Deflationary bias occurs when inflation measures consistently underestimate the true rate of inflation, causing an inaccurate reflection of cost-of-living changes. This bias affects economic policy decisions, wage adjustments, and investment strategies, potentially misleading your financial planning. Explore the full article to understand the causes, implications, and solutions for deflationary bias.

Table of Comparison

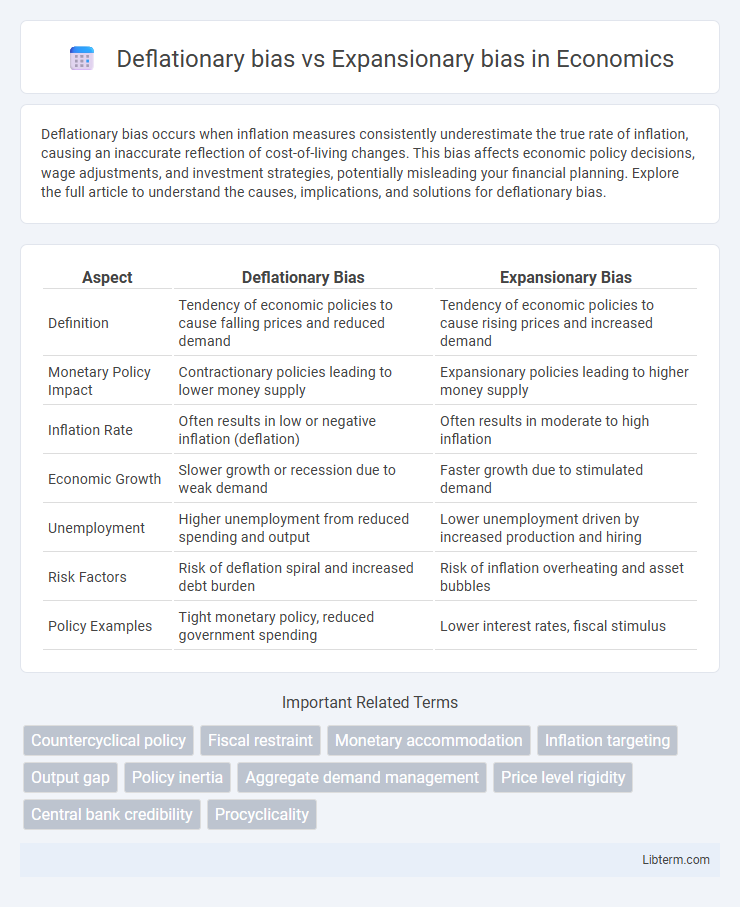

| Aspect | Deflationary Bias | Expansionary Bias |

|---|---|---|

| Definition | Tendency of economic policies to cause falling prices and reduced demand | Tendency of economic policies to cause rising prices and increased demand |

| Monetary Policy Impact | Contractionary policies leading to lower money supply | Expansionary policies leading to higher money supply |

| Inflation Rate | Often results in low or negative inflation (deflation) | Often results in moderate to high inflation |

| Economic Growth | Slower growth or recession due to weak demand | Faster growth due to stimulated demand |

| Unemployment | Higher unemployment from reduced spending and output | Lower unemployment driven by increased production and hiring |

| Risk Factors | Risk of deflation spiral and increased debt burden | Risk of inflation overheating and asset bubbles |

| Policy Examples | Tight monetary policy, reduced government spending | Lower interest rates, fiscal stimulus |

Understanding Deflationary Bias: Definition and Origins

Deflationary bias refers to the systematic underestimation of inflation by official price indices, caused primarily by substitution effects, quality improvements, and the introduction of new goods that are not fully captured in calculations. This bias originates from methodological challenges in measuring true cost-of-living increases, where fixed-basket approaches fail to account for consumer behavior changes and technological advancements. Understanding deflationary bias is crucial for accurate inflation measurement, monetary policy formulation, and economic analysis.

What is Expansionary Bias? Core Concepts Explained

Expansionary bias refers to the tendency of policymakers, especially central banks, to implement excessively loose monetary or fiscal policies, which often result in higher inflation rates and increased economic instability. This bias arises from political pressures to stimulate short-term economic growth and reduce unemployment, even at the expense of long-term price stability. Understanding expansionary bias is crucial for designing credible policies that balance growth objectives with inflation control to ensure sustainable economic performance.

