A nominal anchor is a policy tool used by central banks to stabilize inflation by fixing a target or reference point, such as a specific inflation rate or exchange rate, to guide expectations and economic decisions. This approach helps maintain price stability by reducing uncertainty and providing a clear framework for monetary policy. Explore the rest of the article to understand how a nominal anchor can impact your financial planning and economic environment.

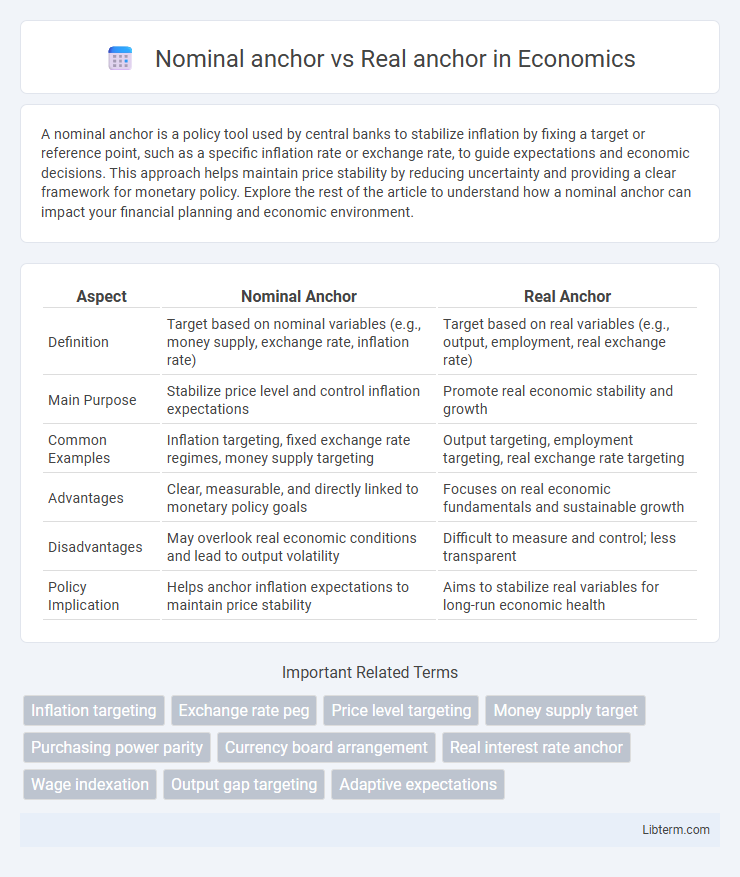

Table of Comparison

| Aspect | Nominal Anchor | Real Anchor |

|---|---|---|

| Definition | Target based on nominal variables (e.g., money supply, exchange rate, inflation rate) | Target based on real variables (e.g., output, employment, real exchange rate) |

| Main Purpose | Stabilize price level and control inflation expectations | Promote real economic stability and growth |

| Common Examples | Inflation targeting, fixed exchange rate regimes, money supply targeting | Output targeting, employment targeting, real exchange rate targeting |

| Advantages | Clear, measurable, and directly linked to monetary policy goals | Focuses on real economic fundamentals and sustainable growth |

| Disadvantages | May overlook real economic conditions and lead to output volatility | Difficult to measure and control; less transparent |

| Policy Implication | Helps anchor inflation expectations to maintain price stability | Aims to stabilize real variables for long-run economic health |

Introduction to Nominal and Real Anchors

Nominal anchors refer to fixed monetary values or exchange rates used to stabilize a country's currency and control inflation by setting explicit targets, such as a currency peg or inflation target. Real anchors focus on tangible economic indicators like the output gap or real interest rates to guide monetary policy and maintain long-term price stability. Understanding the distinction between nominal and real anchors is essential for effective macroeconomic management and combating inflationary pressures.

Defining Nominal Anchor: Concepts and Examples

A nominal anchor refers to a policy tool used to stabilize expectations by fixing a nominal variable such as the inflation rate, money supply growth, or exchange rate, serving as a reference point for economic agents to anticipate future price levels. Examples of nominal anchors include inflation targeting, where central banks set explicit inflation rate targets, and exchange rate pegs, where a country fixes its currency value to another stable currency. By establishing a credible nominal anchor, policymakers aim to reduce inflation volatility and enhance macroeconomic stability without directly controlling real economic variables.

