Galloping inflation drastically reduces the purchasing power of your income, leading to higher costs for everyday goods and services. This rapid price increase disrupts financial planning and can cause economic instability across various sectors. Discover how to protect your finances and adapt strategies by exploring the rest of the article.

Table of Comparison

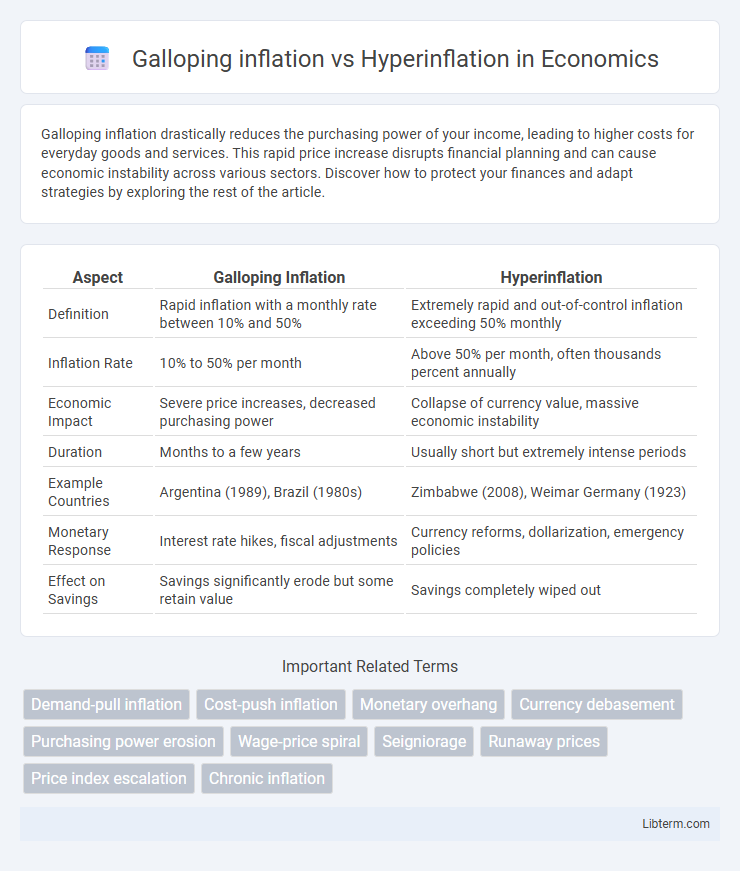

| Aspect | Galloping Inflation | Hyperinflation |

|---|---|---|

| Definition | Rapid inflation with a monthly rate between 10% and 50% | Extremely rapid and out-of-control inflation exceeding 50% monthly |

| Inflation Rate | 10% to 50% per month | Above 50% per month, often thousands percent annually |

| Economic Impact | Severe price increases, decreased purchasing power | Collapse of currency value, massive economic instability |

| Duration | Months to a few years | Usually short but extremely intense periods |

| Example Countries | Argentina (1989), Brazil (1980s) | Zimbabwe (2008), Weimar Germany (1923) |

| Monetary Response | Interest rate hikes, fiscal adjustments | Currency reforms, dollarization, emergency policies |

| Effect on Savings | Savings significantly erode but some retain value | Savings completely wiped out |

Defining Galloping Inflation

Galloping inflation refers to a rapid and severe increase in prices, typically ranging from 10% to 100% annually, significantly eroding purchasing power without completely destabilizing the economy. Unlike hyperinflation, which exceeds 50% monthly and causes extreme economic collapse, galloping inflation disrupts financial planning and savings but still allows for some economic adjustment. Key examples of galloping inflation occurred in countries like Argentina and Turkey during the late 20th century, highlighting the challenges in controlling volatile price spikes.

Understanding Hyperinflation

Hyperinflation is an extreme form of inflation characterized by monthly price increases exceeding 50%, drastically eroding currency value and purchasing power. Unlike galloping inflation, which involves rapid but manageable inflation rates between 10% to 100% annually, hyperinflation results in severe economic instability, often triggered by excessive money printing or loss of confidence in the currency. Understanding hyperinflation requires analyzing factors such as uncontrolled fiscal deficits, collapse of monetary policies, and the social impact of rapidly rising prices on savings and income distribution.

