A traditional economy relies on customs, beliefs, and rituals to make economic decisions, focusing on agriculture, hunting, and barter systems. This economic structure typically preserves cultural heritage and sustains local communities by producing goods for direct use rather than profit. Discover how traditional economies impact modern society and what they reveal about human economic behavior in the rest of the article.

Table of Comparison

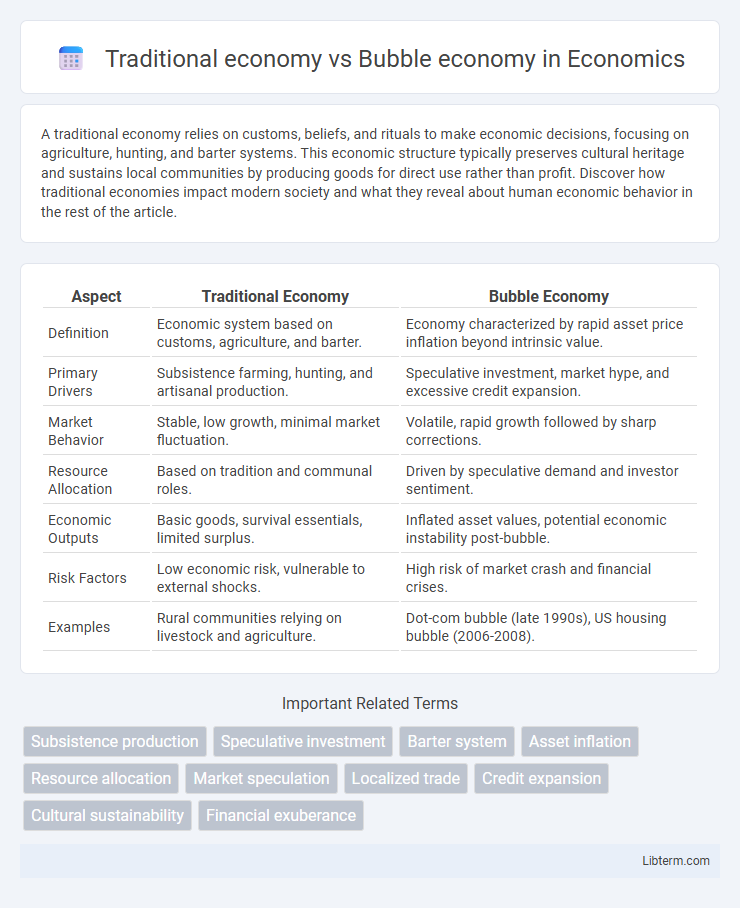

| Aspect | Traditional Economy | Bubble Economy |

|---|---|---|

| Definition | Economic system based on customs, agriculture, and barter. | Economy characterized by rapid asset price inflation beyond intrinsic value. |

| Primary Drivers | Subsistence farming, hunting, and artisanal production. | Speculative investment, market hype, and excessive credit expansion. |

| Market Behavior | Stable, low growth, minimal market fluctuation. | Volatile, rapid growth followed by sharp corrections. |

| Resource Allocation | Based on tradition and communal roles. | Driven by speculative demand and investor sentiment. |

| Economic Outputs | Basic goods, survival essentials, limited surplus. | Inflated asset values, potential economic instability post-bubble. |

| Risk Factors | Low economic risk, vulnerable to external shocks. | High risk of market crash and financial crises. |

| Examples | Rural communities relying on livestock and agriculture. | Dot-com bubble (late 1990s), US housing bubble (2006-2008). |

Defining Traditional Economy: Key Characteristics

A traditional economy is characterized by reliance on customs, agriculture, and barter systems, often operating within close-knit communities where economic roles are inherited and production methods remain unchanged over generations. This system emphasizes sustainability, self-sufficiency, and minimal technological innovation, with trade primarily conducted through direct exchange rather than monetary transactions. Unlike a bubble economy, which is marked by rapid asset price inflation and speculative investment, a traditional economy maintains stability through established practices and resource-based livelihoods.

