The Taylor rule provides a formula that central banks use to set interest rates based on inflation and economic output gaps, aiming to stabilize the economy. By adjusting interest rates according to changes in inflation and GDP deviations, the rule helps guide monetary policy decisions for maintaining price stability and promoting growth. Discover how applying the Taylor rule can influence your understanding of interest rate adjustments and economic stability in the detailed article ahead.

Table of Comparison

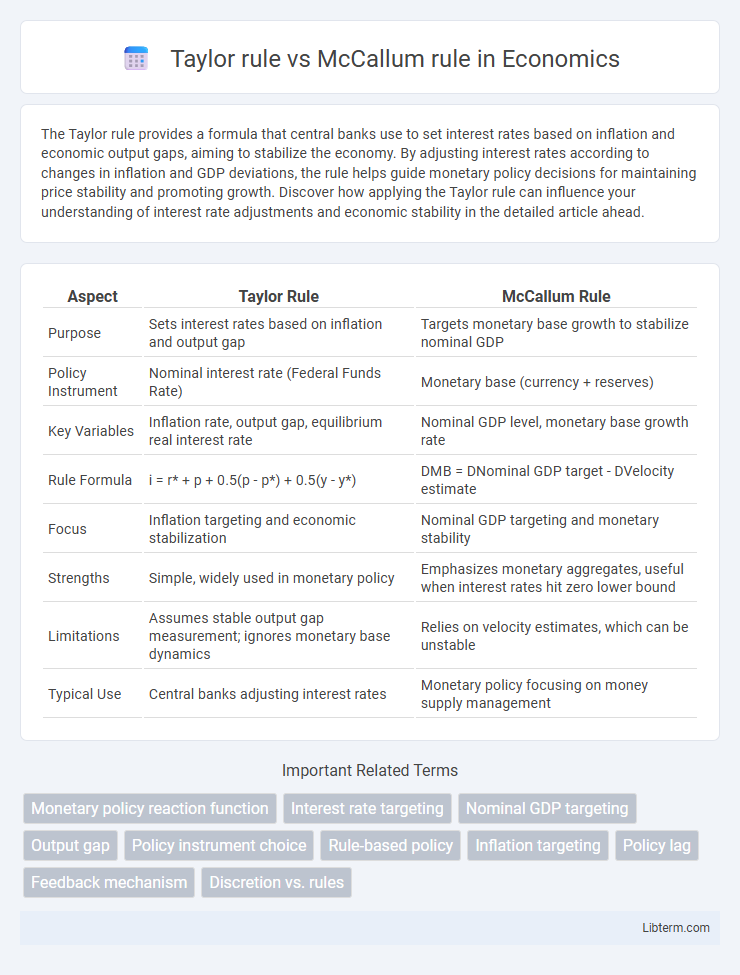

| Aspect | Taylor Rule | McCallum Rule |

|---|---|---|

| Purpose | Sets interest rates based on inflation and output gap | Targets monetary base growth to stabilize nominal GDP |

| Policy Instrument | Nominal interest rate (Federal Funds Rate) | Monetary base (currency + reserves) |

| Key Variables | Inflation rate, output gap, equilibrium real interest rate | Nominal GDP level, monetary base growth rate |

| Rule Formula | i = r* + p + 0.5(p - p*) + 0.5(y - y*) | DMB = DNominal GDP target - DVelocity estimate |

| Focus | Inflation targeting and economic stabilization | Nominal GDP targeting and monetary stability |

| Strengths | Simple, widely used in monetary policy | Emphasizes monetary aggregates, useful when interest rates hit zero lower bound |

| Limitations | Assumes stable output gap measurement; ignores monetary base dynamics | Relies on velocity estimates, which can be unstable |

| Typical Use | Central banks adjusting interest rates | Monetary policy focusing on money supply management |

Introduction to Monetary Policy Rules

The Taylor rule prescribes setting the nominal interest rate based on deviations of inflation from its target and output from its potential, providing a systematic guideline for monetary policy. The McCallum rule emphasizes controlling the monetary base growth rate to stabilize nominal GDP, focusing on money supply rather than interest rates. Both rules aim to guide central banks in achieving price stability and economic growth through rules-based approaches.

Overview of the Taylor Rule

The Taylor Rule is a monetary policy guideline that prescribes how central banks should adjust nominal interest rates in response to deviations in inflation and output from their target levels. It typically sets the federal funds rate based on the current inflation rate, the deviation of inflation from the target rate, and the output gap, balancing price stability and economic growth. The Taylor Rule provides a systematic framework to predict interest rate movements and improve policy transparency, contrasting with the McCallum Rule, which emphasizes controlling the growth rate of the monetary base.