Historical Context: Deflationary vs Expansionary Episodes

Deflationary bias historically emerges during periods of economic contraction, such as the Great Depression of the 1930s, where falling prices and output reflect weakened demand and tight monetary policy. Expansionary bias is evident in post-World War II recoveries, notably the 1950s and 1960s, when aggressive fiscal stimuli and accommodative monetary policies promoted sustained economic growth and increased inflation rates. These biases shape central banks' policy responses, with deflationary episodes demanding easing measures and expansionary episodes often requiring tightening to prevent overheating.

Economic Impacts of Deflationary Bias

Deflationary bias in monetary policy results in a persistent tendency for lower inflation or outright deflation, which can lead to reduced consumer spending and delayed investment decisions, thereby slowing economic growth. This bias often causes real interest rates to remain higher than desired, increasing the debt burden on households and businesses and raising the risk of financial instability. The prolonged deflationary environment can trigger lower wage growth and higher unemployment, further exacerbating economic stagnation and reducing overall aggregate demand.

Consequences of Expansionary Bias on Inflation

Expansionary bias leads to sustained inflationary pressures by consistently promoting excessive government spending and monetary expansion beyond the economy's productive capacity. This persistent increase in aggregate demand causes prices to rise, eroding purchasing power and reducing real wages. Over time, expansionary bias can destabilize the economy, triggering wage-price spirals, reduced investment confidence, and the need for restrictive monetary policies to control inflation.

Policy Drivers Behind Deflationary Bias

Policy drivers behind deflationary bias include restrictive monetary policies such as high interest rates aimed at controlling inflation, fiscal austerity measures that reduce government spending and aggregate demand, and regulatory frameworks emphasizing price stability over economic growth. Central banks prioritizing inflation targeting create conditions where persistent under-demand suppresses price levels, reinforcing deflationary pressures. Structural policies that limit wage growth and suppress credit expansion further entrench deflationary bias by constraining consumer purchasing power and investment incentives.

Political Motivations for Expansionary Bias

Political motivations for expansionary bias often stem from the desire of policymakers to stimulate short-term economic growth before elections by increasing government spending or cutting taxes. This approach can create a temptation to pursue expansionary fiscal policies even when they may lead to long-term inflation or budget deficits. Politicians frequently prioritize policies that boost employment and output temporarily to gain voter support, despite the risk of creating economic imbalances associated with expansionary bias.

Comparing Fiscal Responses: Deflation vs Expansion

Fiscal responses to deflation typically involve expansionary measures such as increased government spending and tax cuts to stimulate demand and prevent economic contraction. In contrast, expansionary bias during inflationary periods often leads to tighter fiscal policies aimed at reducing deficits and curbing excess demand. Comparative analysis shows that deflationary bias fosters proactive stimulus to avoid stagnation, whereas expansionary bias prioritizes fiscal restraint to maintain price stability.

Long-Term Effects on Growth and Stability

Deflationary bias occurs when economic policies or market forces consistently suppress inflation, leading to prolonged periods of reduced demand and slower growth, ultimately risking deflationary spirals that undermine financial stability. Expansionary bias, characterized by persistent efforts to stimulate growth through increased spending or monetary easing, can promote short-term economic expansion but may cause long-term challenges such as high inflation, asset bubbles, and fiscal imbalances. Sustained deflationary bias tends to erode investment incentives and wage growth, while expansionary bias risks overheating the economy, highlighting the delicate balance policymakers must maintain to ensure stable, enduring growth.

Mitigating Biases: Strategies for Balanced Economic Policy

Mitigating deflationary and expansionary biases requires implementing countercyclical fiscal and monetary policies that adjust according to economic conditions, such as automatic stabilizers and rules-based interventions. Central banks can utilize inflation targeting combined with flexible policy frameworks to prevent persistent deviations from equilibrium growth. Enhancing transparency and data-driven decision-making supports balanced economic policy by reducing the risk of entrenched biases that distort market expectations and output stability.

Deflationary bias Infographic

libterm.com

libterm.com