Covered interest arbitrage exploits differences in interest rates between countries while eliminating exchange rate risk through forward contracts. This strategy ensures that returns on investments are locked in, allowing investors to capitalize on interest rate differentials without exposure to currency fluctuations. Discover how covered interest arbitrage can optimize Your international investment returns in the full article.

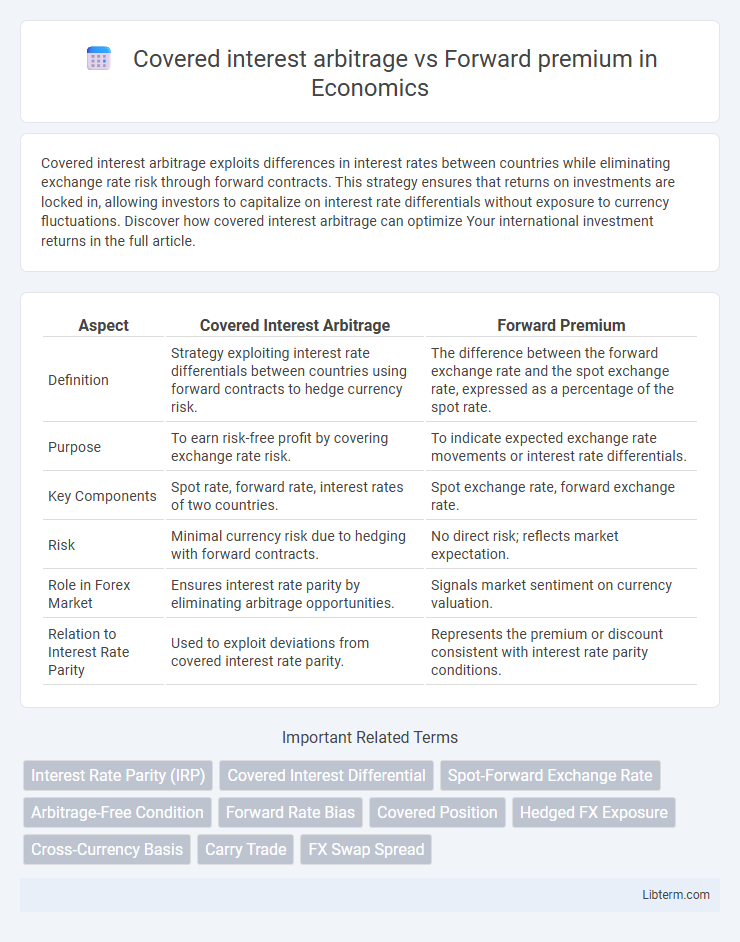

Table of Comparison

| Aspect | Covered Interest Arbitrage | Forward Premium |

|---|---|---|

| Definition | Strategy exploiting interest rate differentials between countries using forward contracts to hedge currency risk. | The difference between the forward exchange rate and the spot exchange rate, expressed as a percentage of the spot rate. |

| Purpose | To earn risk-free profit by covering exchange rate risk. | To indicate expected exchange rate movements or interest rate differentials. |

| Key Components | Spot rate, forward rate, interest rates of two countries. | Spot exchange rate, forward exchange rate. |

| Risk | Minimal currency risk due to hedging with forward contracts. | No direct risk; reflects market expectation. |

| Role in Forex Market | Ensures interest rate parity by eliminating arbitrage opportunities. | Signals market sentiment on currency valuation. |

| Relation to Interest Rate Parity | Used to exploit deviations from covered interest rate parity. | Represents the premium or discount consistent with interest rate parity conditions. |

Introduction to Covered Interest Arbitrage and Forward Premium

Covered interest arbitrage involves exploiting differences in interest rates between two countries while using forward contracts to hedge exchange rate risk, enabling risk-free profits in foreign exchange markets. Forward premium refers to the situation where the forward exchange rate is higher than the spot exchange rate, indicating expectations of currency appreciation relative to another. Understanding the relationship between covered interest arbitrage and forward premium is crucial for traders to identify arbitrage opportunities and ensure exchange rate parity in international finance.

Definitions: Covered Interest Arbitrage and Forward Premium Explained

Covered interest arbitrage involves capitalizing on the interest rate differential between two countries while using a forward contract to hedge exchange rate risk, ensuring a risk-free return. Forward premium refers to the situation where the forward exchange rate is higher than the spot exchange rate, indicating the market's expectation of currency appreciation. Both concepts are crucial in foreign exchange markets for assessing arbitrage opportunities and currency valuation.