Understanding Bubble Economy: Core Features

A Bubble Economy is characterized by rapid asset price inflation driven by speculative investment, often detached from fundamental economic values. This phenomenon is marked by excessive credit expansion, investor exuberance, and market participants' belief in perpetually rising prices, leading to unsustainable economic growth. Unlike a Traditional economy, which relies on established production and consumption patterns, a Bubble Economy is fragile and susceptible to sudden market corrections or crashes.

Historical Context: Origins of Traditional and Bubble Economies

Traditional economies originated from ancient societal structures relying on agriculture, barter systems, and subsistence activities, deeply rooted in customs and cultural practices. Bubble economies emerged from rapid speculative investment cycles, often linked to financial innovations and market optimism, exemplified by historical events such as the Dutch Tulip Mania and the South Sea Bubble. These contrasting origins reflect the shift from stable, resource-based economies to volatile, asset-driven markets influenced by investor behavior and economic expectations.

Resource Allocation: Stability vs. Speculation

Traditional economies allocate resources based on customs and straightforward barter systems, ensuring stable distribution aligned with long-standing societal needs. Bubble economies emphasize speculative investments, resulting in volatile resource allocation driven by market hype rather than fundamental value. This speculative nature often leads to misallocation of capital, causing economic instability and potential market crashes.

Role of Government and Regulation

In a traditional economy, the government typically plays a minimal role with limited regulatory intervention, focusing on customs and established practices to maintain economic stability. Conversely, a bubble economy often experiences significant government involvement aimed at regulating speculative activities, controlling market excesses, and preventing financial crises through monetary policies and regulatory frameworks. Effective regulation in bubble economies is crucial to curb asset inflation and protect market integrity, whereas traditional economies rely more on social norms than formal government control.

Economic Growth Patterns: Slow Evolution vs. Rapid Expansion

Traditional economies exhibit slow economic growth characterized by limited technological innovation and reliance on agriculture or barter systems, resulting in steady but stagnant development patterns. Bubble economies experience rapid expansion fueled by speculative investment and overvalued asset prices, often leading to unsustainable growth spikes followed by sharp contractions. Understanding these divergent growth patterns is crucial for analyzing economic stability and long-term sustainability.

Impact on Society and Culture

Traditional economies emphasize community-oriented values, sustaining cultural heritage through established practices like subsistence farming and barter trade, which foster social cohesion and intergenerational knowledge transfer. Bubble economies, characterized by rapid asset price inflation and speculative investment, often disrupt social stability by creating wealth disparities, consumerism, and cultural shifts toward materialism. The social impact of bubble economies includes increased stress on social services and erosion of traditional community bonds, contrasting sharply with the stability and cultural continuity promoted by traditional economic systems.

Risks and Vulnerabilities: Sustainability vs. Fragility

Traditional economies exhibit sustainability through resource-based production and localized trade, minimizing exposure to global market shocks but facing risks from limited innovation and external disruptions. Bubble economies demonstrate fragility due to speculative asset inflations and excessive leverage, increasing vulnerability to sudden market corrections and financial crises. The inherent instability in bubble economies contrasts sharply with the steady, albeit slower growth, characteristic of traditional economic systems.

Case Studies: Real-World Examples

Traditional economies, such as those found in rural parts of India and sub-Saharan Africa, rely heavily on subsistence farming and barter systems, emphasizing sustainability and community-based resource management. In contrast, bubble economies like Japan during the late 1980s and the U.S. housing market in the mid-2000s experienced rapid asset inflation driven by speculation, followed by sharp economic contractions. These case studies illustrate that traditional economies prioritize long-term stability whereas bubble economies highlight vulnerabilities in market speculation and financial regulation.

Lessons for Modern Economies

Traditional economies emphasize sustainability, community-based resource management, and long-term resilience, highlighting the importance of localized decision-making to maintain social and environmental balance. Bubble economies demonstrate the risks of speculative investment, asset overvaluation, and market inefficiencies, underscoring the necessity for robust financial regulation and transparent economic indicators. Modern economies benefit from integrating traditional stability lessons with vigilant monitoring to prevent asset bubbles and ensure sustainable growth.

Traditional economy Infographic

libterm.com

libterm.com