Trade-Off Theory explains how companies balance the benefits of debt, such as tax advantages, against the costs like financial distress and bankruptcy risks. This approach helps Your business decide the optimal capital structure that maximizes value while minimizing risks. Explore the rest of the article to understand how to apply Trade-Off Theory effectively in your financial strategy.

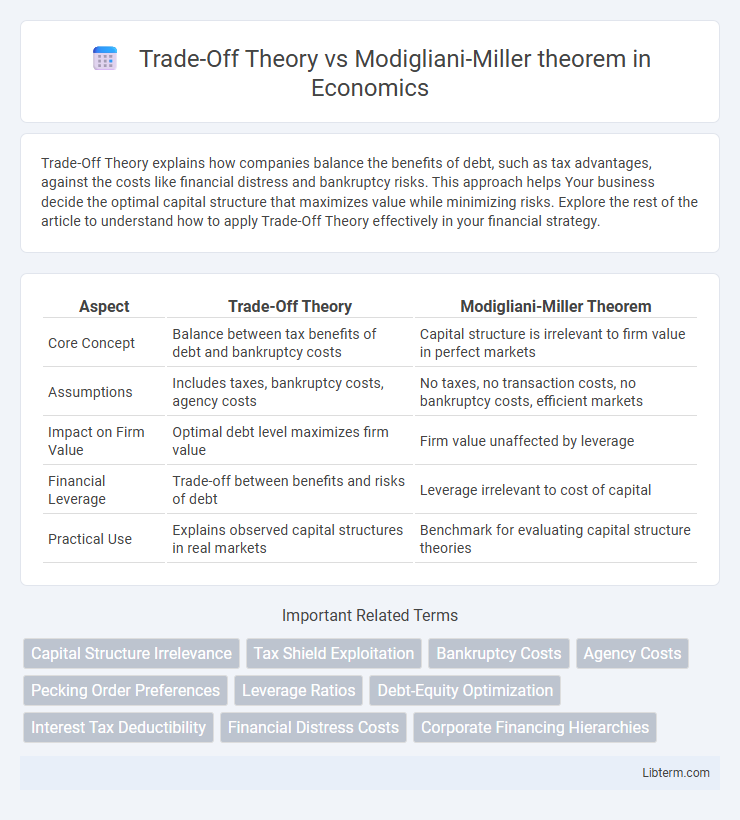

Table of Comparison

| Aspect | Trade-Off Theory | Modigliani-Miller Theorem |

|---|---|---|

| Core Concept | Balance between tax benefits of debt and bankruptcy costs | Capital structure is irrelevant to firm value in perfect markets |

| Assumptions | Includes taxes, bankruptcy costs, agency costs | No taxes, no transaction costs, no bankruptcy costs, efficient markets |

| Impact on Firm Value | Optimal debt level maximizes firm value | Firm value unaffected by leverage |

| Financial Leverage | Trade-off between benefits and risks of debt | Leverage irrelevant to cost of capital |

| Practical Use | Explains observed capital structures in real markets | Benchmark for evaluating capital structure theories |

Introduction to Capital Structure Theories

The Trade-Off Theory of capital structure balances the tax benefits of debt against bankruptcy costs, providing firms with an optimal debt-to-equity ratio to maximize value. In contrast, the Modigliani-Miller theorem posits that under perfect market conditions, a firm's value remains unaffected by its capital structure decisions. Both theories offer foundational insights into the determinants and implications of financing choices, shaping modern corporate finance strategies.

Overview of Trade-Off Theory

Trade-Off Theory suggests firms balance the tax benefits of debt against bankruptcy costs to determine optimal capital structure. This theory emphasizes the trade-off between leveraging tax shields from debt and risking financial distress. It contrasts with the Modigliani-Miller theorem, which posits capital structure irrelevance in perfect markets without taxes or bankruptcy costs.

