Accrual accounting records revenues and expenses when they are incurred, regardless of when cash transactions occur, providing a more accurate financial picture of a business. This method aligns income and expenses in the period they relate to, enhancing financial analysis and decision-making. Explore the rest of the article to understand how accrual accounting can improve your business's financial reporting.

Table of Comparison

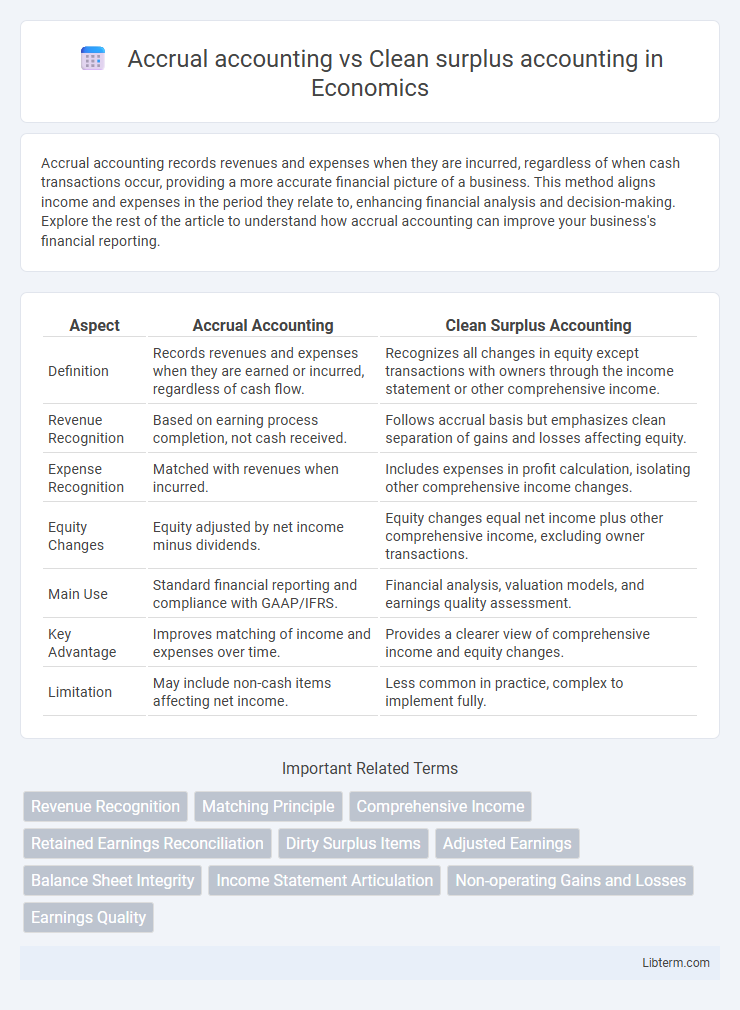

| Aspect | Accrual Accounting | Clean Surplus Accounting |

|---|---|---|

| Definition | Records revenues and expenses when they are earned or incurred, regardless of cash flow. | Recognizes all changes in equity except transactions with owners through the income statement or other comprehensive income. |

| Revenue Recognition | Based on earning process completion, not cash received. | Follows accrual basis but emphasizes clean separation of gains and losses affecting equity. |

| Expense Recognition | Matched with revenues when incurred. | Includes expenses in profit calculation, isolating other comprehensive income changes. |

| Equity Changes | Equity adjusted by net income minus dividends. | Equity changes equal net income plus other comprehensive income, excluding owner transactions. |

| Main Use | Standard financial reporting and compliance with GAAP/IFRS. | Financial analysis, valuation models, and earnings quality assessment. |

| Key Advantage | Improves matching of income and expenses over time. | Provides a clearer view of comprehensive income and equity changes. |

| Limitation | May include non-cash items affecting net income. | Less common in practice, complex to implement fully. |

Introduction to Accrual Accounting and Clean Surplus Accounting

Accrual accounting records financial transactions when they are incurred, regardless of cash flow, ensuring a more accurate reflection of a company's financial position by recognizing revenues and expenses in the period they relate to. Clean surplus accounting adjusts equity changes strictly through income statement items, excluding transactions with owners like dividends or share buybacks, thereby providing a clearer link between net income and changes in equity. The core distinction lies in accrual accounting's comprehensive revenue and expense recognition, contrasted with clean surplus accounting's emphasis on aligning equity changes with reported earnings.