Key Differences Between Galloping Inflation and Hyperinflation

Galloping inflation refers to an inflation rate ranging from 10% to 100% annually, causing significant economic instability but allowing some level of economic adjustment. Hyperinflation exceeds 50% per month, resulting in a catastrophic loss of currency value and collapse of normal economic functions. Key differences include the speed of price increases, the impact on currency stability, and the level of government intervention required to restore confidence.

Causes of Galloping Inflation

Galloping inflation typically arises from demand-pull factors where rapid increases in consumer spending outpace supply, often combined with cost-push elements such as rising wages and raw material prices. Structural economic imbalances, including excessive money supply growth and supply chain disruptions, contribute significantly to galloping inflation's acceleration. Unlike hyperinflation, which results from complete monetary collapse or political instability, galloping inflation remains persistent but somewhat controlled, driven primarily by fiscal deficits and loose monetary policies.

Triggers Behind Hyperinflation

Hyperinflation is typically triggered by an extreme loss of confidence in a country's currency, often caused by massive money supply increases and fiscal imbalances. Galloping inflation, while severe, usually stems from persistent demand-pull factors and cost-push shocks without complete monetary collapse. Key triggers behind hyperinflation include excessive government debt monetization, political instability, and breakdowns in economic institutions, leading to runaway price increases beyond hundreds or thousands percent annually.

Economic Impact of Galloping Inflation

Galloping inflation, characterized by an annual inflation rate between 10% and 100%, severely disrupts economic planning and erodes purchasing power, leading to decreased consumer confidence and reduced investment. Businesses face increased costs and uncertainty, resulting in lower productivity and wage stagnation, which exacerbates income inequality. Unlike hyperinflation, galloping inflation still allows some economic activity to persist, but persistent price volatility undermines long-term economic growth and fiscal stability.

Devastating Effects of Hyperinflation

Hyperinflation causes extreme currency devaluation, leading to skyrocketing prices and loss of purchasing power, which devastates savings and disrupts everyday economic transactions. Unlike galloping inflation, where inflation rates range from 10% to 100% annually, hyperinflation exceeds 50% per month, resulting in widespread shortages, collapse of financial institutions, and severe social unrest. The rapid erosion of trust in the currency under hyperinflation hinders investment, production, and overall economic stability.

Historical Examples of Galloping Inflation

Historical examples of galloping inflation include Germany's Weimar Republic during the early 1920s, where monthly inflation rates reached thousands of percent but did not yet spiral into full hyperinflation. Zimbabwe experienced galloping inflation in the late 1990s, with annual rates exceeding 1,000% before transitioning into hyperinflation in the 2000s. These cases illustrate rapid price increases that severely erode purchasing power without the extreme velocity seen in hyperinflation scenarios.

Notorious Cases of Hyperinflation Worldwide

Hyperinflation is an extreme form of inflation characterized by monthly rates exceeding 50%, leading to rapid currency devaluation and economic collapse, unlike galloping inflation which is high but more manageable. Notorious cases of hyperinflation include Zimbabwe in the late 2000s, where inflation peaked at 79.6 billion percent per month, and the Weimar Republic (Germany) in the early 1920s, with monthly inflation rates reaching 29,500%. Venezuela's hyperinflation since 2016 has also devastated its economy, with inflation rates surpassing 10 million percent annually, illustrating the catastrophic impacts beyond galloping inflation.

Prevention and Policy Responses to Extreme Inflation

Galloping inflation, characterized by monthly rates between 10% and 50%, requires proactive monetary tightening and fiscal discipline to prevent erosion of purchasing power. Hyperinflation, exceeding 50% monthly inflation, demands drastic policy measures including currency reform, stabilization programs backed by international institutions like the IMF, and restoration of public confidence through credible monetary policies. Effective prevention hinges on maintaining central bank independence, controlling money supply growth, and implementing structural economic reforms to avoid destabilizing inflationary spirals.

Galloping inflation Infographic

libterm.com

libterm.com