A hard landing occurs when an aircraft touches down with greater force than normal, potentially causing damage to the plane or discomfort to passengers. Pilots train extensively to manage such situations safely, minimizing risks to everyone onboard. Discover what causes hard landings and how they impact your flight experience in the full article.

Table of Comparison

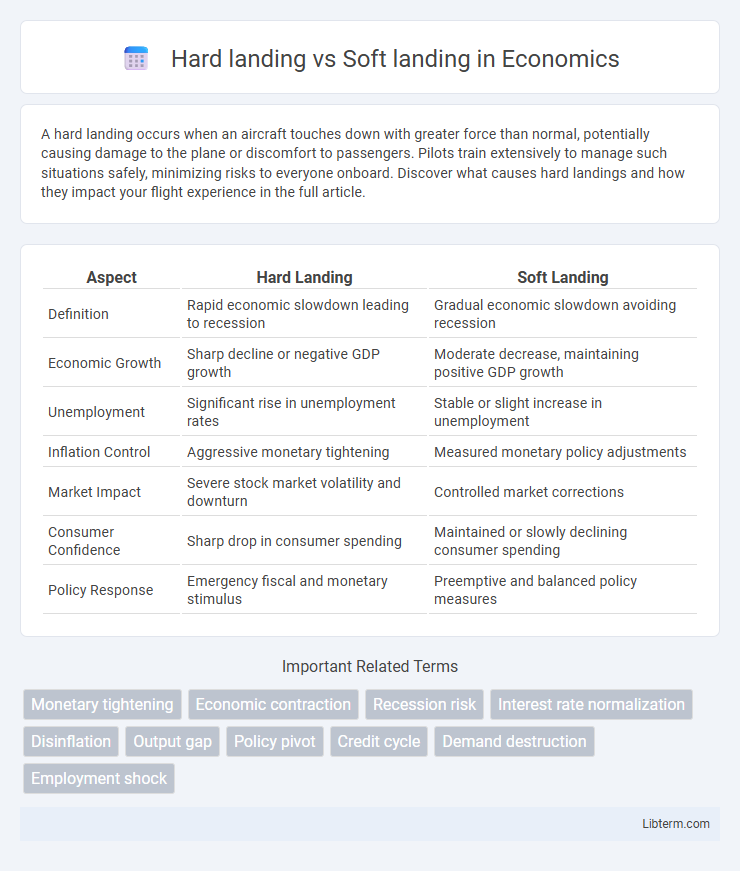

| Aspect | Hard Landing | Soft Landing |

|---|---|---|

| Definition | Rapid economic slowdown leading to recession | Gradual economic slowdown avoiding recession |

| Economic Growth | Sharp decline or negative GDP growth | Moderate decrease, maintaining positive GDP growth |

| Unemployment | Significant rise in unemployment rates | Stable or slight increase in unemployment |

| Inflation Control | Aggressive monetary tightening | Measured monetary policy adjustments |

| Market Impact | Severe stock market volatility and downturn | Controlled market corrections |

| Consumer Confidence | Sharp drop in consumer spending | Maintained or slowly declining consumer spending |

| Policy Response | Emergency fiscal and monetary stimulus | Preemptive and balanced policy measures |

Understanding Hard Landing and Soft Landing

A hard landing in economics refers to a rapid and significant slowdown in economic growth, often characterized by rising unemployment, decreased consumer spending, and potential recession risks. In contrast, a soft landing aims for a controlled economic deceleration where inflation pressures ease while maintaining steady growth and stable employment levels. Policymakers use monetary tightening and fiscal measures to steer the economy toward a soft landing, avoiding the severe consequences associated with a hard landing.

Key Differences Between Hard Landing and Soft Landing

A hard landing occurs when an economy experiences a sharp slowdown leading to recession, marked by high unemployment and falling asset prices, whereas a soft landing involves a gradual economic deceleration that avoids recession, maintaining steady growth and moderate inflation. Key differences include the severity of GDP contraction, impact on labor markets, and central bank policy outcomes, with hard landings linked to aggressive interest rate hikes and soft landings associated with balanced monetary tightening. Investors and policymakers closely monitor inflation rates, unemployment trends, and consumer spending to distinguish between these two economic scenarios.

Economic Indicators Signaling a Hard Landing

Rising unemployment rates, slowing GDP growth, and escalating inflation often signal an impending hard landing in an economy. Sharp declines in consumer confidence and manufacturing output further indicate economic contraction and increased recession risk. Central banks may respond with aggressive interest rate hikes, which can exacerbate financial stress and deepen the downturn.

Signs of a Soft Landing in the Economy

Signs of a soft landing in the economy include steady GDP growth, controlled inflation rates near central bank targets, and a gradual decline in unemployment without a sharp spike. Consumer spending remains resilient, business investments sustain momentum, and credit conditions stay accommodative, reflecting confidence in economic stability. Central banks often achieve this balance through measured interest rate adjustments, avoiding abrupt tightening that could trigger recession.

Causes and Triggers for Hard Landings

Hard landings occur when an economy slows abruptly due to sharp declines in consumer spending, rising unemployment, or aggressive monetary tightening by central banks to curb inflation. Sudden shocks such as geopolitical crises, supply chain disruptions, or rapid asset price corrections also trigger hard landings by destabilizing market confidence and reducing investment. These causes contrast with soft landings, where gradual policy adjustments and resilient demand enable a controlled economic slowdown without triggering recession.

Policy Measures for Achieving a Soft Landing

Monetary policy tightening through gradual interest rate increases helps control inflation without triggering a sharp economic downturn, supporting a soft landing. Fiscal measures like targeted government spending and tax incentives boost demand in key sectors while avoiding overheating. Central banks often communicate transparently to calibrate market expectations and maintain financial stability, reducing the risk of a hard landing.

Market Reactions to Hard Landing vs Soft Landing

Market reactions to a hard landing typically involve sharp declines in stock prices, increased volatility, and flight to safe-haven assets as investors anticipate slower growth and potential recessions. In contrast, a soft landing generally results in more stable or moderately fluctuating markets, reflecting confidence in controlled inflation and manageable economic slowdown. Bond yields often rise during soft landings due to expectations of steady economic health, whereas they tend to fall during hard landings as investors seek safety.

Historical Examples of Hard and Soft Landings

Historical examples of hard landings include the 2008 global financial crisis, where rapid economic contraction and widespread unemployment followed aggressive monetary tightening. The early 1980s recession in the U.S. also exemplifies a hard landing, triggered by the Federal Reserve's sharp interest rate increases to combat inflation. In contrast, soft landings are demonstrated by the mid-1990s U.S. economy, where cautious policy adjustments led to slowed growth without triggering recession, and the late 2010s period before the COVID-19 pandemic, when inflation remained stable and unemployment low despite gradual rate hikes.

Impact on Businesses and Investors

Hard landing in an economy typically causes sharp declines in consumer demand and financial market volatility, leading to reduced corporate earnings and higher default risks for businesses. Investors often face increased portfolio risk, diminished asset values, and lower returns due to abrupt economic contractions and tighter credit conditions. In contrast, a soft landing allows businesses to maintain stable growth and profitability, while investors benefit from steady market performance and moderate risk adjustments.

Preparing for Economic Landings: Strategies for Resilience

Preparing for economic landings requires strategic resilience to mitigate risks associated with both hard and soft landings. Policymakers prioritize flexible fiscal measures, robust monetary policies, and diversified investment portfolios to stabilize markets and protect employment. Businesses enhance operational agility by optimizing cash flow management and stress-testing supply chains to withstand abrupt economic shifts during downturns.

Hard landing Infographic

libterm.com

libterm.com