Automatic stabilizers help shield the economy from fluctuations by adjusting government spending and tax policies without new legislative action. They work by increasing spending on social benefits and reducing tax burdens during downturns, then doing the opposite during economic booms to moderate growth. Discover how these mechanisms support economic stability and what it means for Your financial future in the rest of this article.

Table of Comparison

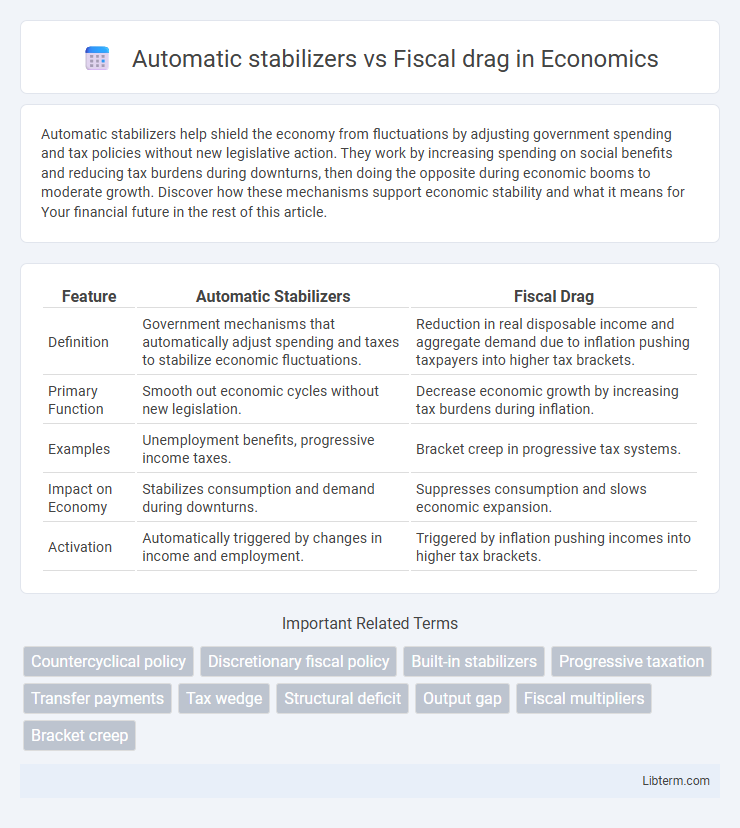

| Feature | Automatic Stabilizers | Fiscal Drag |

|---|---|---|

| Definition | Government mechanisms that automatically adjust spending and taxes to stabilize economic fluctuations. | Reduction in real disposable income and aggregate demand due to inflation pushing taxpayers into higher tax brackets. |

| Primary Function | Smooth out economic cycles without new legislation. | Decrease economic growth by increasing tax burdens during inflation. |

| Examples | Unemployment benefits, progressive income taxes. | Bracket creep in progressive tax systems. |

| Impact on Economy | Stabilizes consumption and demand during downturns. | Suppresses consumption and slows economic expansion. |

| Activation | Automatically triggered by changes in income and employment. | Triggered by inflation pushing incomes into higher tax brackets. |

Understanding Automatic Stabilizers

Automatic stabilizers are government programs, such as unemployment benefits and progressive tax systems, that naturally moderate economic fluctuations without explicit intervention. They increase public spending or reduce tax burdens during economic downturns, boosting aggregate demand and cushioning recessions. These mechanisms contrast with fiscal drag, where rising incomes push taxpayers into higher brackets, potentially slowing economic growth during expansions.

What Is Fiscal Drag?

Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, increasing tax revenues without changes in tax rates. This phenomenon reduces disposable income and dampens consumer spending, effectively slowing economic growth. Unlike automatic stabilizers, which stabilize the economy by varying government spending and taxation with economic cycles, fiscal drag unintentionally tightens fiscal policy during inflationary periods.

