A carbon tax imposes a fee on the carbon content of fossil fuels, encouraging businesses and individuals to reduce greenhouse gas emissions. By internalizing the environmental cost, it promotes cleaner energy alternatives and supports climate change mitigation efforts. Discover how a carbon tax could impact your finances and the broader economy in the rest of this article.

Table of Comparison

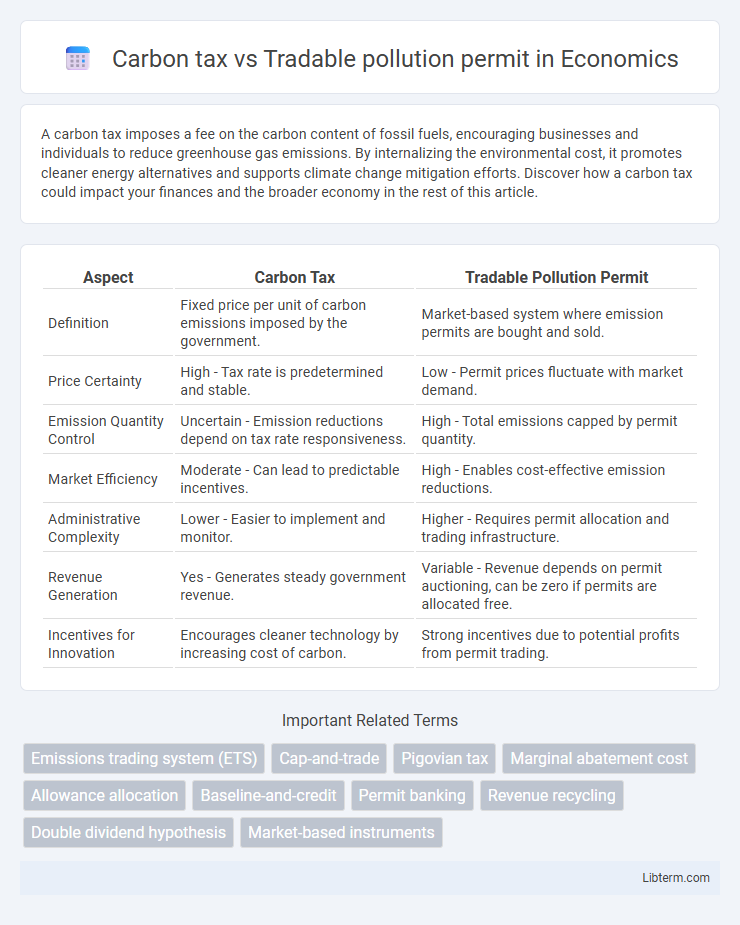

| Aspect | Carbon Tax | Tradable Pollution Permit |

|---|---|---|

| Definition | Fixed price per unit of carbon emissions imposed by the government. | Market-based system where emission permits are bought and sold. |

| Price Certainty | High - Tax rate is predetermined and stable. | Low - Permit prices fluctuate with market demand. |

| Emission Quantity Control | Uncertain - Emission reductions depend on tax rate responsiveness. | High - Total emissions capped by permit quantity. |

| Market Efficiency | Moderate - Can lead to predictable incentives. | High - Enables cost-effective emission reductions. |

| Administrative Complexity | Lower - Easier to implement and monitor. | Higher - Requires permit allocation and trading infrastructure. |

| Revenue Generation | Yes - Generates steady government revenue. | Variable - Revenue depends on permit auctioning, can be zero if permits are allocated free. |

| Incentives for Innovation | Encourages cleaner technology by increasing cost of carbon. | Strong incentives due to potential profits from permit trading. |

Introduction to Carbon Tax and Tradable Pollution Permits

A carbon tax directly sets a fixed price per ton of emitted carbon dioxide, providing businesses with predictable costs to incentivize emission reductions. Tradable pollution permits establish a market-driven cap on total emissions by allocating emission allowances that firms can buy or sell, encouraging cost-effective pollution control. Both mechanisms aim to reduce greenhouse gas emissions but differ in price certainty and flexibility in achieving environmental targets.