Fundamental Principles of Accrual Accounting

Accrual accounting records financial transactions when they are earned or incurred, regardless of cash flow, emphasizing revenue recognition and matching principles to ensure accurate financial representation. The fundamental principles include recognizing revenues when earned, matching expenses to related revenues, and providing a comprehensive view of financial performance over time. In contrast, clean surplus accounting adjusts equity through comprehensive income without affecting retained earnings, aligning more closely with valuation models but potentially overlooking transaction timing reflected in accrual accounting.

Key Concepts of Clean Surplus Accounting

Clean Surplus Accounting integrates changes in shareholders' equity directly with net income and comprehensive income, bypassing the typical separation of equity adjustments outside the income statement. Key concepts include reconciling ending equity through net income and other comprehensive income without extraneous equity transactions, which enhances the accuracy of performance measurement and valuation models. This method contrasts with Accrual Accounting, which focuses on matching revenues and expenses in the period they occur but may exclude unrealized gains or losses that clean surplus accounting captures comprehensively.

Recognition of Revenue and Expenses: A Comparative Overview

Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of cash flow timing, ensuring financial statements reflect economic activities accurately. Clean surplus accounting bypasses certain equity changes by excluding unrealized gains or losses from the income statement, focusing on realized transactions for revenue and expense recognition. This approach impacts how comprehensive income is reported, offering a distinct perspective on matching revenues with expenses compared to traditional accrual methods.

Treatment of Gains and Losses under Both Methods

In accrual accounting, gains and losses are recognized when they are earned or incurred, aligning with the matching principle that records revenues and expenses in the period they occur. Clean surplus accounting excludes certain gains and losses, such as unrealized gains on equity securities, from net income and instead records them directly in equity, maintaining a clean separation between operational results and revaluation effects. This treatment impacts valuation metrics by reflecting comprehensive income differently, influencing financial analysis and performance assessment.

Impact on Financial Statements and Reporting

Accrual accounting recognizes revenues and expenses when they are incurred, enhancing the accuracy of financial statements by matching income and related costs within the same period. Clean surplus accounting excludes items bypassing the income statement, such as unrealized gains and losses, reflecting comprehensive income directly in equity, which impacts retained earnings and equity reporting. This difference influences the presentation of profitability and net assets, affecting users' assessment of financial health and performance.

Relevance for Investors and Financial Analysts

Accrual accounting provides investors and financial analysts with a comprehensive view of a company's financial performance by recognizing revenues and expenses when they are earned or incurred, improving the accuracy of profit measurement. Clean surplus accounting enhances relevance by excluding certain gains and losses from the income statement, instead reflecting them directly in equity, thus offering a clearer perspective on sustainable earnings. The choice between these methods affects the assessment of financial health and valuation models, making the understanding of each approach crucial for informed investment decisions.

Common Applications in Business and Valuation

Accrual accounting is widely applied in financial reporting to match revenues and expenses within the period they occur, providing a more accurate depiction of a company's financial position for stakeholders and facilitating investor decision-making. Clean surplus accounting, primarily used in valuation models, emphasizes the direct relationship between net income and changes in equity, excluding gains and losses from other comprehensive income, thus enhancing the precision of residual income calculations and equity valuation. Both methods are crucial in business valuation, with accrual accounting supporting standardized financial statements and clean surplus accounting improving the analytical accuracy of equity-based valuation metrics.

Advantages and Limitations of Each Accounting Method

Accrual accounting provides a comprehensive view of financial performance by recognizing revenues and expenses when they are incurred, offering improved matching of income and expenses but may involve complex estimations and adjustments that can reduce transparency. Clean surplus accounting streamlines equity measurement by excluding items bypassing the income statement, enhancing the predictability of earnings relevant for valuation models while potentially overlooking important comprehensive income components such as unrealized gains or losses. The choice between accrual and clean surplus accounting depends on the balance between detailed financial insight and simplicity in equity evaluation.

Conclusion: Choosing the Right Approach for Your Needs

Accrual accounting provides a comprehensive view of financial performance by matching revenues and expenses when they occur, enhancing accuracy in financial reporting. Clean surplus accounting, on the other hand, emphasizes equity changes through net income and other comprehensive income, offering insights into stock valuation and firm performance beyond earnings. Selecting the right approach depends on the specific financial analysis goals, regulatory requirements, and the decision-making needs of stakeholders.

Accrual accounting Infographic

libterm.com

libterm.com