Market efficiency reflects how well asset prices incorporate all available information, ensuring fair valuation and optimal resource allocation. High market efficiency benefits investors by reducing opportunities for arbitrage and price manipulation, leading to more reliable investment decisions. Explore the rest of the article to understand how market efficiency impacts your investment strategies.

Table of Comparison

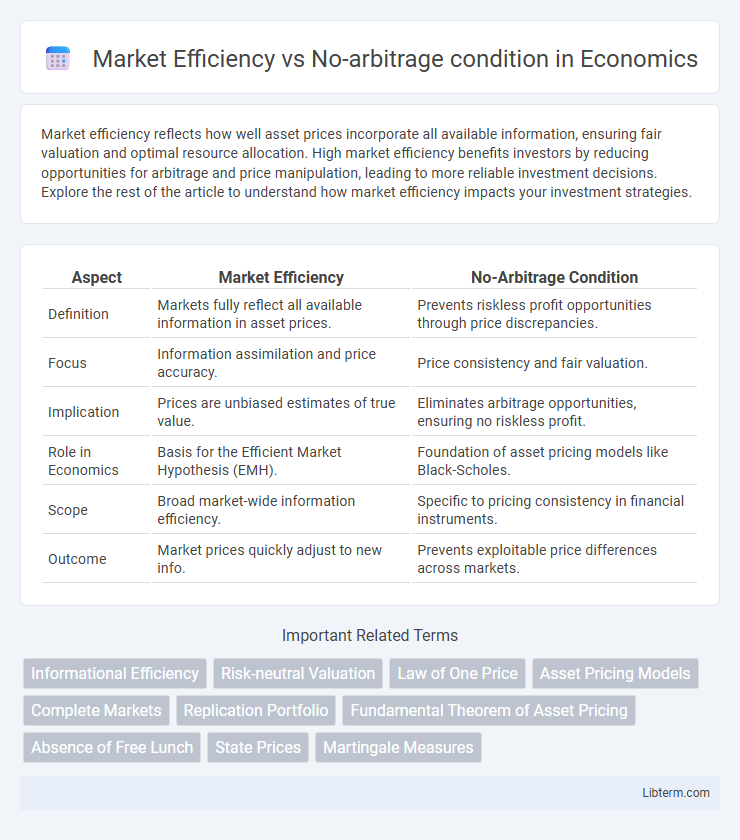

| Aspect | Market Efficiency | No-Arbitrage Condition |

|---|---|---|

| Definition | Markets fully reflect all available information in asset prices. | Prevents riskless profit opportunities through price discrepancies. |

| Focus | Information assimilation and price accuracy. | Price consistency and fair valuation. |

| Implication | Prices are unbiased estimates of true value. | Eliminates arbitrage opportunities, ensuring no riskless profit. |

| Role in Economics | Basis for the Efficient Market Hypothesis (EMH). | Foundation of asset pricing models like Black-Scholes. |

| Scope | Broad market-wide information efficiency. | Specific to pricing consistency in financial instruments. |

| Outcome | Market prices quickly adjust to new info. | Prevents exploitable price differences across markets. |

Introduction to Market Efficiency

Market efficiency refers to the degree to which asset prices fully reflect all available information, ensuring fair value in financial markets. Efficient markets prevent investors from consistently achieving abnormal returns through information-based trading, aligning closely with the no-arbitrage condition which states that there should be no riskless profit opportunities. Understanding market efficiency is crucial for portfolio management and asset pricing models, as it underpins the assumption that prices incorporate and adjust to new data swiftly.

Defining the No-arbitrage Condition

The no-arbitrage condition ensures that there are no opportunities for riskless profits through simultaneous buying and selling of assets in efficient markets. This principle underpins financial modeling and pricing, guaranteeing that asset prices reflect all available information and thereby prevent arbitrage opportunities. Compliance with the no-arbitrage condition is fundamental for the validity of models such as the Black-Scholes option pricing framework and for maintaining market equilibrium.

