neglecting the impact of inflation, leading to an overestimation of their investment's true profitability. Failing to adjust for inflation distorts the purchasing power of returns, causing misleading comparisons across different time periods or investment options. An accurate evaluation requires subtracting the inflation rate from nominal returns to reflect the real return, which truly measures the growth of wealth.

Real Return vs. Nominal Return: Which Is More Important?

Real return adjusts the nominal return for inflation, providing a more accurate measure of an investment's purchasing power over time. Investors prioritize real return when assessing the true growth of their wealth, as nominal return can be misleading during periods of high inflation. Understanding the difference helps in making informed decisions, ensuring investment strategies preserve or increase real value rather than just face-value gains.

Real return Infographic

libterm.com

libterm.com