Money influences real effects by shaping economic behavior, driving consumption patterns, and impacting investment decisions that determine overall economic growth. Its role in facilitating trade, allocating resources, and stabilizing markets directly affects livelihoods and business operations. Explore this article to understand how your financial choices translate into tangible outcomes in the economy.

Table of Comparison

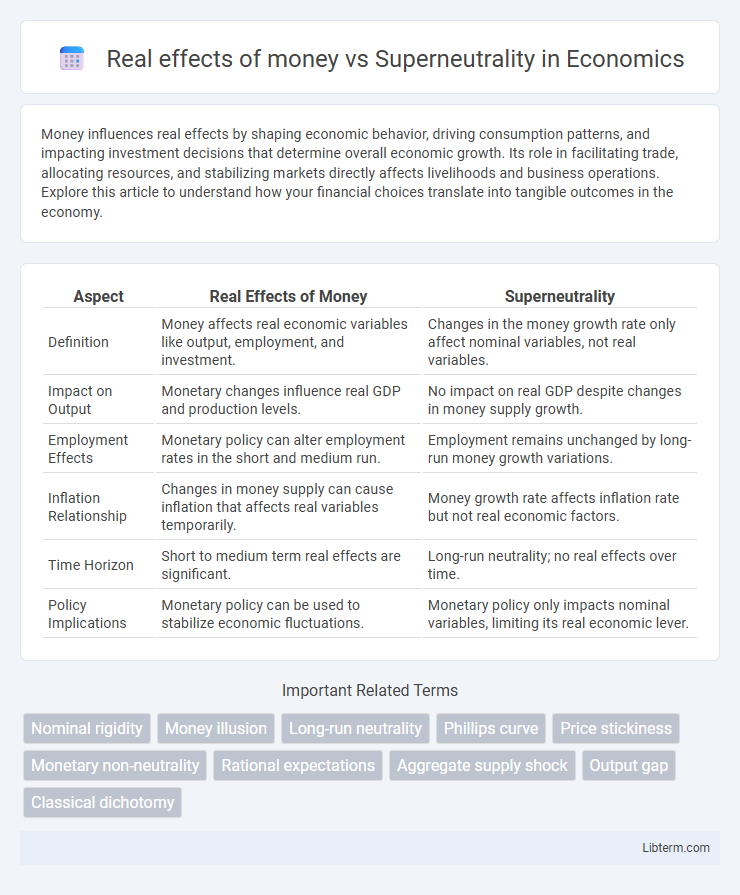

| Aspect | Real Effects of Money | Superneutrality |

|---|---|---|

| Definition | Money affects real economic variables like output, employment, and investment. | Changes in the money growth rate only affect nominal variables, not real variables. |

| Impact on Output | Monetary changes influence real GDP and production levels. | No impact on real GDP despite changes in money supply growth. |

| Employment Effects | Monetary policy can alter employment rates in the short and medium run. | Employment remains unchanged by long-run money growth variations. |

| Inflation Relationship | Changes in money supply can cause inflation that affects real variables temporarily. | Money growth rate affects inflation rate but not real economic factors. |

| Time Horizon | Short to medium term real effects are significant. | Long-run neutrality; no real effects over time. |

| Policy Implications | Monetary policy can be used to stabilize economic fluctuations. | Monetary policy only impacts nominal variables, limiting its real economic lever. |

Understanding Money: Real Effects Explained

Money has real effects on the economy when changes in the money supply influence output, employment, or real interest rates, challenging the superneutrality hypothesis which posits that money supply changes only affect nominal variables like prices and wages. Empirical evidence shows that monetary expansions can stimulate demand and production in the short run due to price rigidity and information asymmetries. Understanding these real effects of money is crucial for effective monetary policy aimed at stabilizing economic fluctuations without causing excessive inflation.

The Economic Theory of Superneutrality

The Economic Theory of Superneutrality posits that changes in the money supply do not affect real economic variables such as output, employment, or real interest rates in the long run, highlighting a neutrality of money beyond nominal effects. In contrast, real effects of money argue that variations in the money supply can influence real economic performance due to price rigidities, information asymmetries, or market imperfections. Empirical studies on superneutrality often focus on testing whether long-term growth rates or real variables respond to monetary expansion, revealing that money is frequently not superneutral, especially in the short to medium term.

