Tax incidence analyzes who ultimately bears the economic burden of a tax, whether producers or consumers. Understanding this concept helps you grasp the real impact of taxation on prices, wages, and resource allocation in the market. Explore the article to learn how tax incidence influences economic behavior and policy decisions.

Table of Comparison

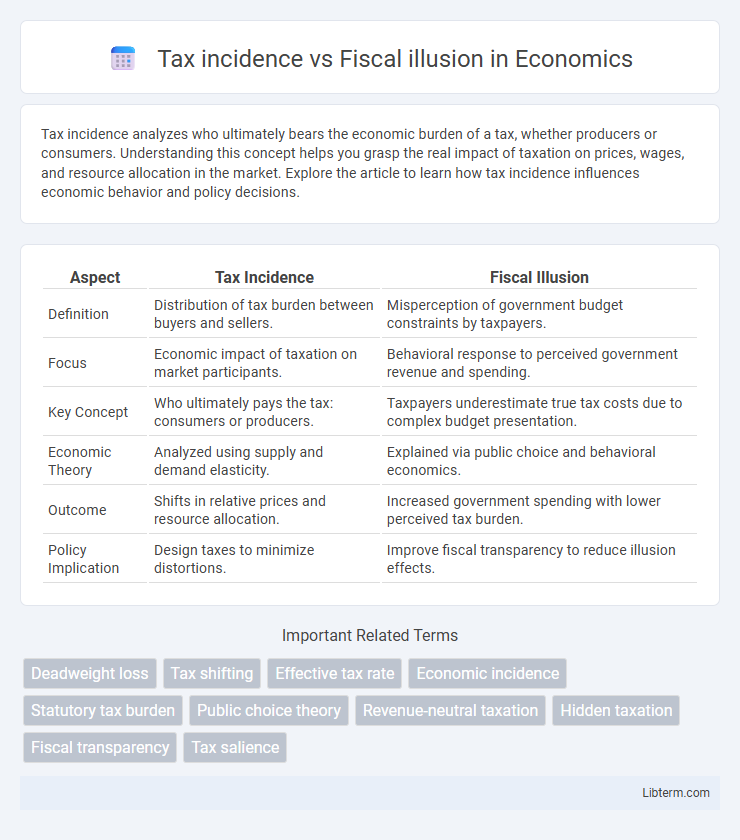

| Aspect | Tax Incidence | Fiscal Illusion |

|---|---|---|

| Definition | Distribution of tax burden between buyers and sellers. | Misperception of government budget constraints by taxpayers. |

| Focus | Economic impact of taxation on market participants. | Behavioral response to perceived government revenue and spending. |

| Key Concept | Who ultimately pays the tax: consumers or producers. | Taxpayers underestimate true tax costs due to complex budget presentation. |

| Economic Theory | Analyzed using supply and demand elasticity. | Explained via public choice and behavioral economics. |

| Outcome | Shifts in relative prices and resource allocation. | Increased government spending with lower perceived tax burden. |

| Policy Implication | Design taxes to minimize distortions. | Improve fiscal transparency to reduce illusion effects. |

Introduction to Tax Incidence and Fiscal Illusion

Tax incidence examines who ultimately bears the economic burden of taxation, distinguishing between statutory taxpayers and economic bearers, crucial for understanding tax policy impact. Fiscal illusion arises when governments obscure the true cost of public expenditures through complex tax structures or deficit financing, leading to misperceptions about taxation levels and public spending. Recognizing tax incidence helps in revealing who truly pays taxes, while awareness of fiscal illusion addresses the transparency and efficiency of government fiscal behavior.

Understanding the Concept of Tax Incidence

Tax incidence examines who ultimately bears the economic burden of a tax, distinguishing between statutory taxpayers and those who experience actual cost shifts through changes in prices or wages. Fiscal illusion occurs when taxpayers underestimate the true cost of government spending because taxes are less visible or perceived indirectly. Understanding tax incidence is crucial for policymakers to accurately assess who shoulders tax costs and design equitable fiscal policies.

