The primary deficit occurs when a government's current expenditures exceed its revenues, excluding interest payments on existing debt. Understanding this financial imbalance is crucial for assessing fiscal sustainability and economic policy effectiveness. Explore the article to learn how the primary deficit impacts your country's economic health and future growth.

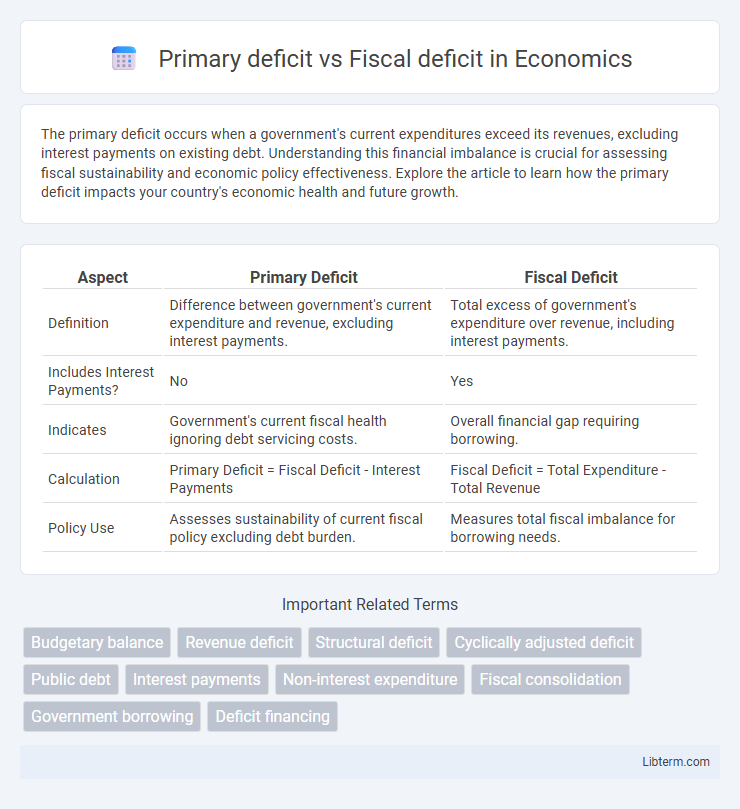

Table of Comparison

| Aspect | Primary Deficit | Fiscal Deficit |

|---|---|---|

| Definition | Difference between government's current expenditure and revenue, excluding interest payments. | Total excess of government's expenditure over revenue, including interest payments. |

| Includes Interest Payments? | No | Yes |

| Indicates | Government's current fiscal health ignoring debt servicing costs. | Overall financial gap requiring borrowing. |

| Calculation | Primary Deficit = Fiscal Deficit - Interest Payments | Fiscal Deficit = Total Expenditure - Total Revenue |

| Policy Use | Assesses sustainability of current fiscal policy excluding debt burden. | Measures total fiscal imbalance for borrowing needs. |

Understanding Primary Deficit

Primary deficit measures the government's fiscal health by calculating the difference between its current expenditures and revenues, excluding interest payments on outstanding debt. It indicates whether the government's revenue generation is sufficient to cover its non-interest spending, providing insight into the sustainability of fiscal policy. A primary deficit suggests the need for borrowing beyond interest obligations, affecting debt accumulation and economic stability.

What is Fiscal Deficit?

Fiscal deficit represents the gap between the government's total expenditures and its total revenues, excluding borrowings, during a fiscal year. It reflects the need for the government to borrow funds to meet its spending obligations when income from taxes and other sources is insufficient. This measure is crucial for assessing the sustainability of public finances and the overall economic health of a country.

Key Differences Between Primary and Fiscal Deficit

Primary deficit refers to the difference between the government's total revenue and its non-interest expenditures, excluding interest payments on debt. Fiscal deficit includes the total shortfall in the government's finances, accounting for both non-interest expenditures and interest payments on outstanding debt. The key difference lies in the inclusion of interest payments, with fiscal deficit providing a broader measure of the government's overall borrowing requirements.

How to Calculate Primary Deficit

Primary deficit is calculated by subtracting interest payments on the government's debt from the fiscal deficit to measure the borrowing requirements excluding debt servicing costs. Fiscal deficit represents the total shortfall of government revenue over expenditure, including interest payments. To calculate the primary deficit, use the formula: Primary Deficit = Fiscal Deficit - Interest Payments on Debt.

Fiscal Deficit Calculation Explained

Fiscal deficit represents the gap between the government's total expenditure and its total revenue (excluding borrowing) within a fiscal year, reflecting the total amount the government needs to borrow to meet its expenses. Primary deficit measures the fiscal deficit excluding interest payments on previous borrowings, highlighting the current fiscal health without debt servicing costs. Fiscal deficit calculation involves subtracting total revenue receipts from total expenditure, where a higher fiscal deficit indicates a greater reliance on borrowing and potential impact on economic stability.

Economic Implications of Primary Deficit

The primary deficit represents the difference between government revenue and non-interest expenditures, excluding interest payments, providing a clearer view of fiscal discipline by showing whether current fiscal policies are sustainable without new borrowing. A persistent primary deficit indicates structural imbalances, leading to increased debt levels and higher interest obligations that can crowd out public investment and slow economic growth. Monitoring the primary deficit helps policymakers implement corrective measures to maintain macroeconomic stability and investor confidence.

Fiscal Deficit: Impact on the Economy

Fiscal deficit occurs when a government's total expenditures exceed its total revenues, excluding borrowings, leading to increased public debt. High fiscal deficits can trigger inflationary pressure, crowd out private investment, and cause higher interest rates, thereby slowing economic growth. Persistent fiscal deficits undermine fiscal sustainability and may erode investor confidence, affecting currency stability and long-term economic prospects.

Causes of Primary and Fiscal Deficits

Primary deficit occurs when a government's total revenue, excluding interest payments, is less than its expenditures, primarily caused by high public spending on welfare, subsidies, and infrastructure without equivalent revenue generation. Fiscal deficit includes interest payments on past borrowings along with primary deficit causes, stemming from excessive borrowing, unplanned expenditures, and lower tax collections. Structural issues like tax evasion, inefficient tax administration, and economic downturns often exacerbate both deficits, impacting the overall fiscal health.

Managing and Reducing Government Deficits

Managing government deficits requires distinguishing between the primary deficit, which excludes interest payments on debt, and the fiscal deficit, encompassing total government borrowing needs. Reducing the primary deficit through efficient expenditure control and enhanced revenue collection directly lowers the fiscal deficit by limiting the accumulation of new debt. Sustainable deficit management prioritizes structural reforms and targeted fiscal policies to balance spending and revenue, ensuring long-term economic stability.

Primary Deficit vs Fiscal Deficit: Which is More Significant?

Primary deficit measures the government's fiscal health by excluding interest payments on debt, highlighting the gap between current revenues and expenditures. Fiscal deficit includes interest payments, representing the total borrowing requirement and overall fiscal sustainability. Understanding the distinction is crucial, as a high primary deficit signals immediate budgetary imbalance, while a large fiscal deficit indicates growing debt servicing burdens.

Primary deficit Infographic

libterm.com

libterm.com