Post-Keynesian economics challenges classical economic models by emphasizing the importance of uncertainty, effective demand, and the roles of institutions and power in economic outcomes. It focuses on how economies can remain in a state of disequilibrium and the implications this has for policy-making, particularly in areas like employment and income distribution. Discover how Post-Keynesian principles offer fresh perspectives that could reshape your understanding of economic dynamics by reading the rest of the article.

Table of Comparison

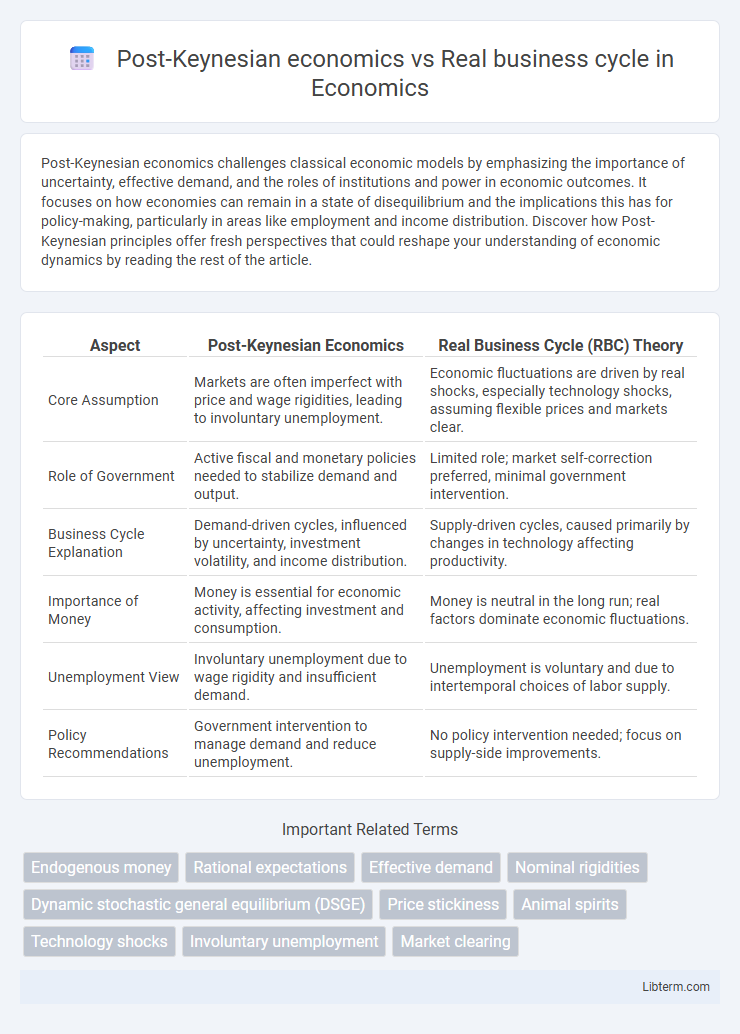

| Aspect | Post-Keynesian Economics | Real Business Cycle (RBC) Theory |

|---|---|---|

| Core Assumption | Markets are often imperfect with price and wage rigidities, leading to involuntary unemployment. | Economic fluctuations are driven by real shocks, especially technology shocks, assuming flexible prices and markets clear. |

| Role of Government | Active fiscal and monetary policies needed to stabilize demand and output. | Limited role; market self-correction preferred, minimal government intervention. |

| Business Cycle Explanation | Demand-driven cycles, influenced by uncertainty, investment volatility, and income distribution. | Supply-driven cycles, caused primarily by changes in technology affecting productivity. |

| Importance of Money | Money is essential for economic activity, affecting investment and consumption. | Money is neutral in the long run; real factors dominate economic fluctuations. |

| Unemployment View | Involuntary unemployment due to wage rigidity and insufficient demand. | Unemployment is voluntary and due to intertemporal choices of labor supply. |

| Policy Recommendations | Government intervention to manage demand and reduce unemployment. | No policy intervention needed; focus on supply-side improvements. |

Introduction to Post-Keynesian Economics and Real Business Cycle Theory

Post-Keynesian economics emphasizes the role of effective demand, uncertainty, and institutional factors in driving economic fluctuations, contrasting with Real Business Cycle theory that attributes cycles primarily to real shocks like technology changes. Post-Keynesians critique RBC models for neglecting money, finance, and wage rigidities, advocating for active policy interventions to stabilize output and employment. Real Business Cycle theory relies on micro-founded models with rational expectations, stressing supply-side explanations and market-clearing conditions in business cycle dynamics.

Historical Origins and Theoretical Foundations

Post-Keynesian economics emerged from the critiques of Keynesian theory in the mid-20th century, emphasizing uncertainty, effective demand, and the non-neutrality of money rooted in John Maynard Keynes's 1936 "The General Theory." In contrast, Real Business Cycle (RBC) theory, developed in the 1980s by economists like Finn E. Kydland and Edward C. Prescott, builds on neoclassical foundations, modeling economic fluctuations as responses to real shocks such as technology changes, assuming rational expectations and market clearing. These differing historical origins reflect divergent theoretical foundations, with Post-Keynesian economics focusing on inherent market imperfections and aggregate demand constraints, while RBC theory relies on microeconomic optimization and equilibrium analysis.

