Electronic money offers a secure and efficient way to conduct transactions without physical cash, leveraging digital platforms for instant payments and transfers. It enhances financial accessibility and convenience, allowing You to manage your finances anytime, anywhere. Discover more about how electronic money can transform Your payment experience in the rest of this article.

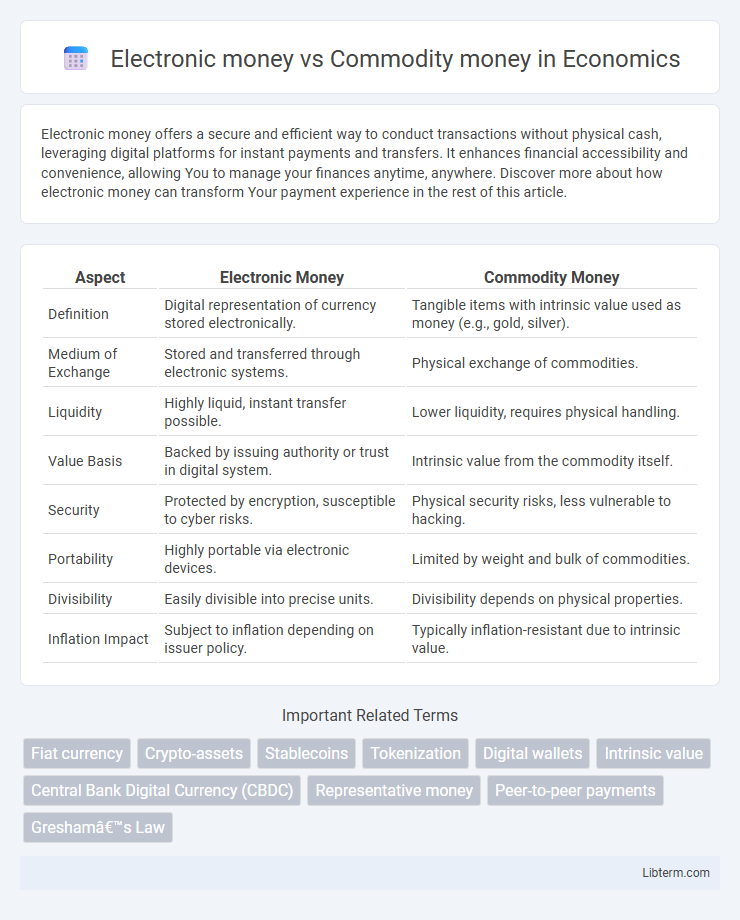

Table of Comparison

| Aspect | Electronic Money | Commodity Money |

|---|---|---|

| Definition | Digital representation of currency stored electronically. | Tangible items with intrinsic value used as money (e.g., gold, silver). |

| Medium of Exchange | Stored and transferred through electronic systems. | Physical exchange of commodities. |

| Liquidity | Highly liquid, instant transfer possible. | Lower liquidity, requires physical handling. |

| Value Basis | Backed by issuing authority or trust in digital system. | Intrinsic value from the commodity itself. |

| Security | Protected by encryption, susceptible to cyber risks. | Physical security risks, less vulnerable to hacking. |

| Portability | Highly portable via electronic devices. | Limited by weight and bulk of commodities. |

| Divisibility | Easily divisible into precise units. | Divisibility depends on physical properties. |

| Inflation Impact | Subject to inflation depending on issuer policy. | Typically inflation-resistant due to intrinsic value. |

Introduction to Electronic Money and Commodity Money

Electronic money represents a digital form of currency stored and transacted electronically using devices such as smartphones, computers, or prepaid cards. Commodity money, historically linked to physical goods like gold or silver, derives its value from the intrinsic worth of the commodity itself. The evolution from commodity money to electronic money highlights a shift towards faster, more convenient, and technology-driven financial transactions in modern economies.