Core Principles of Carbon Tax

A carbon tax directly sets a fixed price per metric ton of CO2 emissions, incentivizing businesses to reduce emissions by internalizing environmental costs. It provides price certainty, allowing companies to plan investments in low-carbon technologies with predictable financial implications. This tax mechanism drives behavioral change by making carbon-intensive activities more expensive without specifying emission limits.

Key Concepts Behind Tradable Pollution Permits

Tradable pollution permits, also known as cap-and-trade systems, allocate a fixed number of emissions allowances that firms can buy or sell, creating a financial incentive to reduce pollution efficiently. This market-based approach leverages supply and demand to set a carbon price, encouraging innovation and cost-effective emissions cuts while ensuring total emissions remain within a predetermined cap. Unlike a carbon tax that sets a fixed price per ton of pollution, tradable permits directly limit total emissions, providing environmental certainty with flexible economic adaptation.

Economic Impacts: Comparing the Two Approaches

Carbon tax provides price certainty by setting a fixed cost per ton of emissions, encouraging firms to innovate and reduce pollution while generating predictable government revenue. Tradable pollution permits create a market for emission rights, allowing flexibility in reduction efforts but potentially causing price volatility due to fluctuating permit demand. Economic efficiency depends on market conditions; carbon taxes ensure consistent incentives, whereas permits excel in capping emissions but may lead to uncertain costs for businesses.

Environmental Effectiveness: Carbon Tax vs. Tradable Permits

Carbon tax sets a fixed price on carbon emissions, providing consistent economic incentives for reduction but without guaranteeing specific emission limits. Tradable pollution permits establish a cap on total emissions, ensuring environmental targets are met through a limited number of permits that can be bought and sold. Research shows tradable permits often achieve greater environmental effectiveness by directly controlling emission volumes, while carbon taxes offer price stability and predictability for emitters.

Policy Flexibility and Administrative Complexity

Carbon tax offers greater policy flexibility by setting a fixed price on emissions, allowing businesses to decide their reduction methods and timing, while tradable pollution permits impose a cap on total emissions with a market for permits that can fluctuate in price. Administrative complexity is typically lower for carbon tax since it requires monitoring emissions and collecting tax revenue, whereas tradable permit systems demand rigorous tracking of permit ownership, trading, and compliance enforcement. Policymakers must weigh the straightforward implementation of carbon taxes against the dynamic market mechanisms and administrative demands inherent in tradable permit programs.

Market Predictability: Price Certainty vs. Emissions Certainty

Carbon tax offers price certainty by setting a fixed cost per ton of emissions, enabling businesses to predict expenses and plan investments accordingly. Tradable pollution permits provide emissions certainty by capping total emissions and allowing market forces to determine the price of permits based on demand and supply fluctuations. This trade-off influences policy choice: carbon tax ensures stable pricing while emissions quantities may vary, whereas tradable permits fix emission levels with variable costs.

Global Case Studies and Practical Applications

Global case studies reveal distinct advantages of carbon taxes and tradable pollution permits in reducing greenhouse gas emissions. Sweden's carbon tax, implemented since 1991, has successfully driven a 25% reduction in fossil fuel use while maintaining economic growth, highlighting the tax's efficacy in steady emission cuts. Contrastingly, the U.S. Acid Rain Program employing tradable permits achieved a 50% decline in sulfur dioxide emissions by capping total emissions and allowing market trading, demonstrating flexibility and cost-effectiveness in pollution control.

Challenges and Criticisms of Each System

Carbon tax faces challenges in setting the optimal price that balances economic impact with emission reductions, often criticized for its lack of flexibility in varying market conditions. Tradable pollution permits, while providing flexibility and market-driven allocation, encounter criticism for potential market manipulation, uneven distribution of permits, and complexity in monitoring and enforcement. Both systems struggle with political resistance and concerns over fairness, particularly regarding their economic impact on low-income populations and industries reliant on fossil fuels.

Future Outlook and Recommendations

Carbon tax offers predictable pricing that incentivizes innovation in emissions reduction, while tradable pollution permits provide flexibility by capping total emissions and allowing market-driven allocation. Future policies may blend these tools to balance cost certainty and environmental effectiveness, enhancing adaptability to economic conditions and technological advances. Policymakers should prioritize transparent mechanisms, robust monitoring, and gradual adjustments to optimize long-term climate goals and economic sustainability.

Carbon tax Infographic

libterm.com

libterm.com