Mechanisms Behind Covered Interest Arbitrage

Covered interest arbitrage involves exploiting differences in interest rates between two countries while using forward contracts to hedge exchange rate risk, ensuring a risk-free return. The mechanism relies on borrowing in a currency with a lower interest rate, converting it to a currency with a higher interest rate, and simultaneously entering a forward contract to convert the investment back at maturity. This process aligns with the forward premium or discount, where the forward exchange rate reflects the interest rate differential, maintaining no-arbitrage conditions in the foreign exchange market.

Understanding Forward Premium in Currency Markets

Forward premium in currency markets represents the rate at which a currency is expected to appreciate or depreciate relative to another currency, reflecting differences between spot and forward exchange rates. Covered interest arbitrage exploits this forward premium by simultaneously engaging in spot and forward contracts alongside interest rate differentials between countries to lock in riskless profits. Understanding forward premium helps investors assess expectations of currency movements and informs decisions on hedging and arbitrage strategies in foreign exchange markets.

Mathematical Relationship Between Covered Interest Arbitrage and Forward Premium

The mathematical relationship between covered interest arbitrage (CIA) and forward premium is expressed through the covered interest parity (CIP) condition: (1 + i_domestic) = (F/S) * (1 + i_foreign), where i_domestic and i_foreign are the domestic and foreign interest rates, F is the forward exchange rate, and S is the spot exchange rate. Forward premium is defined as (F - S)/S, representing the expected appreciation or depreciation of the foreign currency in the forward market relative to the spot price. Covered interest arbitrage exploits deviations from CIP, where discrepancies between forward premium and interest rate differentials present riskless profit opportunities until arbitrage forces parity.

Factors Influencing Covered Interest Arbitrage Opportunities

Covered interest arbitrage opportunities depend heavily on interest rate differentials between two countries, forward exchange rates, and spot exchange rates, which together influence potential arbitrage profits. Transaction costs, capital controls, and market liquidity also play critical roles in determining the feasibility of executing covered interest arbitrage strategies. Exchange rate expectations embedded in the forward premium can either bolster or diminish arbitrage opportunities by affecting the cost of hedging currency risk.

Causes and Implications of Forward Premiums

Forward premiums arise when the forward exchange rate exceeds the spot exchange rate, driven by interest rate differentials between two countries as explained by the interest rate parity theory. Covered interest arbitrage exploits these premiums by simultaneously borrowing in the low-interest currency, converting to a high-interest currency, and using forward contracts to lock in exchange rates, ensuring risk-free profits. The implications of persistent forward premiums include market expectations of currency depreciation or appreciation, influencing hedging strategies, capital flows, and monetary policy decisions.

Covered Interest Rate Parity: Theory and Practice

Covered interest arbitrage exploits differences between spot exchange rates adjusted by forward premiums and interest rate differentials to achieve riskless profits. The Covered Interest Rate Parity (CIRP) theory asserts that the forward exchange rate should fully reflect the interest rate differential between two countries, eliminating arbitrage opportunities in efficient markets. Empirical evidence shows that while CIRP holds under normal market conditions, deviations occur due to transaction costs, capital controls, and market frictions, impacting practical application.

Real-World Examples: Covered Interest Arbitrage vs Forward Premium

In 2023, Japanese investors exploited covered interest arbitrage by borrowing yen at low domestic interest rates and investing in higher-yielding U.S. Treasury bonds, locking in profits through forward contracts that neutralized exchange rate risk. Meanwhile, Indian exporters utilized the forward premium by entering into forward contracts to sell rupees at a premium against the U.S. dollar, ensuring predictable rupee inflows despite currency fluctuations amid inflationary pressures. These real-world examples demonstrate how covered interest arbitrage capitalizes on interest rate differentials with exchange risk hedging, whereas forward premium strategies hinge on forward rate deviations from spot rates to manage foreign exchange exposure.

Impact on Global Financial Markets and Investor Strategies

Covered interest arbitrage exploits differences between spot and forward exchange rates to secure risk-free profits, influencing currency demand and capital flows across global markets. The forward premium reflects expected currency depreciation or appreciation, guiding investor hedging strategies and affecting interest rate differentials. These mechanisms drive currency stability and liquidity, shaping portfolio decisions and risk management in international finance.

Covered interest arbitrage Infographic

libterm.com

libterm.com