The income effect explains how changes in your income influence your purchasing power and consumption choices, leading to shifts in demand for goods and services. When income rises, you can afford to buy more normal goods, while a decrease may reduce your overall consumption. Explore the rest of the article to understand how the income effect impacts consumer behavior and market dynamics.

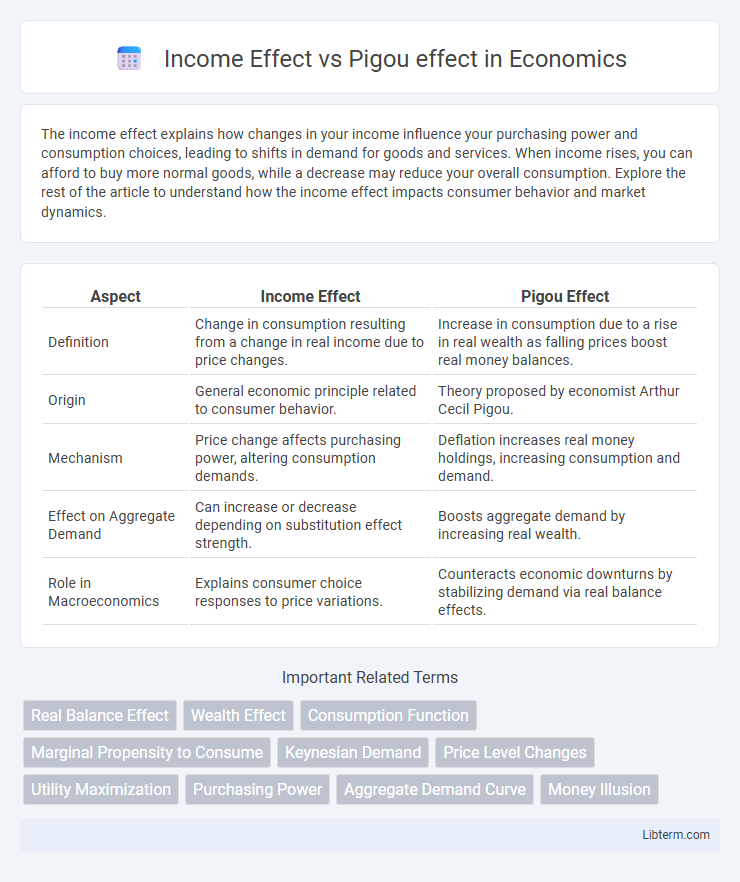

Table of Comparison

| Aspect | Income Effect | Pigou Effect |

|---|---|---|

| Definition | Change in consumption resulting from a change in real income due to price changes. | Increase in consumption due to a rise in real wealth as falling prices boost real money balances. |

| Origin | General economic principle related to consumer behavior. | Theory proposed by economist Arthur Cecil Pigou. |

| Mechanism | Price change affects purchasing power, altering consumption demands. | Deflation increases real money holdings, increasing consumption and demand. |

| Effect on Aggregate Demand | Can increase or decrease depending on substitution effect strength. | Boosts aggregate demand by increasing real wealth. |

| Role in Macroeconomics | Explains consumer choice responses to price variations. | Counteracts economic downturns by stabilizing demand via real balance effects. |

Introduction to Income Effect vs Pigou Effect

The income effect describes how changes in purchasing power influence consumer demand when prices vary, directly impacting real income and consumption patterns. The Pigou effect, a specific type of income effect, highlights increased aggregate demand resulting from rising real balances during deflation, which can stabilize economic activity. Both effects play crucial roles in understanding consumer behavior and macroeconomic adjustments in response to price level changes.

Defining the Income Effect

The Income Effect refers to the change in consumer purchasing power resulting from a change in real income or prices, influencing the quantity of goods demanded. When prices decrease, consumers effectively experience a rise in real income, enabling increased consumption without additional spending. The Pigou Effect specifically highlights this phenomenon in the context of aggregate demand, where falling prices raise real wealth and stimulate economic output.

