The multiplier effect describes how an initial increase in spending leads to a larger overall rise in national income and economic activity. It highlights the importance of your investments in stimulating broader economic growth through successive rounds of spending. Explore the article to understand how the multiplier effect can impact your financial decisions and the economy.

Table of Comparison

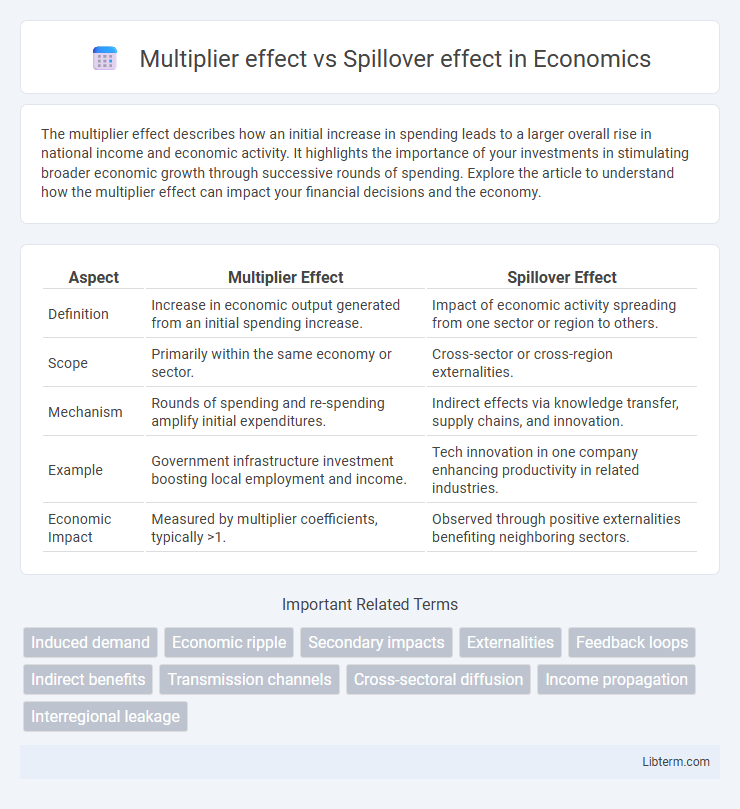

| Aspect | Multiplier Effect | Spillover Effect |

|---|---|---|

| Definition | Increase in economic output generated from an initial spending increase. | Impact of economic activity spreading from one sector or region to others. |

| Scope | Primarily within the same economy or sector. | Cross-sector or cross-region externalities. |

| Mechanism | Rounds of spending and re-spending amplify initial expenditures. | Indirect effects via knowledge transfer, supply chains, and innovation. |

| Example | Government infrastructure investment boosting local employment and income. | Tech innovation in one company enhancing productivity in related industries. |

| Economic Impact | Measured by multiplier coefficients, typically >1. | Observed through positive externalities benefiting neighboring sectors. |

Understanding the Multiplier Effect

The multiplier effect measures how an initial investment generates a greater total economic impact by triggering successive rounds of spending and income generation within a community or economy. It quantifies the amplified output resulting from direct, indirect, and induced effects, demonstrating the compounding benefits of fiscal policies or business activities. Understanding the multiplier effect enables policymakers and economists to estimate the broader economic value created by targeted investments or government expenditures.

Defining Spillover Effect

The spillover effect refers to the impact that seemingly unrelated events or actions in one area have on another area, often extending beyond the original scope. It occurs when economic or social benefits or costs spread from one region, sector, or group to others unintentionally. Unlike the multiplier effect, which measures the amplifying impact of an initial investment within the same economy, spillover effects capture externalities influencing adjacent economies or sectors.

Key Differences Between Multiplier and Spillover Effects

The multiplier effect refers to the amplified economic impact generated when an initial investment leads to increased consumption and income within an economy, creating a chain reaction of spending. In contrast, the spillover effect describes the unintended consequences, positive or negative, that economic activities in one sector or region impose on others without direct financial transactions. Key differences lie in the multiplier effect's focus on cyclical internal growth magnification, whereas spillover effects emphasize externalities affecting adjacent markets or communities.

Economic Drivers of the Multiplier Effect

The multiplier effect in economics occurs when an initial increase in spending leads to a greater overall increase in national income, driven by factors like consumer consumption, business investment, and government expenditure. Key economic drivers include the marginal propensity to consume (MPC), which determines how much additional income is spent, and the interconnectedness of industries through supply chains that amplify spending impacts. In contrast, spillover effects refer to unintended economic benefits or costs experienced by unrelated sectors or regions, often without direct reciprocal effects.

Mechanisms Behind Spillover Effects

Spillover effects occur when economic activities in one sector or region indirectly influence other sectors or regions through various transmission channels such as technology diffusion, labor mobility, and supply chain linkages. These mechanisms enable knowledge sharing, innovation diffusion, and resource reallocation, enhancing productivity beyond the initial area of impact. Unlike the multiplier effect, which primarily measures immediate demand-driven responses, spillover effects capture broader, longer-term interactions that contribute to structural economic growth.

Real-World Examples of Multiplier Effects

The multiplier effect in economics illustrates how an initial investment, such as a government infrastructure project in a city, generates multiple rounds of spending, leading to a larger overall economic impact, exemplified by job creation and increased local business revenues. In contrast, the spillover effect captures unintended consequences beyond the primary target, such as pollution affecting neighboring communities or innovation in Silicon Valley influencing global tech industries. Real-world cases like the automotive industry's growth in Detroit highlight the multiplier effect, where supply chain expansion and increased consumer spending significantly amplified regional economic development.

Practical Illustrations of Spillover Effects

Spillover effects occur when the benefits or costs of an economic activity extend beyond the initial parties involved, such as a factory improving local infrastructure that benefits surrounding businesses. For example, a university's research breakthroughs can lead to new startups, boosting regional innovation and employment rates. These external benefits highlight spillover effects' role in fostering broader economic growth beyond direct investments.

Policy Implications: Choosing the Right Approach

Policy implications of the multiplier effect emphasize targeted investments in key sectors to amplify economic growth through reinforced demand cycles and job creation. In contrast, spillover effects highlight the importance of fostering innovation ecosystems and cross-sector collaborations that generate long-term productivity gains beyond initial investments. Choosing the right approach requires evaluating regional economic structures, sectoral interdependencies, and the desired balance between immediate economic stimulus and sustained developmental impact.

Challenges in Measuring Both Effects

Measuring the multiplier effect faces challenges due to the difficulty in isolating economic impacts from initial spending versus subsequent rounds of spending, often complicated by varying regional economic structures and leakages. The spillover effect measurement is hindered by the intangible and diffuse nature of benefits, such as knowledge transfer or innovation diffusion, which are hard to quantify and attribute to specific sources. Both effects require robust data collection and sophisticated econometric models to accurately capture direct, indirect, and induced impacts within dynamic economic systems.

Multiplier Effect vs Spillover Effect: Summary and Insights

The multiplier effect amplifies economic activity by increasing total output through successive rounds of spending within a specific region or sector, while the spillover effect extends the impact of economic activities beyond initial boundaries, influencing neighboring regions or industries. Understanding these effects is crucial for policymakers to design targeted interventions that maximize local economic growth and regional development. Insights reveal that the multiplier effect drives internal demand cycles, whereas spillover effects facilitate knowledge transfer, innovation diffusion, and cross-sectoral synergies.

Multiplier effect Infographic

libterm.com

libterm.com