Defining Fiscal Illusion in Public Finance

Fiscal illusion in public finance occurs when taxpayers misperceive the true cost of government spending, often underestimating the burden due to complex tax structures or indirect financing methods. This phenomenon contrasts with tax incidence, which analyzes the actual economic burden borne by individuals or businesses after tax implementation. Understanding fiscal illusion helps explain why voters may support higher public expenditures despite hidden or deferred tax costs.

Key Differences Between Tax Incidence and Fiscal Illusion

Tax incidence examines who ultimately bears the economic burden of a tax, whether consumers, producers, or others, based on market reactions and price changes. Fiscal illusion occurs when taxpayers underestimate the true cost of government spending due to complex tax structures or hidden subsidies, leading to distorted perceptions of public finance. The key difference lies in tax incidence analyzing actual economic effects, while fiscal illusion focuses on psychological misperceptions affecting taxpayer behavior.

The Economic Impact of Tax Incidence

Tax incidence refers to the distribution of the economic burden of a tax between buyers and sellers, influencing consumer prices and producer revenues. Fiscal illusion occurs when taxpayers underestimate the true cost of government expenditures due to the indirect nature of taxation, distorting economic decision-making and resource allocation. The economic impact of tax incidence shapes market behavior, affecting labor supply, investment incentives, and overall economic efficiency by altering relative prices and workload distribution.

Mechanisms and Causes of Fiscal Illusion

Fiscal illusion arises when taxpayers misperceive the true cost of government spending due to complex tax structures, leading to underestimation of the tax burden. This distortion is driven by mechanisms such as tax fragmentation, where multiple taxes obscure total tax liability, and deficit financing that separates government spending from immediate taxation. The divergence between perceived and actual tax costs encourages higher public expenditure, differentiating fiscal illusion from the straightforward economic incidence of taxation.

Real-World Examples: Tax Incidence vs Fiscal Illusion

Tax incidence refers to the actual economic burden of a tax, as seen when consumers bear higher prices of gasoline due to fuel taxes in the U.S., while fiscal illusion occurs when taxpayers underestimate this burden because government spending is financed through less visible taxes or deficits, such as municipal bonds funding city projects. For instance, in European countries, voters may support high government spending due to fiscal illusion when social benefits are funded by indirect taxes embedded in prices rather than direct income taxes. Real-world examples highlight how understanding tax incidence reveals who truly pays taxes, whereas fiscal illusion explains public misperceptions about government spending costs.

Policy Implications of Tax Incidence and Fiscal Illusion

Tax incidence analysis reveals how the economic burden of taxation is distributed between consumers, producers, and other stakeholders, influencing policy decisions on tax design and equity. Fiscal illusion, the misperception of tax burdens due to indirect or complicated tax structures, can lead policymakers to underestimate the true cost of public services, encouraging inefficient government spending. Effective policy must balance transparent tax incidence with measures mitigating fiscal illusion to ensure equitable taxation and optimal allocation of public resources.

Addressing Fiscal Illusion in Tax Policy Design

Addressing fiscal illusion in tax policy design requires transparent taxation mechanisms that clearly communicate the true cost of public services to taxpayers, reducing misperceptions about government spending. Tax incidence analysis helps identify the actual economic burden across different groups, ensuring policies do not obscure who ultimately pays the taxes. Implementing explicit tax schedules and minimizing indirect or hidden taxes mitigates fiscal illusion, promoting efficient allocation of resources and informed voter decisions.

Conclusion: Lessons for Taxation and Public Awareness

Tax incidence reveals the true economic burden of taxes, often differing from statutory obligations, while fiscal illusion highlights taxpayers' misperceptions about government spending and taxation. Understanding these concepts guides policymakers to design transparent tax systems that minimize distortions and improve efficiency. Enhancing public awareness about the real costs of taxation fosters informed citizen participation and supports equitable fiscal policies.

Tax incidence Infographic

libterm.com

libterm.com