Understanding the Pigou Effect

The Pigou Effect refers to the real balance effect where a rise in real wealth, due to falling price levels, increases consumer spending and boosts aggregate demand. Unlike the Income Effect, which focuses on changes in income affecting consumption, the Pigou Effect emphasizes how changes in the value of money holdings influence consumption behavior. This concept highlights the stabilizing role of real balances in countering economic downturns and deflationary pressures.

Historical Background and Development

The Income Effect, rooted in classical economics, describes how changes in consumers' real income influence demand for goods and services, with origins traced back to early 20th-century microeconomic theory. The Pigou Effect, named after economist Arthur Cecil Pigou in the 1940s, expands on this by linking real balance increases from falling prices to higher consumption and aggregate demand. Both effects significantly contributed to Keynesian and post-Keynesian debates on price-level changes and their impact on economic output and employment.

Key Differences Between the Two Effects

The Income Effect refers to a change in consumer purchasing power due to variations in real income, influencing demand for goods and services; it primarily highlights how price changes impact consumption by altering effective income. The Pigou Effect, also known as the real balance effect, emphasizes the relationship between changes in real money balances and aggregate demand, suggesting that falling price levels increase real wealth, thereby stimulating consumption and boosting economic activity. Key differences include the Income Effect's focus on individual consumption changes from income shifts, while the Pigou Effect addresses macroeconomic adjustments through real wealth changes affecting overall demand.

Relevance in Modern Economic Theory

The Income Effect explains how changes in purchasing power influence consumer demand, directly impacting consumption patterns and aggregate demand in modern economic models. The Pigou Effect specifically highlights how increases in real wealth, due to falling price levels, can stimulate spending and counteract deflationary pressures, playing a crucial role in New Keynesian economics. Understanding both effects is essential for designing monetary and fiscal policies that stabilize economies and maintain growth in contemporary economic theory.

Real-World Examples Illustrating Both Effects

The Income Effect is illustrated by a worker receiving a raise, enabling increased consumption due to higher real income, commonly seen in wage growth impacting consumer spending patterns. The Pigou Effect occurs during deflation when falling prices increase real wealth, incentivizing higher consumption despite stagnant nominal incomes, as observed in Japan's prolonged deflationary period. These contrasting effects highlight how changes in real income and price levels influence aggregate demand in diverse economic contexts.

Criticisms and Limitations

The Income Effect, which describes changes in consumption resulting from altered purchasing power, faces criticism for oversimplifying consumer behavior and neglecting factors like expectations and credit constraints. The Pigou Effect, suggesting that falling prices increase real wealth and thus spending, is limited by empirical evidence showing weak price-consumption links and unrealistic assumptions about liquidation of money holdings. Both concepts struggle to accurately predict economic dynamics during deflationary periods due to their reliance on idealized consumer responses and disregard for market imperfections.

Implications for Economic Policy

The Income Effect influences consumer spending by altering real purchasing power as prices change, guiding policies that stabilize inflation to maintain consumption levels. The Pigou effect, highlighting increased real wealth from falling prices, supports deflationary policies aimed at boosting demand during recessions through enhanced consumer confidence. Policymakers must balance these effects to design strategies that effectively stimulate economic growth without triggering inflationary or deflationary spirals.

Conclusion: Synthesizing the Effects

Income Effect reflects changes in consumer spending due to variations in real income from price changes, while the Pigou Effect specifically highlights increased consumption driven by rising real balances of wealth during deflation. Synthesizing these effects reveals that both mechanisms emphasize the role of purchasing power in influencing aggregate demand but differ in their direct triggers--price fluctuations for the Income Effect versus wealth valuation for the Pigou Effect. Understanding this distinction helps clarify how monetary and fiscal policies impact economic stability through shifts in consumption patterns.

Income Effect Infographic

libterm.com

libterm.com