Understanding the Modigliani-Miller Theorem

The Modigliani-Miller theorem establishes that, in perfect markets without taxes, bankruptcy costs, or asymmetric information, a firm's value remains unaffected by its capital structure. This foundational principle contrasts with the Trade-Off Theory, which incorporates real-world factors like tax shields and bankruptcy costs to explain optimal debt levels. Understanding the Modigliani-Miller theorem helps in recognizing the baseline assumption that capital structure choices do not create or destroy firm value in ideal conditions.

Core Assumptions of Trade-Off Theory

The Trade-Off Theory assumes firms balance the tax benefits of debt against the costs of financial distress to determine optimal capital structure, emphasizing the role of bankruptcy costs and agency costs. It considers asymmetric information, where managers have better knowledge of firm value than investors, influencing debt levels to signal confidence. Unlike the Modigliani-Miller theorem, which assumes no taxes, no bankruptcy costs, and perfect markets, the Trade-Off Theory incorporates real-world frictions affecting leverage decisions.

Key Assumptions of the Modigliani-Miller Theorem

The Modigliani-Miller theorem assumes perfect capital markets with no taxes, bankruptcy costs, or asymmetric information, and that firms and investors can borrow and lend at the same risk-free rate. It further presumes that investment decisions are unaffected by financing choices and that individuals and corporations have homogeneous expectations regarding future earnings. These stringent assumptions lead to the conclusion that capital structure is irrelevant to firm value, contrasting with the Trade-Off Theory's emphasis on tax benefits and bankruptcy costs influencing leverage decisions.

Debt and Equity Balancing: A Comparative Analysis

The Trade-Off Theory emphasizes balancing debt and equity by weighing tax benefits of debt against bankruptcy costs, suggesting an optimal capital structure exists for maximizing firm value. In contrast, the Modigliani-Miller theorem under perfect market conditions states that capital structure is irrelevant to firm value, as debt and equity mix do not affect overall cost of capital. Empirical studies often support Trade-Off Theory's practical application, acknowledging market imperfections ignored in Modigliani-Miller's framework.

Real-World Applications of Trade-Off Theory

The Trade-Off Theory provides a practical framework for firms to balance the benefits of debt, such as tax shields, against bankruptcy costs, making it more applicable in real-world capital structure decisions than the Modigliani-Miller theorem's theoretical perfect market assumptions. In industries with volatile earnings, companies use the Trade-Off Theory to optimize leverage by considering financial distress risks, which the Modigliani-Miller theorem ignores. Empirical evidence supports the Trade-Off Theory's relevance, as firms adjust their debt levels dynamically to approach an optimal capital structure that reflects market imperfections and agency costs.

Practical Implications of the MM Theorem

The Modigliani-Miller theorem emphasizes that in perfect markets, a firm's capital structure does not affect its overall value, highlighting the irrelevance of debt or equity financing costs. This theorem shapes practical financial strategies by suggesting that factors such as taxes, bankruptcy costs, and information asymmetries must drive capital structure decisions, rather than theoretical valuation changes. Firms apply this insight by balancing tax shields from debt against potential financial distress costs, aligning more closely with the Trade-Off Theory in real-world scenarios.

Limitations and Critiques of Each Approach

The Trade-Off Theory faces criticism for its reliance on assumptions about bankruptcy costs and tax shields, which can vary significantly across industries and firms, limiting its universal applicability. The Modigliani-Miller theorem, while foundational in capital structure theory, is often critiqued for its unrealistic assumptions such as perfect markets, no taxes, and no bankruptcy costs, making it less practical for real-world financial decision-making. Both approaches struggle to fully capture dynamic market conditions and agency costs, challenging their use in comprehensive capital structure analysis.

Conclusion: Choosing the Right Theory for Capital Structure Decisions

Trade-Off Theory emphasizes balancing the benefits of debt tax shields against bankruptcy costs, making it practical for firms with tangible assets and predictable cash flows. Modigliani-Miller theorem, under ideal market conditions, argues capital structure is irrelevant, serving as a foundational benchmark rather than a direct guide. Choosing the right capital structure approach depends on firm-specific factors like market imperfections, tax considerations, and financial distress risks, with Trade-Off Theory offering a more actionable framework in real-world scenarios.

Trade-Off Theory Infographic

libterm.com

libterm.com