A debt-for-equity swap is a financial restructuring tool where a company exchanges its debt obligations for equity shares, reducing its debt burden and improving its balance sheet. This process can help companies avoid bankruptcy, realign stakeholder interests, and strengthen cash flow. Explore the rest of the article to understand how a debt-for-equity swap might benefit your financial strategy.

Table of Comparison

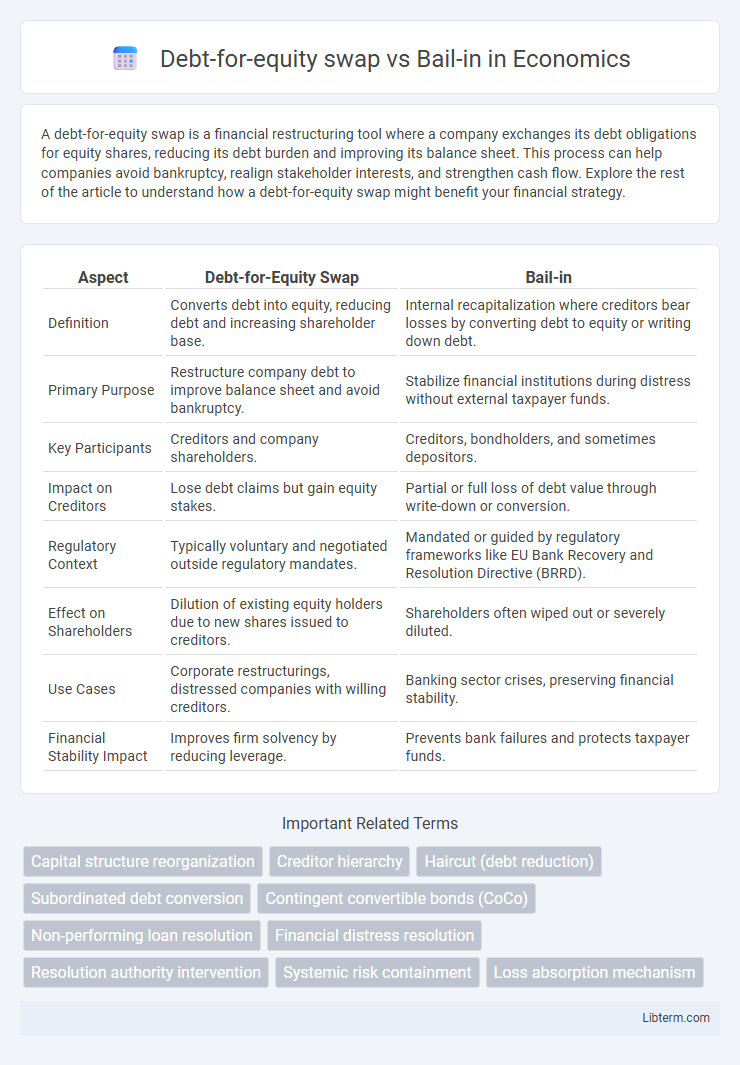

| Aspect | Debt-for-Equity Swap | Bail-in |

|---|---|---|

| Definition | Converts debt into equity, reducing debt and increasing shareholder base. | Internal recapitalization where creditors bear losses by converting debt to equity or writing down debt. |

| Primary Purpose | Restructure company debt to improve balance sheet and avoid bankruptcy. | Stabilize financial institutions during distress without external taxpayer funds. |

| Key Participants | Creditors and company shareholders. | Creditors, bondholders, and sometimes depositors. |

| Impact on Creditors | Lose debt claims but gain equity stakes. | Partial or full loss of debt value through write-down or conversion. |

| Regulatory Context | Typically voluntary and negotiated outside regulatory mandates. | Mandated or guided by regulatory frameworks like EU Bank Recovery and Resolution Directive (BRRD). |

| Effect on Shareholders | Dilution of existing equity holders due to new shares issued to creditors. | Shareholders often wiped out or severely diluted. |

| Use Cases | Corporate restructurings, distressed companies with willing creditors. | Banking sector crises, preserving financial stability. |

| Financial Stability Impact | Improves firm solvency by reducing leverage. | Prevents bank failures and protects taxpayer funds. |

Introduction to Debt-for-Equity Swap and Bail-In

Debt-for-equity swaps involve exchanging a company's debt for equity shares, effectively reducing liabilities and improving the balance sheet while giving creditors an ownership stake. Bail-ins are a regulatory tool used to stabilize failing financial institutions by converting certain liabilities into equity, protecting taxpayers by absorbing losses internally. Both mechanisms aim to restore financial health, with debt-for-equity swaps negotiated between creditors and firms, whereas bail-ins are imposed by authorities during crises to prevent insolvency.