Core Principles of Market Efficiency

Core principles of market efficiency assert that asset prices fully reflect all available information, eliminating opportunities for consistent excess returns through arbitrage. The no-arbitrage condition underpins this concept by ensuring that price discrepancies are corrected swiftly, preventing riskless profit opportunities. Together, these principles maintain equilibrium in financial markets, promoting fair valuation and optimal capital allocation.

Key Assumptions Behind No-arbitrage

The no-arbitrage condition relies on the key assumptions that markets are frictionless, allowing for unlimited borrowing and lending at a risk-free rate, and that all agents have access to the same information, ensuring price consistency across assets. It presumes no transaction costs or taxes, meaning arbitrage opportunities would be instantaneously exploited and eliminated. These assumptions underpin the equivalence between no-arbitrage and market efficiency, ensuring asset prices reflect all available information without permitting riskless profit opportunities.

Relationship Between Market Efficiency and No-arbitrage

Market efficiency implies that all available information is fully reflected in asset prices, preventing consistent excess returns, which aligns with the no-arbitrage condition where price discrepancies allowing riskless profits do not exist. The no-arbitrage condition serves as a foundational principle ensuring market efficiency by eliminating opportunities to exploit mispricings. Therefore, the presence of no-arbitrage enforces price consistency, directly supporting the concept of efficient markets in financial theory.

Types of Market Efficiency (Weak, Semi-strong, Strong)

The concept of market efficiency is classified into three types: weak, semi-strong, and strong, each reflecting the level of information reflected in asset prices. Weak form efficiency asserts that past price data and trends are fully incorporated into current prices, rendering technical analysis ineffective. Semi-strong form efficiency includes all publicly available information, meaning fundamental analysis cannot consistently generate excess returns, while strong form efficiency posits that all information, public and private, is instantaneously reflected in market prices, eliminating any arbitrage opportunities.

Implications of No-arbitrage in Financial Markets

No-arbitrage conditions ensure that financial markets remain efficient by preventing riskless profit opportunities, which aligns asset prices with their true economic values. This principle supports the validity of pricing models such as the Black-Scholes option pricing model and helps maintain equilibrium in derivatives and securities markets. Enforcing no-arbitrage conditions reduces market distortions, enhances liquidity, and promotes fair valuation across different asset classes, thereby reinforcing overall market stability.

Real-world Examples: Efficient Markets vs Arbitrage Opportunities

Market efficiency implies asset prices fully reflect all available information, as seen in the U.S. stock market where high liquidity and information flow minimize arbitrage chances. Conversely, emerging markets like those in some frontier economies often exhibit temporary arbitrage opportunities due to less transparency and slower information dissemination. For instance, inefficiencies in currency exchange rates in developing countries create short-lived arbitrage windows that do not exist in more efficient markets.

Challenges and Criticisms of Market Efficiency and No-arbitrage

Market efficiency assumes all available information is instantly and fully reflected in asset prices, yet challenges arise due to behavioral biases, information asymmetries, and market anomalies that persistently defy this assumption. No-arbitrage conditions, fundamental in pricing derivative securities, face criticism for relying on idealized markets without transaction costs, liquidity constraints, or market frictions, which are prevalent in real-world trading environments. Both concepts struggle with empirical inconsistencies, such as price bubbles and crashes, questioning their validity as absolute frameworks in dynamic financial markets.

Conclusion: Integrating Market Efficiency and No-arbitrage in Financial Analysis

Integrating market efficiency and the no-arbitrage condition enhances financial analysis by ensuring asset prices fully reflect all available information and eliminate riskless profit opportunities. Market efficiency supports the assumption that prices follow a fair value, while the no-arbitrage condition prevents price discrepancies exploitative through arbitrage strategies. This integration provides a robust framework for pricing models, risk management, and investment decision-making in financial markets.

Market Efficiency Infographic

libterm.com

libterm.com