Distinguishing Between Real and Nominal Variables

Money has real effects when changes in the money supply influence real variables such as output, employment, and consumption, whereas superneutrality posits that in the long run, proportional changes in money supply affect only nominal variables like prices and wages without altering real economic factors. Distinguishing between real and nominal variables is essential: nominal variables are measured in monetary terms and can be influenced by inflation, while real variables are adjusted for price level changes, reflecting the actual quantity of goods and services. Empirical evidence often shows that money is not superneutral in the short to medium term, as unexpected changes in money supply impact real economic activity, contrasting with the classical long-run neutrality assumption.

Historical Perspectives on Money’s Real Effects

Historical perspectives reveal that money often has significant real effects on output, employment, and investment, contradicting the classical theory of superneutrality which claims that money supply changes do not influence real economic variables. Empirical studies from periods of hyperinflation, monetary expansions, and recessions show that changes in money supply can alter relative prices, factor allocation, and capital accumulation, thereby impacting real economic growth. These findings challenge the superneutrality hypothesis and underscore the importance of monetary policy in shaping long-term economic outcomes.

Empirical Evidence: When Money Matters

Empirical evidence demonstrates that changes in money supply have real effects on output and employment, contradicting the superneutrality hypothesis which claims money supply only influences nominal variables in the long run. Studies using high-frequency data reveal that unexpected monetary expansions boost industrial production and reduce unemployment temporarily. These findings underscore the importance of monetary policy timing and credibility in impacting real economic activity beyond mere price level changes.

Case Studies Challenging Superneutrality

Empirical case studies such as the hyperinflation episodes in Zimbabwe and Weimar Germany demonstrate that changes in money supply can have significant real effects on output, employment, and prices, directly challenging the classical concept of superneutrality. Research in these contexts reveals that nominal money expansions impact capital accumulation, wage-setting, and consumption patterns, contradicting the assumption that monetary variables solely influence nominal indicators without affecting real economic growth. These findings emphasize the importance of monetary policy's real influence, especially in economies experiencing friction or disequilibrium.

Policy Implications: Inflation and Real Output

Inflation influences real output by altering consumption, investment decisions, and wage-setting behavior, demonstrating that money is not superneutral in the short to medium term. Central banks must consider that changes in the money supply can affect employment and production levels, not just prices. Policymakers should implement inflation targeting frameworks to stabilize expectations and minimize distortions in real economic activity caused by unexpected inflation.

Money in the Long Run: The Superneutrality Debate

The debate on superneutrality of money explores whether changes in the money supply affect real economic variables like output and employment in the long run. Empirical studies suggest that while nominal shocks might have short-term real effects, persistent changes in money supply predominantly influence inflation without altering real growth or unemployment, supporting the superneutrality premise. However, certain models incorporating price stickiness or capital accumulation challenge strict superneutrality, indicating nuanced real effects of money over time.

Critiques and Limitations of Superneutrality

Superneutrality of money posits that changes in the growth rate of money supply have no long-term effects on real variables like output or employment, holding the nominal interest rate constant. Critiques highlight that empirical evidence often contradicts this notion, showing that monetary expansions can influence real economic activity, particularly in the short to medium term, due to price stickiness, wage rigidity, and information asymmetries. Limitations of superneutrality stem from these frictions, as well as from the role of expectations and monetary policy credibility, which prevent instantaneous adjustments and allow money supply changes to impact real economic outcomes.

Future Research Directions in Monetary Economics

Future research in monetary economics should investigate the conditions under which money exhibits real effects versus instances of superneutrality, emphasizing the role of nominal rigidities and expectations in dynamic settings. Empirical studies could employ high-frequency data and natural experiments to identify monetary policy's impact on output, investment, and employment beyond inflation effects. The development of DSGE models incorporating heterogeneous agents and financial frictions will enhance understanding of how monetary shocks propagate through the economy over varying time horizons.

Real effects of money Infographic

libterm.com

libterm.com