Experimental economics uses controlled experiments to study economic behavior and decision-making, providing insights that traditional theoretical models may overlook. Researchers create real-world scenarios to observe how participants respond to incentives, risks, and strategic interactions. Explore the rest of the article to understand how experimental economics can deepen your grasp of market dynamics and human behavior.

Table of Comparison

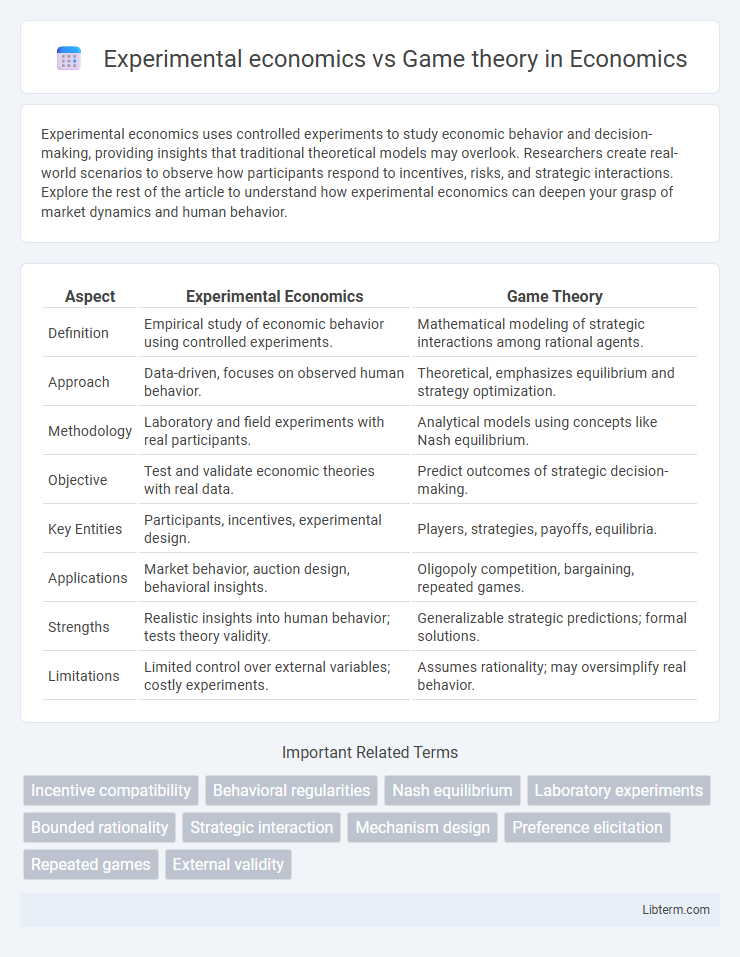

| Aspect | Experimental Economics | Game Theory |

|---|---|---|

| Definition | Empirical study of economic behavior using controlled experiments. | Mathematical modeling of strategic interactions among rational agents. |

| Approach | Data-driven, focuses on observed human behavior. | Theoretical, emphasizes equilibrium and strategy optimization. |

| Methodology | Laboratory and field experiments with real participants. | Analytical models using concepts like Nash equilibrium. |

| Objective | Test and validate economic theories with real data. | Predict outcomes of strategic decision-making. |

| Key Entities | Participants, incentives, experimental design. | Players, strategies, payoffs, equilibria. |

| Applications | Market behavior, auction design, behavioral insights. | Oligopoly competition, bargaining, repeated games. |

| Strengths | Realistic insights into human behavior; tests theory validity. | Generalizable strategic predictions; formal solutions. |

| Limitations | Limited control over external variables; costly experiments. | Assumes rationality; may oversimplify real behavior. |

Introduction to Experimental Economics and Game Theory

Experimental economics uses controlled laboratory experiments to test and validate theories of economic behavior, emphasizing real human decision-making under varying conditions. Game theory provides mathematical models to analyze strategic interactions among rational agents, focusing on predicting outcomes based on players' preferences and possible strategies. Both fields intersect in studying strategic behavior, with experimental economics empirically examining the assumptions and predictions derived from game-theoretic models.

