Crowdfunding harnesses the power of collective financial support to fund projects, startups, or charitable causes through online platforms. It offers a flexible and accessible way for entrepreneurs and creatives to validate ideas while engaging directly with their audience. Discover how you can leverage crowdfunding effectively and explore its benefits in the following article.

Table of Comparison

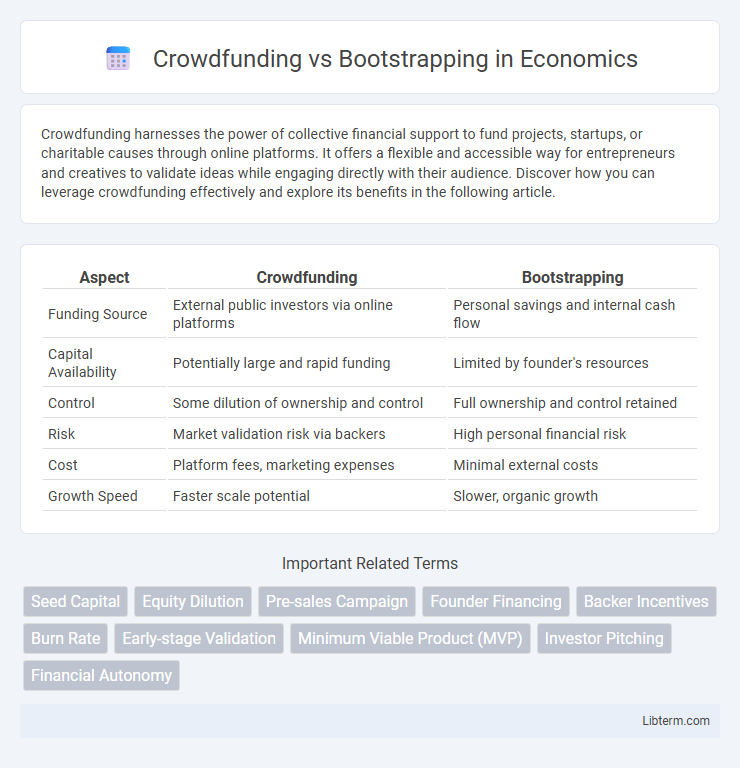

| Aspect | Crowdfunding | Bootstrapping |

|---|---|---|

| Funding Source | External public investors via online platforms | Personal savings and internal cash flow |

| Capital Availability | Potentially large and rapid funding | Limited by founder's resources |

| Control | Some dilution of ownership and control | Full ownership and control retained |

| Risk | Market validation risk via backers | High personal financial risk |

| Cost | Platform fees, marketing expenses | Minimal external costs |

| Growth Speed | Faster scale potential | Slower, organic growth |

Introduction to Crowdfunding and Bootstrapping

Crowdfunding is a fundraising method where entrepreneurs raise capital by collecting small amounts of money from a large number of people, typically via online platforms like Kickstarter or Indiegogo, enabling access to a broad investor base. Bootstrapping involves self-funding a startup through personal savings, reinvested revenues, or minimal external debt, allowing founders to retain full control without diluting equity. Both methods offer distinct advantages depending on business goals, funding needs, and growth strategies.

Defining Crowdfunding: How It Works

Crowdfunding involves raising capital through small contributions from a large number of individuals, typically via online platforms like Kickstarter, Indiegogo, or GoFundMe. Entrepreneurs create campaigns outlining their project goals, funding targets, and rewards or equity offers to attract backers. This method leverages broad public interest to validate ideas and secure necessary funds without traditional financial institutions.

Understanding Bootstrapping: The Basics

Bootstrapping involves funding a startup using personal savings, revenue from initial sales, or reinvested profits, avoiding external investors or loans. This approach demands rigorous budget management and a lean operational strategy to sustain growth while maintaining full control over the business. Entrepreneurs relying on bootstrapping often prioritize cash flow optimization and incremental scaling to achieve long-term financial independence.

Key Differences Between Crowdfunding and Bootstrapping

Crowdfunding involves raising capital from a large number of individuals, often through platforms like Kickstarter or Indiegogo, allowing entrepreneurs to access a wider pool of resources without incurring debt or giving up equity prematurely. Bootstrapping relies on using personal savings, reinvested profits, or operating revenues to fund a startup, maintaining full control and ownership while potentially limiting rapid growth due to resource constraints. The key differences lie in funding sources, ownership dilution, risk exposure, and scalability, with crowdfunding offering broader financial backing but potential obligations to backers, whereas bootstrapping emphasizes self-reliance and autonomy.

Advantages of Crowdfunding for Startups

Crowdfunding offers startups access to a wide pool of potential investors, enabling them to raise capital without giving up significant equity or taking on debt. It also serves as a powerful marketing tool by validating product ideas and generating early customer engagement and feedback. The transparent nature of crowdfunding campaigns builds trust and community support, which can enhance brand loyalty and long-term business growth.

Benefits of Bootstrapping Your Business

Bootstrapping your business enables complete ownership control and fosters disciplined financial management by relying solely on personal savings and revenue. This method encourages sustainable growth without external debt or equity dilution, allowing entrepreneurs to make agile decisions and preserve company vision. Cost efficiency and resourcefulness cultivated through bootstrapping increase long-term resilience and operational independence.

Common Challenges with Crowdfunding

Crowdfunding campaigns often face challenges such as reaching funding goals, maintaining backer engagement, and managing the logistics of reward fulfillment. Creators must also navigate platform fees and compliance with regulatory requirements, which can impact overall funding success. Additionally, ensuring transparent communication and managing public expectations remain critical hurdles throughout the campaign lifecycle.

Pitfalls of Bootstrapping to Consider

Bootstrapping often limits a startup's growth due to constrained personal finances and the inability to scale quickly. Entrepreneurs risk burnout and reduced innovation potential as resources are stretched thin without external funding. Poor cash flow management and unforeseen expenses can critically jeopardize business sustainability in a bootstrapped model.

Choosing the Right Funding Method for Your Business

Choosing the right funding method for your business depends on factors such as growth goals, control preferences, and financial needs. Crowdfunding provides access to capital from a broad audience and validates market interest, ideal for consumer-focused products seeking rapid expansion. Bootstrapping maintains full ownership and control, leveraging personal savings and revenue, which suits businesses prioritizing long-term sustainability and limited external influence.

Final Thoughts: Crowdfunding vs Bootstrapping

Crowdfunding offers access to a broad audience and potential market validation but requires significant marketing effort and relinquishing some control. Bootstrapping maintains full ownership and fosters resourcefulness, yet it limits available capital and growth speed. Choosing between crowdfunding and bootstrapping depends on your business goals, risk tolerance, and long-term vision for scalability.

Crowdfunding Infographic

libterm.com

libterm.com