Quantitative easing is a monetary policy used by central banks to stimulate the economy by increasing the money supply through large-scale asset purchases, such as government bonds. This approach lowers interest rates and encourages lending and investment, aiming to boost economic growth during periods of low inflation or recession. Discover how quantitative easing can impact Your financial decisions and the broader economy by reading the rest of the article.

Table of Comparison

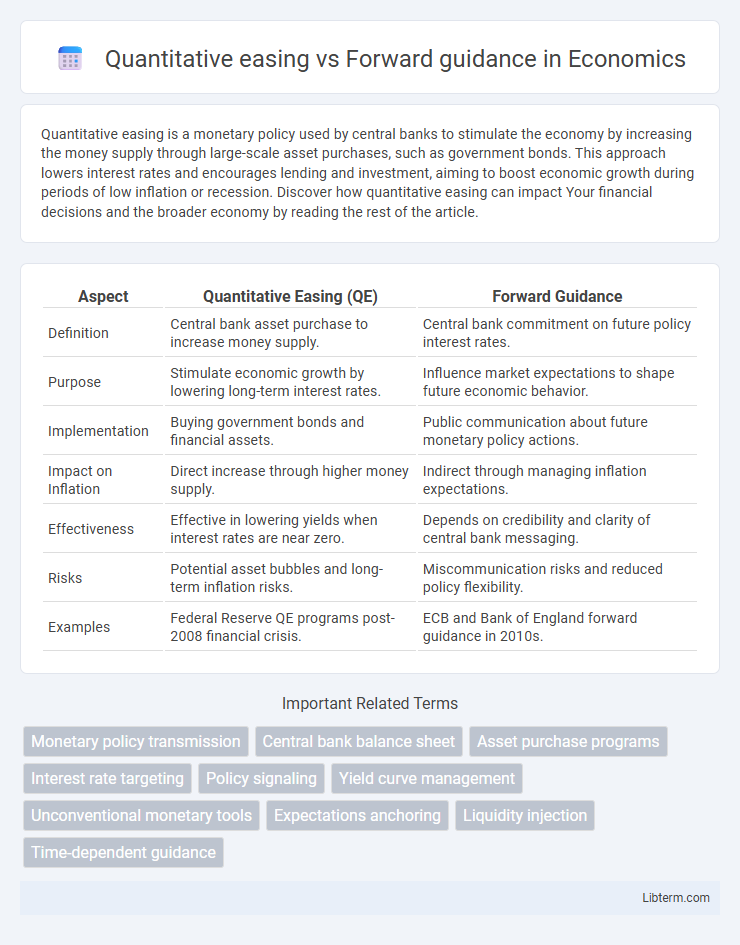

| Aspect | Quantitative Easing (QE) | Forward Guidance |

|---|---|---|

| Definition | Central bank asset purchase to increase money supply. | Central bank commitment on future policy interest rates. |

| Purpose | Stimulate economic growth by lowering long-term interest rates. | Influence market expectations to shape future economic behavior. |

| Implementation | Buying government bonds and financial assets. | Public communication about future monetary policy actions. |

| Impact on Inflation | Direct increase through higher money supply. | Indirect through managing inflation expectations. |

| Effectiveness | Effective in lowering yields when interest rates are near zero. | Depends on credibility and clarity of central bank messaging. |

| Risks | Potential asset bubbles and long-term inflation risks. | Miscommunication risks and reduced policy flexibility. |

| Examples | Federal Reserve QE programs post-2008 financial crisis. | ECB and Bank of England forward guidance in 2010s. |

Defining Quantitative Easing and Forward Guidance

Quantitative easing (QE) is a monetary policy tool where central banks purchase long-term securities to increase money supply and stimulate economic activity. Forward guidance involves central banks communicating future policy intentions to influence market expectations and economic decisions. Both strategies aim to manage inflation and support growth but operate through distinct mechanisms--QE through asset purchases and liquidity injection, and forward guidance through signaling future interest rate paths.

Historical Origins of QE and Forward Guidance

Quantitative easing originated in Japan in the early 2000s as a response to deflation and stagnant growth, aiming to increase money supply by purchasing long-term securities. Forward guidance emerged prominently after the 2008 global financial crisis, as central banks used communication strategies to influence market expectations about future interest rates. Both tools evolved to complement traditional monetary policy during periods of near-zero interest rates and economic uncertainty.