Core Concepts: Defining Experimental Economics

Experimental economics involves empirical testing of economic theories through controlled experiments, emphasizing real human behavior under varying incentives and environments. Game theory provides a mathematical framework to analyze strategic interactions among rational decision-makers, focusing on equilibrium concepts and payoff optimization. Experimental economics validates and refines game theory models by observing actual decision-making patterns in laboratory or field settings.

Core Concepts: Understanding Game Theory

Game theory provides a mathematical framework for analyzing strategic interactions among rational players, emphasizing concepts like Nash equilibrium, dominant strategies, and payoff matrices. Experimental economics tests these theoretical predictions through controlled laboratory or field experiments, observing actual human behavior and decision-making under various game scenarios. Understanding game theory's core principles is essential for designing experiments that reveal discrepancies between predicted and observed behaviors in economic settings.

Methodological Differences between the Two Fields

Experimental economics employs controlled laboratory experiments and real-world data collection to empirically test economic theories and observe decision-making behavior. Game theory, by contrast, relies on mathematical modeling and logical frameworks to predict strategic interactions between rational agents under defined rules. While experimental economics validates and refines theoretical predictions through empirical evidence, game theory emphasizes formal model construction and equilibrium analysis without necessarily requiring empirical testing.

Role of Human Behavior and Rationality

Experimental economics uses controlled laboratory settings to observe actual human behavior, revealing deviations from the purely rational agents assumed in game theory models. Game theory relies on mathematical frameworks that predict decision-making based on the assumption of rationality and strategic interaction among players. Insights from experimental economics challenge and refine game theory by incorporating bounded rationality, preferences, and psychological factors into strategic analysis.

Laboratory Experiments vs. Theoretical Models

Laboratory experiments in experimental economics provide empirical data by observing real human behavior under controlled conditions, allowing researchers to test hypotheses and validate theoretical predictions. In contrast, game theory relies on abstract, mathematical models to predict strategic interactions and decision-making among rational agents without direct empirical observation. The interplay between laboratory experiments and theoretical models enhances the robustness of economic analysis by bridging observed behavior with formal strategic reasoning.

Key Applications in Real-World Scenarios

Experimental economics provides empirical data on human behavior by conducting controlled lab and field experiments, informing policy design in markets, auctions, and public goods provision. Game theory offers a mathematical framework to predict strategies and outcomes in competitive and cooperative scenarios, widely used in economics, political science, and business strategy development. Together, they enhance decision-making processes in negotiations, mechanism design, and regulatory environments through a blend of theoretical models and observed behaviors.

Insights from Experimental Economics for Game Theory

Experimental economics provides empirical data that validates and refines game theory models by testing strategic interactions in controlled environments. Insights from experimental economics reveal how real human behavior often deviates from theoretical predictions due to bounded rationality, fairness concerns, and learning dynamics. These findings contribute to more robust game theory frameworks that better predict outcomes in economic, social, and political interactions.

Limitations and Critiques of Both Approaches

Experimental economics faces limitations such as artificial laboratory settings that may not fully capture real-world complexities, leading to challenges in external validity. Game theory, while providing robust mathematical models to predict strategic behavior, often relies on assumptions like rationality and common knowledge that may not hold in practice, limiting its descriptive accuracy. Both approaches encounter critiques for their simplified frameworks, which can overlook dynamic social, psychological, and institutional factors influencing economic decision-making.

Future Directions: Integrating Experimental Economics and Game Theory

Future directions in integrating experimental economics and game theory emphasize the development of hybrid models that combine empirical data with theoretical predictions to improve the accuracy of behavioral forecasts. Advances in neuroeconomics and data analytics enable the design of experiments that reveal underlying decision-making processes, enhancing the validation of game-theoretic assumptions. Cross-disciplinary collaboration is poised to expand the applicability of these integrated approaches in areas such as market design, policy evaluation, and behavioral finance.

Experimental economics Infographic

libterm.com

libterm.com