Defining Debt-for-Equity Swap

Debt-for-equity swap involves exchanging a company's debt for ownership equity, reducing financial leverage and improving balance sheet stability. This restructuring tool allows creditors to convert loans into shares, aligning interests and potentially restoring solvency without external capital injection. Unlike bail-in, which imposes losses on creditors to recapitalize a failing institution, debt-for-equity swaps are negotiated agreements that restructure obligations to preserve enterprise value.

What is a Bail-In?

A bail-in is a financial mechanism where a troubled bank's creditors and depositors absorb losses by having part of their debt converted into equity, stabilizing the institution without external taxpayer funds. Unlike debt-for-equity swaps, which are typically voluntary negotiations between a company and its creditors, bail-ins are mandatory interventions imposed by regulatory authorities during a bank's resolution process. The European Union's Bank Recovery and Resolution Directive (BRRD) formalizes bail-ins to prevent systemic risks and protect public finances.

Key Differences Between Debt-for-Equity Swap and Bail-In

Debt-for-equity swaps involve creditors exchanging outstanding debt for equity ownership in the company, directly converting liabilities into shareholder stakes to improve the firm's balance sheet and reduce default risk. Bail-ins are broader restructuring mechanisms where a company's creditors and depositors absorb losses by having their claims written down or converted into equity to recapitalize the institution without external bailout funds. Key differences include the scope of affected parties--debt-for-equity swaps typically target specific debts, while bail-ins can impact a wider range of creditors and depositors--and the regulatory context, as bail-ins are often mandated by resolution authorities during financial distress to maintain systemic stability.

Legal and Regulatory Frameworks

Debt-for-equity swaps involve exchanging debt claims for equity stakes, typically requiring approval under securities laws and adherence to corporate governance regulations. Bail-ins, mandated by banking resolution frameworks such as the EU Bank Recovery and Resolution Directive (BRRD) or the Dodd-Frank Act in the US, impose losses on creditors to recapitalize failing financial institutions without external bailouts. Both mechanisms operate within strict legal boundaries to protect creditor rights, ensure market stability, and comply with insolvency and financial regulatory statutes.

Impacts on Creditors and Shareholders

Debt-for-equity swaps convert creditor claims into equity, diluting existing shareholders but reducing debt burdens and enhancing the company's balance sheet, improving long-term viability. Bail-ins impose losses on creditors by writing down debt or converting it into equity, often preserving shareholder value but increasing risk for bondholders and unsecured creditors. Both mechanisms shift financial risk and ownership structures, affecting recovery rates for creditors and control stakes for shareholders.

Advantages of Debt-for-Equity Swaps

Debt-for-equity swaps convert a company's debt into equity, improving its balance sheet by reducing liabilities and enhancing financial stability. This mechanism aligns creditor and shareholder interests, fostering long-term value creation without immediate cash outflows. In contrast to bail-ins, debt-for-equity swaps typically provide clearer restructuring terms and can help restore investor confidence more effectively.

Risks and Challenges with Bail-Ins

Bail-ins carry significant risks including the potential loss of investor confidence and financial market instability due to the forced conversion of debt to equity, which can dilute existing shareholders' value and disrupt bank operations. The complexity in valuing impaired assets and the legal uncertainties surrounding creditor rights may lead to prolonged disputes, challenging the effectiveness of bail-ins in restoring bank solvency. Moreover, the risk of triggering contagion effects across the banking sector can exacerbate systemic financial risks, undermining overall economic stability.

Case Studies: Real-World Applications

Debt-for-equity swaps were successfully implemented during the Greek debt crisis, where sovereign bonds were exchanged for equity to reduce government liabilities and stabilize finances. Bail-ins played a critical role in the 2013 Cyprus banking crisis, forcing creditors to absorb losses and recapitalize banks without taxpayer bailouts. These case studies highlight how debt-for-equity swaps mitigate sovereign debt risks while bail-ins provide an internal resolution mechanism for banking sector insolvencies.

Conclusion: Choosing the Right Restructuring Strategy

Debt-for-equity swaps convert creditor claims into ownership stakes, effectively reducing debt burden and aligning interests between lenders and the company, while bail-ins involve mandatory debt write-downs or conversions imposed on creditors to stabilize capital structures without external funding. Selecting the optimal restructuring strategy depends on the company's financial health, market conditions, existing creditor agreements, and the long-term goals of preserving operational control and minimizing bankruptcy risks. Careful assessment ensures the chosen method balances creditor recovery with sustainable business viability and shareholder value preservation.

Debt-for-equity swap Infographic

libterm.com

libterm.com