Dynamic stochastic general equilibrium (DSGE) models are essential tools used by economists to analyze macroeconomic policy and forecast economic fluctuations by incorporating microeconomic foundations, randomness, and time dynamics. These models capture how shocks affect the economy over time through optimizing agents and market-clearing conditions, providing insights into fiscal and monetary policy impacts. Discover how DSGE models can deepen your understanding of complex economic interactions by reading the full article.

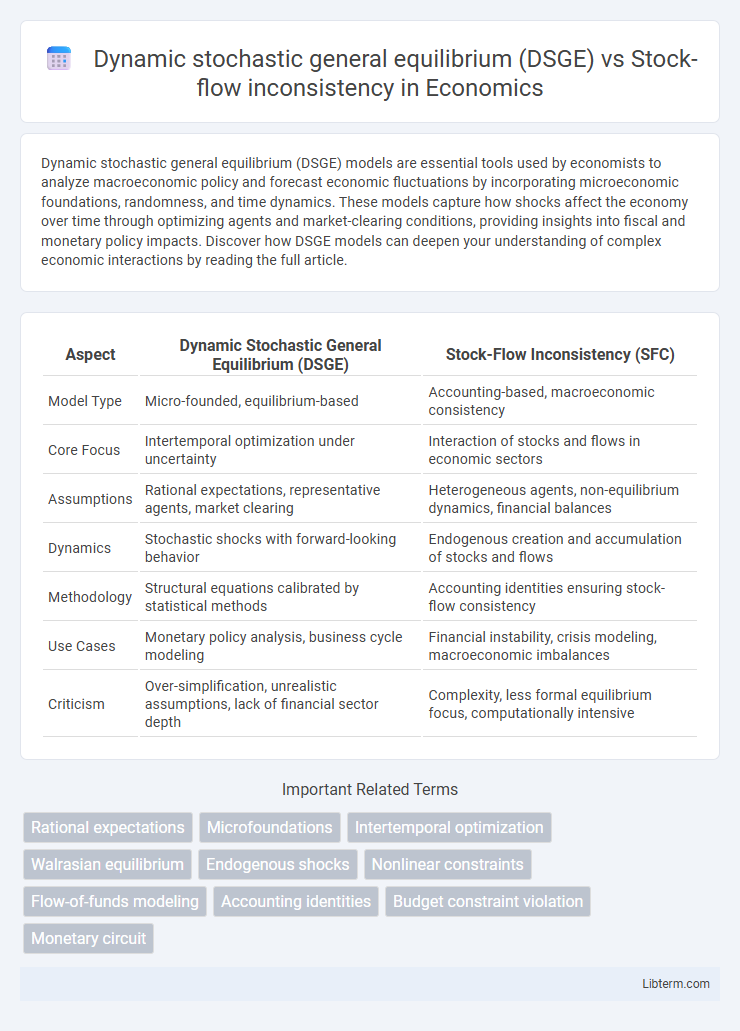

Table of Comparison

| Aspect | Dynamic Stochastic General Equilibrium (DSGE) | Stock-Flow Inconsistency (SFC) |

|---|---|---|

| Model Type | Micro-founded, equilibrium-based | Accounting-based, macroeconomic consistency |

| Core Focus | Intertemporal optimization under uncertainty | Interaction of stocks and flows in economic sectors |

| Assumptions | Rational expectations, representative agents, market clearing | Heterogeneous agents, non-equilibrium dynamics, financial balances |

| Dynamics | Stochastic shocks with forward-looking behavior | Endogenous creation and accumulation of stocks and flows |

| Methodology | Structural equations calibrated by statistical methods | Accounting identities ensuring stock-flow consistency |

| Use Cases | Monetary policy analysis, business cycle modeling | Financial instability, crisis modeling, macroeconomic imbalances |

| Criticism | Over-simplification, unrealistic assumptions, lack of financial sector depth | Complexity, less formal equilibrium focus, computationally intensive |

Introduction to DSGE Models

Dynamic stochastic general equilibrium (DSGE) models represent the economy through microfounded equations that integrate optimizing behavior and market clearing conditions under uncertainty. These models emphasize equilibrium dynamics driven by shocks and policy changes, relying on rational expectations and intertemporal optimization frameworks. In contrast, stock-flow consistent (SFC) models focus on accounting principles linking stocks and flows across sectors, prioritizing empirical consistency over equilibrium conditions.

Understanding Stock-Flow Inconsistency

Stock-flow inconsistency (SFC) models emphasize the integration of real and financial sectors through a detailed representation of stocks and flows, ensuring all monetary transactions and asset accumulations are consistently accounted for across agents and sectors. Unlike Dynamic Stochastic General Equilibrium (DSGE) models, which rely on representative agents and rational expectations with equilibrium constraints, SFC models focus on macroeconomic dynamics driven by accounting identities and non-equilibrium behavior, capturing financial imbalances and debt dynamics more effectively. SFC frameworks provide powerful tools for analyzing systemic risk, liquidity constraints, and the impacts of fiscal and monetary policies in heterogeneous-agent economies where stock and flow variables co-evolve.

