Stackelberg competition models a strategic game in economics where one firm, the leader, sets its output before other firms, the followers, decide on their quantities. This dynamic results in the leader having a first-mover advantage, influencing market prices and followers' decisions to maximize profits. Discover how understanding Stackelberg competition can help you analyze competitive strategies and market behaviors in this detailed article.

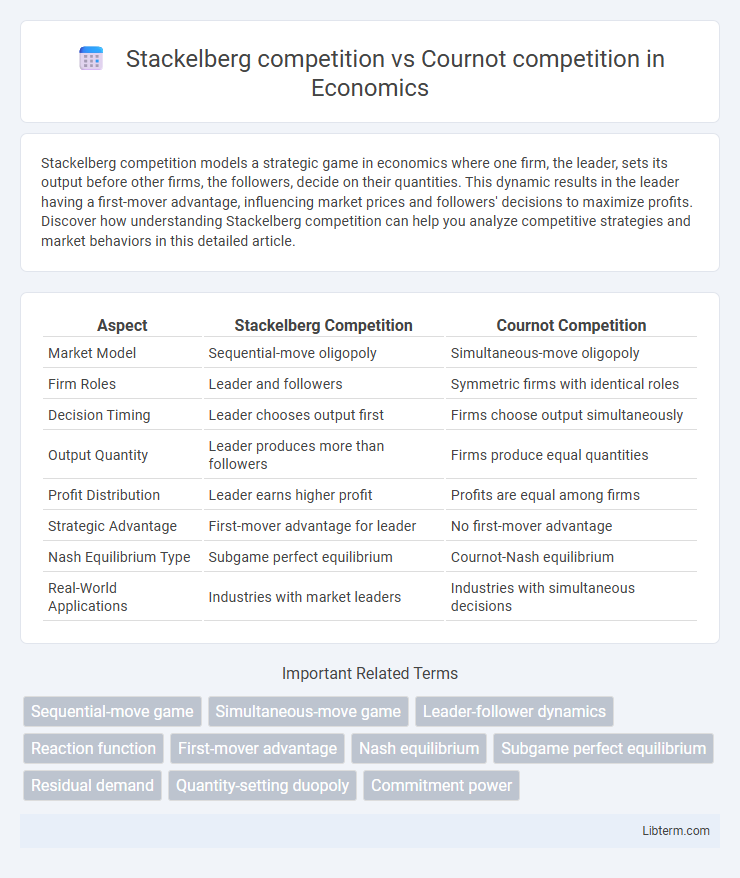

Table of Comparison

| Aspect | Stackelberg Competition | Cournot Competition |

|---|---|---|

| Market Model | Sequential-move oligopoly | Simultaneous-move oligopoly |

| Firm Roles | Leader and followers | Symmetric firms with identical roles |

| Decision Timing | Leader chooses output first | Firms choose output simultaneously |

| Output Quantity | Leader produces more than followers | Firms produce equal quantities |

| Profit Distribution | Leader earns higher profit | Profits are equal among firms |

| Strategic Advantage | First-mover advantage for leader | No first-mover advantage |

| Nash Equilibrium Type | Subgame perfect equilibrium | Cournot-Nash equilibrium |

| Real-World Applications | Industries with market leaders | Industries with simultaneous decisions |

Introduction to Stackelberg and Cournot Competition

Stackelberg competition models firms competing sequentially, where a leader firm moves first and followers react, influencing market outcomes and strategic advantage. Cournot competition involves firms choosing quantities simultaneously, assuming rivals' output is fixed, leading to equilibrium based on mutual quantity decisions. Both frameworks analyze oligopolistic behavior but differ fundamentally in timing and strategic commitment, affecting firms' output, pricing, and profits.

Defining Stackelberg Competition

Stackelberg competition is a strategic game in economics where firms compete by choosing quantities sequentially, with the leader firm moving first and the follower firms reacting to this decision. Unlike Cournot competition, where firms select quantities simultaneously, the Stackelberg model emphasizes the advantage of commitment and information asymmetry in quantity setting. The leader's ability to anticipate the followers' responses typically results in higher profits and market influence compared to the Cournot equilibrium.

