A lump-sum tax is a fixed amount of tax levied on individuals or businesses regardless of their income or wealth, ensuring simplicity and administrative ease. It does not distort economic decisions since it remains constant irrespective of changes in economic behavior. Explore the rest of the article to understand how lump-sum taxes impact equity and efficiency in taxation.

Table of Comparison

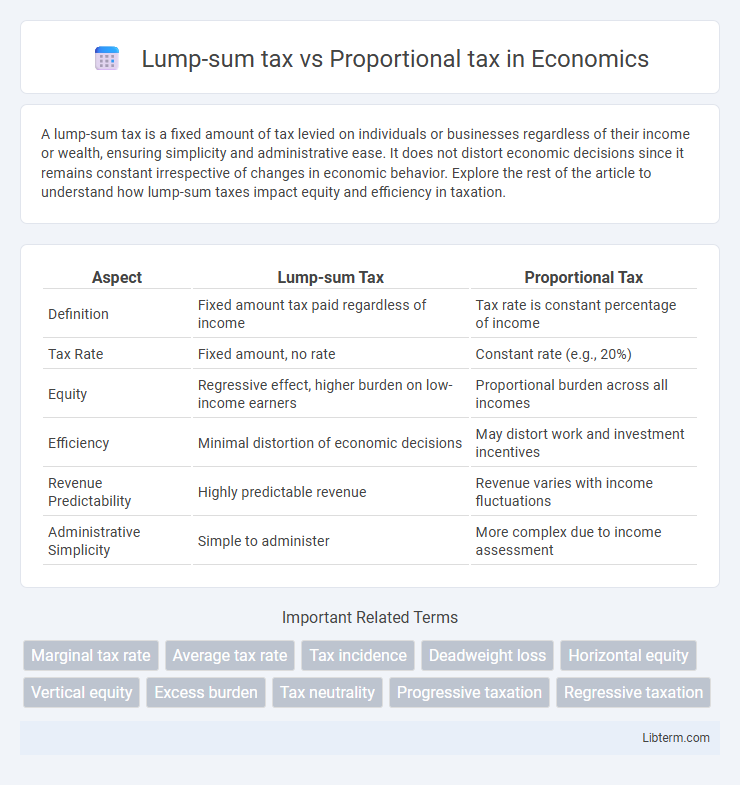

| Aspect | Lump-sum Tax | Proportional Tax |

|---|---|---|

| Definition | Fixed amount tax paid regardless of income | Tax rate is constant percentage of income |

| Tax Rate | Fixed amount, no rate | Constant rate (e.g., 20%) |

| Equity | Regressive effect, higher burden on low-income earners | Proportional burden across all incomes |

| Efficiency | Minimal distortion of economic decisions | May distort work and investment incentives |

| Revenue Predictability | Highly predictable revenue | Revenue varies with income fluctuations |

| Administrative Simplicity | Simple to administer | More complex due to income assessment |

Introduction to Lump-Sum and Proportional Taxes

Lump-sum taxes impose a fixed amount on individuals regardless of income, ensuring simplicity and minimal economic distortion. Proportional taxes, also known as flat taxes, charge a constant percentage of income, maintaining fairness by taxing all earners at the same rate. Both tax systems influence economic behavior differently, with lump-sum taxes considered efficient but regressive, while proportional taxes balance equity and efficiency.

Defining Lump-Sum Taxation

Lump-sum taxation is a fixed tax amount imposed on individuals or entities regardless of income, consumption, or wealth, creating a straightforward and administratively efficient revenue system. Unlike proportional tax, which charges a constant percentage rate relative to the tax base, lump-sum tax does not alter economic behavior or distort incentives due to its invariant nature. This non-distortionary characteristic makes lump-sum taxes theoretically optimal in economic models, but their practical application is limited by equity concerns and political feasibility.

Understanding Proportional Tax Systems

Proportional tax systems impose a constant tax rate on all income levels, ensuring that every taxpayer contributes the same percentage regardless of earnings. This tax structure promotes fairness by maintaining equal tax rates, but it may impact income distribution due to uniform treatment of low and high incomes. Understanding proportional taxes helps policymakers balance simplicity with equity in designing effective tax frameworks.

Key Differences Between Lump-Sum and Proportional Taxes

Lump-sum tax imposes a fixed amount on all taxpayers regardless of income or economic activity, while proportional tax levies a constant percentage rate on income or value, maintaining the same tax rate across all income levels. Lump-sum taxes are considered regressive as they do not adjust for ability to pay, often placing a heavier relative burden on lower-income individuals, whereas proportional taxes ensure tax liability increases directly with income. Key differences include the impact on equity and efficiency, with lump-sum taxes being simpler to administer but less equitable, and proportional taxes offering a fairer distribution of tax burdens but potentially more complex to implement.

Economic Efficiency of Lump-Sum Tax

Lump-sum taxes are considered economically efficient because they do not distort individual choices or behavior, as the tax amount remains fixed regardless of income or consumption levels. Unlike proportional taxes, which apply a constant rate on income and may discourage additional work or investment by reducing marginal returns, lump-sum taxes impose no marginal cost on economic decisions. This absence of behavioral distortion ensures that lump-sum taxes minimize deadweight loss and maximize overall economic efficiency.

Equity Considerations in Proportional Taxation

Proportional tax systems apply a constant tax rate across all income levels, which can raise equity concerns as they may place a relatively higher burden on low-income earners compared to high-income individuals. Unlike lump-sum taxes, which charge a fixed amount regardless of income, proportional taxes may perpetuate income inequality by not adjusting for taxpayers' ability to pay. Equity considerations in proportional taxation often emphasize the need for complementary measures, such as tax credits or exemptions, to mitigate regressive effects and promote fairness.

Impact on Income Distribution

Lump-sum taxes impose the same fixed amount on all individuals regardless of income, resulting in a regressive impact that disproportionately burdens lower-income households and exacerbates income inequality. Proportional taxes apply a constant tax rate across all income levels, maintaining the existing income distribution without reducing inequality but also avoiding progressive tax burdens on higher earners. The choice between lump-sum and proportional taxation profoundly affects redistributive outcomes, with lump-sum taxes reducing disposable income more severely for poorer groups while proportional taxes preserve relative income shares.

Administrative Simplicity and Compliance

Lump-sum tax offers superior administrative simplicity due to its fixed amount structure, requiring minimal calculation and straightforward collection processes. Proportional tax involves percentage-based calculations on income or transactions, increasing complexity in assessment, record-keeping, and enforcement. Compliance tends to be higher for lump-sum taxes as taxpayers face clear, unchanging obligations, whereas proportional taxes may encounter evasion due to variable rates and intricate reporting requirements.

Real-World Examples and Applications

Lump-sum taxes, such as the UK's poll tax implemented in Scotland during the late 1980s, impose a fixed amount on individuals regardless of income, often leading to public backlash due to perceived unfairness. Proportional taxes, exemplified by Russia's flat income tax rate introduced in 2001 at 13%, apply the same percentage rate across all income levels, simplifying tax administration and encouraging compliance. Countries like Estonia and Hong Kong also employ proportional tax systems, enhancing economic growth by maintaining consistent tax rates on personal and corporate income.

Conclusion: Choosing the Right Tax System

Selecting the appropriate tax system depends on economic goals, administrative efficiency, and equity considerations. Lump-sum taxes ensure simplicity and minimal distortion but can be regressive, while proportional taxes maintain fairness through consistent rates but may create minor economic inefficiencies. Policymakers must balance revenue needs, taxpayer behavior, and social equity when deciding between lump-sum and proportional taxation models.

Lump-sum tax Infographic

libterm.com

libterm.com