Core Objectives of Each Policy Tool

Quantitative easing primarily aims to lower long-term interest rates and increase money supply by purchasing government bonds and financial assets, stimulating economic growth and preventing deflation. Forward guidance focuses on shaping market expectations about the future path of monetary policy, reducing uncertainty and influencing inflation and output through communicated commitments. Both tools target economic stabilization, but quantitative easing directly impacts liquidity, while forward guidance guides expectations to achieve policy goals.

Mechanisms of Quantitative Easing

Quantitative easing (QE) operates by central banks purchasing long-term securities, such as government bonds, to inject liquidity directly into the financial system, lowering interest rates and encouraging lending and investment. This mechanism expands the central bank's balance sheet, increasing the money supply and targeting asset prices to stimulate economic activity. Forward guidance, in contrast, influences expectations by signaling future monetary policy intentions to shape market behavior without immediate asset purchases.

Mechanisms of Forward Guidance

Forward guidance operates by shaping market expectations regarding the future path of interest rates, thereby influencing long-term yields and economic decisions without immediate balance sheet expansion. Unlike quantitative easing, which involves large-scale asset purchases to increase money supply and lower yields directly, forward guidance relies on central bank communication to steer inflation and growth forecasts. This mechanism enhances policy effectiveness by anchoring expectations, reducing uncertainty, and encouraging spending and investment over time.

Economic Conditions Favoring Each Approach

Quantitative easing proves effective during deep recessions or deflationary environments when conventional monetary policy hits the zero lower bound, enabling central banks to inject liquidity directly into financial systems. Forward guidance works best in stable or moderately weak economic conditions by shaping market expectations about the future path of interest rates, thereby influencing economic behavior without altering the current balance sheet. Each approach is strategically favored depending on economic indicators such as inflation rates, unemployment levels, and financial market stability.

Impacts on Financial Markets and Interest Rates

Quantitative easing (QE) influences financial markets by directly increasing liquidity through large-scale asset purchases, which lowers long-term interest rates and stimulates investment. Forward guidance affects market expectations by signaling the central bank's future policy intentions, thereby shaping short-term interest rates and reducing market uncertainty. Both tools alter bond yields and equity prices, but QE has a more immediate and tangible impact on asset prices, while forward guidance primarily manages investor expectations and confidence.

Case Studies: QE vs Forward Guidance in Action

The Bank of England's quantitative easing (QE) program in response to the 2008 financial crisis expanded its asset purchases by over PS435 billion, directly lowering long-term interest rates and supporting economic recovery. Conversely, the Federal Reserve's forward guidance strategy between 2012 and 2014 clearly communicated future interest rate policies, which helped anchor market expectations and reduced borrowing costs without immediate asset purchases. Case studies reveal QE's direct impact on balance sheets contrasts with forward guidance's reliance on influencing market psychology and expectations to stimulate economic activity.

Benefits and Risks of Each Strategy

Quantitative easing (QE) benefits include lowering long-term interest rates and stimulating asset prices, boosting economic growth during downturns, but it risks inflation, asset bubbles, and distorted financial markets. Forward guidance enhances policy transparency and anchors market expectations, reducing uncertainty and improving the effectiveness of monetary policy, yet it may lose credibility if economic conditions change unexpectedly or if communication is inconsistent. Both strategies aim to influence economic behavior, but QE directly impacts liquidity and balance sheets, while forward guidance shapes future expectations without immediate market intervention.

Future Outlook: Evolving Roles in Monetary Policy

Quantitative easing (QE) and forward guidance both play pivotal roles in shaping future monetary policy frameworks, with QE focusing on asset purchases to influence long-term interest rates and forward guidance targeting market expectations through explicit communication. As global economies face evolving inflationary pressures and uncertain growth trajectories, central banks are integrating QE with enhanced forward guidance to manage expectations and stabilize financial markets effectively. Innovations in data analytics and real-time monitoring are enabling more adaptive and anticipatory monetary strategies, signaling a future where these tools operate synergistically to promote economic resilience.

Quantitative easing Infographic

libterm.com

libterm.com