Definition and Key Features of Electronic Money

Electronic money, defined as digital currency stored electronically on devices or online platforms, facilitates seamless and instant transactions without physical cash. It features enhanced security protocols, convenience for online and mobile payments, and real-time balance updates, distinguishing it from commodity money, which is based on intrinsic value assets like gold or silver. Unlike commodity money, electronic money relies on technological infrastructure and regulatory frameworks to ensure authenticity and prevent fraud.

Definition and Key Features of Commodity Money

Commodity money is a type of currency made from precious metals or other valuable goods that possess intrinsic value, such as gold, silver, or salt. Its key features include inherent worth due to the material itself, durability, divisibility, and universal acceptability, which historically ensured trust in transactions. Unlike electronic money, which exists digitally and depends on technology and financial institutions, commodity money directly represents value through its physical substance.

Historical Evolution of Money: From Commodity to Electronic

The historical evolution of money traces its origins from commodity money, where intrinsic value items like gold and silver were used as mediums of exchange, to electronic money, which relies on digital data and electronic transactions. Commodity money's physical form provided tangible value, facilitating trade in early economies, while electronic money leverages advancements in technology to enable faster, more efficient, and borderless financial exchanges. This transition reflects broader economic shifts emphasizing convenience, security, and scalability in modern financial systems.

Security and Fraud Risks: Commodity vs Electronic Money

Electronic money employs encrypted transactions and multi-factor authentication to enhance security, reducing the risk of fraud compared to commodity money, which relies on physical possession and can be counterfeited or stolen. Commodity money, such as gold or silver, faces challenges including physical security risks and difficulties in verifying authenticity, increasing exposure to theft and fraud. Advanced digital security protocols in electronic money systems minimize unauthorized access and provide traceability, offering a more secure and reliable alternative to the tangible vulnerabilities of commodity money.

Liquidity and Accessibility Comparison

Electronic money offers superior liquidity due to its instantaneous transfer capabilities and integration with digital payment platforms, enabling seamless transactions across global markets. Commodity money, such as gold or silver, often faces liquidity constraints linked to physical storage, transport costs, and market acceptance variability. Accessibility is significantly enhanced in electronic money systems through widespread internet availability and mobile technology, whereas commodity money accessibility remains limited by the need for physical possession and verification processes.

Storage, Transfer, and Transaction Speed

Electronic money offers superior storage convenience with digital wallets that securely hold value without physical bulk, unlike commodity money which requires physical safekeeping and is susceptible to damage or theft. Transfers of electronic money occur instantly across global networks, enabling seamless peer-to-peer and merchant transactions, while commodity money requires physical exchange or complex logistics, limiting speed and geographical reach. Transaction speed with electronic money is significantly faster due to automated processing and blockchain verification systems, contrasting sharply with the slower, manual handling involved in commodity money transactions.

Centralization and Regulation Issues

Electronic money operates under centralized systems controlled by financial institutions or governments, enabling strict regulatory oversight and transaction monitoring. Commodity money, such as gold or silver, relies on intrinsic value with decentralized use and minimal regulatory control, leading to challenges in standardization and widespread acceptance. The centralization of electronic money facilitates compliance with anti-money laundering laws, whereas commodity money's decentralized nature limits regulatory enforcement and poses risks of illicit trade.

Environmental Impact: Digital vs Physical Money

Electronic money significantly reduces environmental impact by minimizing the need for physical resources like paper and metals used in commodity money production. The energy consumption of digital currency systems, primarily through data centers and blockchain networks, can be high but is increasingly offset by advancements in renewable energy integration and energy-efficient technologies. Commodity money, such as coins and banknotes, generates substantial waste and pollution during manufacturing, transportation, and disposal, making digital money a more sustainable option in terms of environmental footprint.

Future Trends and Challenges for Money Systems

Electronic money offers faster, more efficient transactions and increased financial inclusion through digital wallets and blockchain technology, poised to dominate future money systems. Commodity money, rooted in physical assets like gold or silver, faces limitations due to scarcity and lack of flexibility in modern economies. Challenges for money systems include cybersecurity risks, regulatory frameworks, and the need to balance innovation with stability to ensure secure and accessible digital financial infrastructures.

Electronic money Infographic

libterm.com

libterm.com