Understanding Cournot Competition

Cournot competition models firms competing by choosing quantities simultaneously, assuming rivals' output is fixed, leading to equilibrium where no firm benefits from unilaterally changing its quantity. This contrasts with Stackelberg competition, where firms move sequentially, with a leader firm setting output first and followers reacting accordingly. Understanding Cournot competition is essential for analyzing industries with homogeneous products and strategic interdependence in quantity decisions.

Key Differences Between Stackelberg and Cournot Models

Stackelberg competition involves a leader-follower dynamic where the leader firm commits to output first, gaining a strategic advantage over the follower, unlike Cournot competition where firms decide quantities simultaneously. In Cournot models, firms choose production quantities independently and simultaneously, leading to equilibrium without prior commitment or timing advantage. The key difference lies in the timing of moves and strategic commitment, impacting market equilibrium, output levels, and firm profits.

Role of Leadership and Timing in Stackelberg Competition

Stackelberg competition features a leader-follower dynamic where the leader firm moves first by setting its output, influencing the follower's production decisions and enabling the leader to achieve a strategic advantage and higher profits. Timing is crucial as the leader's first-mover advantage forces the follower to optimize output based on the leader's already established quantity. In contrast, Cournot competition assumes simultaneous moves by firms, with no inherent leadership or timing advantage, leading to equilibrium based purely on mutual quantity choices.

Simultaneity in Cournot Competition

In Cournot competition, firms choose quantities simultaneously, each firm making output decisions without knowing the rivals' choices, leading to a strategic interdependence in quantity setting. Stackelberg competition contrasts this by introducing a sequential move structure, where the leader firm commits to an output first and the follower firms optimize their quantities after observing the leader's decision. The simultaneity in Cournot models results in equilibrium where firms anticipate competitors' quantity choices, whereas the Stackelberg framework allows for first-mover advantage through sequential decision-making.

Profit Outcomes: Stackelberg Leader vs. Cournot Firms

In Stackelberg competition, the leader firm gains a strategic advantage by committing to output first, often resulting in higher profits compared to Cournot firms that choose quantities simultaneously. The Stackelberg leader capitalizes on its first-mover position to influence the follower's output decisions, increasing market share and earnings. Cournot firms, operating without sequential moves, typically achieve lower profits due to mutual quantity competition and less strategic market control.

Real-World Applications of Stackelberg and Cournot Models

Stackelberg competition models firms with sequential moves, reflecting real-world industries like automotive manufacturing and telecommunications where market leaders set quantities first, influencing followers' decisions. Cournot competition suits markets with simultaneous quantity decisions, evident in oligopolies such as electricity generation and commodity markets, where firms independently choose output without observing rivals' moves. Both models help predict strategic interactions in imperfectly competitive markets, guiding pricing and output strategies in sectors with varying degrees of market power and information asymmetry.

Implications for Market Strategy and Policy

Stackelberg competition impacts market strategy by enabling the leader firm to set output first, influencing follower firms' production decisions and potentially securing higher profits and market share. In contrast, Cournot competition assumes simultaneous quantity setting, promoting more balanced competitive outcomes and often resulting in less aggressive strategic positioning. Policymakers should recognize that Stackelberg dynamics may intensify market power concentration, necessitating careful antitrust evaluation, whereas Cournot models provide insights into equilibrium outcomes under more symmetric competition.

Conclusion: Choosing Between Stackelberg and Cournot Strategies

Choosing between Stackelberg and Cournot competition depends on the timing and strategic advantage of firms within an oligopoly. Stackelberg competition favors the firm that can commit to output first, gaining a leadership position and potentially securing higher profits by influencing the follower's production decisions. Cournot competition assumes simultaneous moves, resulting in more balanced market shares but potentially less optimal outcomes for firms capable of aggressive commitment.

Stackelberg competition Infographic

libterm.com

libterm.com