Key Differences Between Automatic Stabilizers and Fiscal Drag

Automatic stabilizers are economic policies and programs, such as unemployment benefits and progressive taxes, that naturally counteract fluctuations in a country's economic activity without additional government intervention. Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, increasing tax revenue and potentially slowing economic growth unintentionally. The key difference lies in automatic stabilizers actively smoothing economic cycles by adjusting spending or taxes automatically, whereas fiscal drag results from bracket creep that may reduce disposable income and aggregate demand over time.

How Automatic Stabilizers Work in the Economy

Automatic stabilizers work by adjusting government spending and tax revenues in response to economic fluctuations without explicit policy changes, thereby smoothing economic cycles. During a recession, increased unemployment benefits and reduced tax revenues boost aggregate demand, while in a boom, higher tax collection and lower welfare payments help moderate inflation. This countercyclical mechanism reduces the amplitude of economic fluctuations and supports overall economic stability.

Mechanisms Behind Fiscal Drag

Fiscal drag occurs when rising incomes push taxpayers into higher tax brackets, increasing tax revenues without changes in tax rates, effectively slowing economic growth by reducing disposable income. Automatic stabilizers, such as progressive tax systems and unemployment benefits, counteract fiscal drag by adjusting tax burdens and public spending in response to economic fluctuations. The mechanism behind fiscal drag hinges on bracket creep, where inflation and nominal wage growth push individuals into higher tax brackets, thereby increasing tax liabilities even if real incomes remain constant.

Economic Impacts of Automatic Stabilizers

Automatic stabilizers, such as progressive taxes and unemployment benefits, mitigate economic fluctuations by dampening the effects of recessions and booms without explicit government intervention. These mechanisms increase disposable income during downturns, supporting consumption and stabilizing aggregate demand, which helps reduce unemployment rates and avoid deeper recessions. In contrast, fiscal drag occurs when rising incomes push taxpayers into higher brackets, unintentionally restraining growth by reducing disposable income and dampening economic expansion during recoveries.

Fiscal Drag and Its Effect on Economic Growth

Fiscal drag occurs when inflation and income growth push taxpayers into higher tax brackets, increasing tax burdens without legislative changes and reducing disposable income. This phenomenon can slow economic growth by dampening consumer spending and decreasing aggregate demand, as households face higher taxes and lower incentives to work or invest. Unlike automatic stabilizers, fiscal drag acts as a contractionary force during inflationary periods, potentially prolonging economic downturns if not addressed through tax policy adjustments.

Real-World Examples of Automatic Stabilizers

Automatic stabilizers such as unemployment insurance and progressive tax systems help moderate economic fluctuations by increasing government spending or reducing taxes automatically during recessions, as seen in the 2008 Global Financial Crisis where U.S. unemployment benefits expanded to support consumer demand. Fiscal drag occurs when inflation or income growth pushes taxpayers into higher tax brackets without adjusting the brackets, effectively increasing tax burdens and restricting economic growth. Countries like the UK have periodically adjusted tax thresholds to counteract fiscal drag and maintain automatic stabilizer effectiveness in stabilizing the economy.

Addressing Fiscal Drag: Policy Responses

Addressing fiscal drag requires targeted policy responses such as adjusting tax brackets to account for inflation, ensuring that wage increases do not push taxpayers into higher tax rates unintentionally. Automatic stabilizers like progressive tax systems and unemployment benefits help counteract economic fluctuations but may not fully mitigate fiscal drag without proactive tax indexation policies. Implementing periodic tax code adjustments preserves taxpayers' real income and maintains fiscal balance during economic growth.

Balancing Automatic Stabilizers and Fiscal Drag in Economic Policy

Balancing automatic stabilizers and fiscal drag is crucial for effective economic policy to maintain stability and growth. Automatic stabilizers, such as unemployment benefits and progressive taxes, automatically dampen economic fluctuations without new legislation, while fiscal drag occurs when inflation and wage growth push taxpayers into higher brackets, inadvertently increasing tax burden and slowing economic expansion. Policymakers must carefully calibrate tax rates and transfer programs to ensure automatic stabilizers provide timely relief without exacerbating fiscal drag, allowing for counter-cyclical support while minimizing unintended contractionary effects.

Automatic stabilizers Infographic

libterm.com

libterm.com