Core Assumptions: Demand vs. Supply-Side Drivers

Post-Keynesian economics emphasizes demand-side drivers, asserting that aggregate demand fluctuations primarily determine economic output and employment due to market imperfections and wage rigidity. In contrast, Real Business Cycle (RBC) theory focuses on supply-side factors, attributing economic fluctuations to real shocks such as technology changes that affect productivity and labor supply decisions. These core assumptions fundamentally shape their divergent policy implications, with Post-Keynesians advocating for demand management and RBC theorists emphasizing market equilibrium adjustments.

Treatment of Market Equilibrium and Disequilibrium

Post-Keynesian economics rejects the notion of automatic market equilibrium, emphasizing persistent disequilibrium due to price and wage rigidities, uncertainty, and effective demand deficiencies. Real business cycle theory assumes markets clear continuously through flexible prices and wages, treating fluctuations as optimal responses to technology shocks and intertemporal preferences. The Post-Keynesian approach highlights involuntary unemployment and cyclical instability, whereas Real business cycle models attribute variations solely to real shocks without inherent disequilibrium.

Role of Government Policy in Economic Stabilization

Post-Keynesian economics emphasizes active government intervention through fiscal policy to stabilize economic fluctuations and address demand deficiencies, supporting measures such as government spending and taxation adjustments to mitigate recessions. In contrast, Real Business Cycle (RBC) theory argues that economic fluctuations result from real shocks like technology changes, advocating minimal government role, as market forces efficiently restore equilibrium without policy interference. Therefore, Post-Keynesians see government policy as essential for smoothing cycles, whereas RBC proponents consider such policies often ineffective or destabilizing.

Price and Wage Flexibility in Both Frameworks

Post-Keynesian economics emphasizes price and wage rigidity, arguing that sticky wages and prices prevent markets from clearing quickly, leading to persistent unemployment and output gaps. In contrast, Real Business Cycle (RBC) theory assumes flexible prices and wages that adjust instantaneously to maintain full employment, attributing economic fluctuations primarily to real shocks such as technology changes. The divergence in assumptions about price and wage flexibility underpins the Post-Keynesian critique of RBC's inability to explain unemployment and demand-driven recessions.

Approach to Unemployment and Labor Markets

Post-Keynesian economics views unemployment as primarily driven by insufficient aggregate demand, emphasizing wage rigidity and the role of labor market institutions in sustaining involuntary unemployment. In contrast, Real Business Cycle (RBC) theory attributes unemployment to real shocks affecting productivity, interpreting labor market fluctuations as optimal responses to changes in technology and preferences, with frictionless markets adjusting efficiently. Post-Keynesians advocate active fiscal policies to manage demand and reduce unemployment, while RBC models suggest minimal intervention, highlighting supply-side factors and market-clearing mechanisms.

Empirical Evidence and Real-World Applications

Post-Keynesian economics emphasizes the role of demand fluctuations, uncertainty, and institutional factors in explaining economic cycles, supported by empirical studies highlighting wage rigidity and liquidity constraints. Real Business Cycle (RBC) theory attributes economic fluctuations to technology shocks and intertemporal optimization, with mixed empirical validation, especially due to its limited explanation of persistent unemployment and demand-driven recessions. In real-world applications, Post-Keynesian models effectively inform counter-cyclical fiscal policies, while RBC frameworks primarily guide long-term growth analysis and supply-side interventions.

Major Criticisms and Debates

Post-Keynesian economics criticizes Real Business Cycle (RBC) theory for its reliance on the assumption of continuous market clearing and rational expectations, which overlook unemployment and demand-driven fluctuations. RBC models are challenged for underestimating the role of monetary and fiscal policy in stabilizing the economy, while Post-Keynesians emphasize uncertainty, effective demand, and imperfect information as central to business cycles. Debates also center on the differing views about wage and price rigidities, with Post-Keynesians arguing they are critical to understanding recessions, contrasting with the RBC focus on technology shocks as primary drivers.

Future Directions and Policy Implications

Post-Keynesian economics emphasizes the role of uncertainty, effective demand, and institutional factors in shaping economic cycles, advocating for active fiscal and monetary policies to stabilize growth and reduce unemployment. Real Business Cycle (RBC) theory focuses on technology shocks and market clearing, recommending minimal government intervention as economies are self-correcting over time. Future research integrates heterodox insights from Post-Keynesian models with RBC's microfoundations to develop policy frameworks addressing income distribution, financial instability, and climate change impacts for sustainable economic resilience.

Post-Keynesian economics Infographic

libterm.com

libterm.com