Core Assumptions of DSGE Frameworks

Dynamic stochastic general equilibrium (DSGE) models rest on core assumptions including rational expectations, optimization by representative agents, and market clearing, which together create a structured framework for analyzing macroeconomic fluctuations. These models emphasize microeconomic foundations, intertemporal optimization, and equilibrium conditions under uncertainty, relying heavily on linearization techniques around steady states. In contrast, DSGE frameworks typically abstract from accounting consistency in financial stocks and flows, a gap addressed by stock-flow consistent (SFC) models that integrate detailed sectoral balance sheets and ensure accounting identities hold over time.

Limitations of Traditional Stock-Flow Modeling

Traditional stock-flow inconsistency (SFC) models often struggle to capture dynamic behaviors and forward-looking expectations essential in macroeconomic analysis. Unlike dynamic stochastic general equilibrium (DSGE) models that incorporate intertemporal optimization and stochastic shocks, SFC models may oversimplify agents' adaptive behavior and market adjustments. This limitation hinders SFC frameworks from fully addressing the complexities of real-world economic fluctuations and policy impacts.

Key Differences: DSGE vs Stock-Flow Approaches

Dynamic Stochastic General Equilibrium (DSGE) models rely on microeconomic foundations and equilibrium conditions to analyze macroeconomic dynamics under uncertainty, emphasizing representative agents and rational expectations. In contrast, Stock-Flow Consistent (SFC) models focus on accounting identities ensuring that all stocks and flows are coherently integrated over time, capturing sectoral interactions and financial balances without assuming equilibrium. The key difference lies in DSGE's emphasis on equilibrium optimization with stochastic shocks versus SFC's detailed macroeconomic accounting framework that highlights financial stocks and flows interdependencies.

Real-World Applicability and Predictive Power

Dynamic Stochastic General Equilibrium (DSGE) models excel in providing micro-founded frameworks based on rational expectations, enabling policy simulations under equilibrium conditions, but often face criticism for limited real-world applicability due to assumptions like market clearing and representative agents. Stock-flow Consistent (SFC) models incorporate detailed accounting of financial stocks and flows, capturing non-equilibrium dynamics and heterogeneity among agents, which enhances their capacity to reflect real-world economic complexities and financial instability. The predictive power of DSGE models tends to be constrained by their equilibrium focus and parameter calibration, while SFC models demonstrate stronger empirical relevance through their ability to integrate financial constraints and sectoral interactions, making them valuable for analyzing macroeconomic crises and policy impacts.

Criticisms of DSGE Regarding Stock-Flow Dynamics

Dynamic stochastic general equilibrium (DSGE) models face criticism for their inadequate representation of stock-flow dynamics, often assuming instantaneous adjustment and equilibrium between stocks and flows, which fails to capture real-world financial imbalances and accumulation processes. This limitation leads to unrealistic simplifications in modeling credit, debt, and asset price dynamics, undermining the ability to analyze financial crises and macroeconomic instability. In contrast, Stock-flow consistent (SFC) models emphasize the coherent integration of stocks and flows, ensuring that all financial and real sector transactions are accurately accounted for, offering a more robust framework for analyzing economic disequilibria and policy impacts.

Implications for Policy Analysis

Dynamic stochastic general equilibrium (DSGE) models rely on micro-founded optimization and rational expectations to analyze policy impacts in economies characterized by shocks and frictions. Stock-flow consistency (SFC) models emphasize accounting identities and the interaction between stocks and flows, capturing financial imbalances and distributional effects often missed by DSGE frameworks. Policy analysis using SFC models reveals potential unintended consequences and financial instability risks, while DSGE models provide insights into equilibrium dynamics under optimizing behavior and forward-looking agents.

Advances in Integrating Stock-Flow Consistency

Recent advances in integrating stock-flow consistency (SFC) within Dynamic Stochastic General Equilibrium (DSGE) models enhance macroeconomic analysis by explicitly accounting for the interdependencies between stocks and flows in financial and real sectors. This synthesis improves the representation of endogenous financial imbalances, liquidity constraints, and sectoral balances, overcoming key limitations of traditional DSGE frameworks that often neglect stock-flow relationships. Incorporating SFC principles into DSGE models provides a more robust foundation for understanding economic dynamics, systemic risk, and policy implications in a stochastic environment.

Future Directions in Macroeconomic Modeling

Future directions in macroeconomic modeling emphasize integrating Dynamic Stochastic General Equilibrium (DSGE) frameworks with Stock-Flow Consistent (SFC) approaches to capture both microeconomic optimization and macroeconomic financial dynamics. Advances in combining DSGE's rigorous behavioral foundations with SFC's comprehensive accounting of monetary circuits aim to enhance policy analysis during financial crises and systemic risks. Researchers are increasingly focusing on hybrid models that leverage the strengths of both methodologies to improve realism in dynamic macroeconomic simulations and forecasting.

Dynamic stochastic general equilibrium (DSGE) Infographic

libterm.com

libterm.com