Understanding Real Anchor: Key Principles

Real anchors stabilize an economy by tying monetary policy to a tangible economic variable, such as the exchange rate or inflation-targeting frameworks, fostering long-term price stability. Unlike nominal anchors, which rely on fixed values such as a currency peg or money supply growth rates, real anchors adjust to economic conditions, enhancing credibility and reducing inflationary expectations. Key principles of understanding real anchors include their role in anchoring inflation expectations, promoting economic flexibility, and supporting sustainable growth through adaptive policy mechanisms.

Purpose and Importance of Monetary Anchors

Nominal anchors stabilize inflation expectations by fixing a monetary variable such as the money supply or exchange rate, providing clear policy guidance to prevent runaway inflation. Real anchors focus on stabilizing key real economic variables like output or employment, ensuring sustainable economic growth and maintaining long-term economic stability. Monetary anchors play a crucial role in anchoring inflation expectations, enhancing policy credibility, and promoting macroeconomic stability.

Differences Between Nominal and Real Anchors

Nominal anchors stabilize an economy by tying the monetary policy to a specific nominal variable, such as inflation rate or exchange rate targets, whereas real anchors focus on maintaining stability in real economic variables like output or employment levels. Nominal anchors guide expectations by setting explicit nominal targets, influencing inflation perceptions, while real anchors aim to stabilize the economy's fundamental real factors, often without fixed nominal targets. The key difference lies in their approach to economic stability: nominal anchors target price-level certainty, whereas real anchors prioritize sustainable real economic growth and resource utilization.

Nominal Anchors in Monetary Policy Frameworks

Nominal anchors in monetary policy frameworks refer to specific target variables such as inflation rates or exchange rates that central banks use to stabilize the economy and guide expectations. By committing to a clear nominal anchor, policymakers enhance transparency and credibility, reducing inflation volatility and inflationary expectations. Unlike real anchors, which focus on real economic variables like the real interest rate, nominal anchors primarily help anchor inflation expectations directly, ensuring price stability.

Real Anchors and Economic Stability

Real anchors, such as targeting money supply growth or inflation rates, provide a more reliable basis for economic stability compared to nominal anchors like fixed exchange rates. By aligning policy with real economic variables, central banks can reduce inflation volatility and enhance long-term growth prospects. Empirical studies show that economies using real anchors experience fewer external shocks and maintain consistent purchasing power.

Advantages and Limitations of Nominal Anchors

Nominal anchors stabilize inflation expectations by targeting a specific price level or inflation rate, making monetary policy more predictable and transparent for businesses and consumers. Their advantages include simplicity and ease of communication, but limitations arise from their vulnerability to shocks that cause real economic distortions, potentially leading to output volatility. Unlike real anchors, nominal anchors do not guarantee long-term price stability rigidly tied to economic fundamentals like money supply or exchange rates.

Pros and Cons of Real Anchors

Real anchors provide a stable benchmark tied to tangible economic indicators, helping to reduce inflation volatility and enhance credibility in monetary policy by maintaining purchasing power over time. However, real anchors can be difficult to implement due to measurement challenges in accurately estimating real variables like the natural rate of output or inflation expectations. Their reliance on forward-looking data can introduce uncertainty and complicate policy communication, potentially reducing flexibility during economic shocks.

Choosing the Right Anchor: Policy Implications

Choosing the right anchor is crucial for stabilizing inflation expectations and maintaining monetary credibility; nominal anchors, such as fixed exchange rates or inflation targets, provide clear benchmarks but may lack flexibility during shocks. Real anchors, including output targets or the price level path, offer adaptability by accounting for economic conditions but risk weaker immediate clarity for markets. Policymakers must balance commitment and flexibility, ensuring their anchor aligns with economic structure and credibility to effectively guide inflation dynamics and maintain macroeconomic stability.

Nominal anchor Infographic

libterm.com

libterm.com