Overview of the McCallum Rule

The McCallum Rule is a monetary policy guideline that targets the growth rate of nominal GDP to stabilize economic performance, differing from the Taylor Rule which adjusts interest rates based on inflation and output gaps. It emphasizes controlling the monetary base rather than short-term interest rates, aiming to guide central banks in managing liquidity to achieve macroeconomic stability. By focusing on a target nominal GDP level, the McCallum Rule provides a framework for monetary policy that is particularly useful when interest rates approach the zero lower bound.

Key Components of the Taylor Rule

The Taylor rule primarily relies on three key components: the target inflation rate, the equilibrium real interest rate, and the output gap, which measures the difference between actual and potential GDP. This rule adjusts the nominal interest rate based on deviations of inflation from its target and output from its potential. Unlike the McCallum rule, which emphasizes monetary base targeting to achieve nominal GDP stability, the Taylor rule focuses on stabilizing inflation and economic output through interest rate adjustments.

Key Components of the McCallum Rule

The McCallum rule emphasizes targeting the nominal GDP level by adjusting the growth rate of the monetary base, incorporating factors such as the velocity of money and the desired nominal income path. Its key components include the target nominal GDP growth rate, the actual monetary base growth, and the velocity of money, which together guide central banks in setting monetary policy to stabilize long-term price levels. Unlike the Taylor rule, which focuses on interest rates responding to inflation and output gaps, the McCallum rule prioritizes monetary aggregates and nominal GDP targeting for controlling inflation and economic stability.

Comparing Taylor Rule and McCallum Rule

The Taylor Rule prescribes interest rate adjustments based on deviations of inflation and economic output from their targets, emphasizing monetary policy's reaction to inflation gaps and output gaps. The McCallum Rule, however, targets nominal GDP growth through adjustments in the monetary base, prioritizing monetary aggregates over interest rates. While the Taylor Rule relies on observable economic variables like inflation and output, the McCallum Rule focuses on controlling nominal GDP growth to stabilize the economy amid different monetary conditions.

Strengths and Weaknesses of the Taylor Rule

The Taylor Rule provides a straightforward formula linking interest rates to inflation and output gaps, enabling predictable and transparent monetary policy decisions that help stabilize the economy. Its simplicity facilitates communication and policy implementation but can oversimplify real-world complexities, often neglecting financial market conditions and the zero lower bound on interest rates. Critics argue its rigid structure may lead to policy missteps during economic shocks or unusual conditions, highlighting the need for more flexible or complementary rules like the McCallum Rule, which targets monetary aggregates.

Strengths and Weaknesses of the McCallum Rule

The McCallum rule's strength lies in its focus on targeting nominal GDP growth through adjustments in the monetary base, providing a clear framework for stabilizing economic output and inflation without relying heavily on interest rate signals. Its reliance on monetary base control can be advantageous in periods when interest rate policy is less effective, such as the zero lower bound. However, the McCallum rule faces weaknesses including sensitivity to velocity shocks and measurement errors in the monetary base, which can reduce its precision and effectiveness in real-world monetary policy implementation.

Taylor Rule vs McCallum Rule in Practice

The Taylor Rule guides monetary policy by adjusting interest rates based on inflation and output gaps, providing a clear, rule-based approach frequently used by central banks to stabilize the economy. The McCallum Rule focuses on controlling the money supply growth relative to nominal GDP targets, offering an alternative framework suited for times when central banks prefer targeting monetary aggregates over interest rates. In practice, the Taylor Rule's simplicity and responsiveness to real-time economic indicators make it more commonly implemented, while the McCallum Rule finds use in specific contexts where money supply control aligns better with policy objectives.

Policy Implications and Future Perspectives

The Taylor rule, emphasizing interest rate adjustments based on inflation and output gaps, guides central banks toward stabilizing economic fluctuations through systematic monetary policy responses. The McCallum rule targets nominal GDP growth by adjusting the money supply, offering a framework adaptable to periods of liquidity traps or unconventional monetary environments. Future perspectives highlight integrating both rules with real-time data analytics to enhance policy responsiveness, while balancing inflation control and economic growth objectives in an increasingly complex global financial system.

Taylor rule Infographic

libterm.com

libterm.com