Stackelberg competition models strategic decision-making where one firm, the leader, sets its output first and the follower firms react accordingly, creating a sequential move game. This approach highlights the advantage of commitment and timing in competitive markets, influencing firms' production quantities and pricing strategies. Explore the rest of the article to understand how Stackelberg competition shapes market dynamics and your business strategy.

Table of Comparison

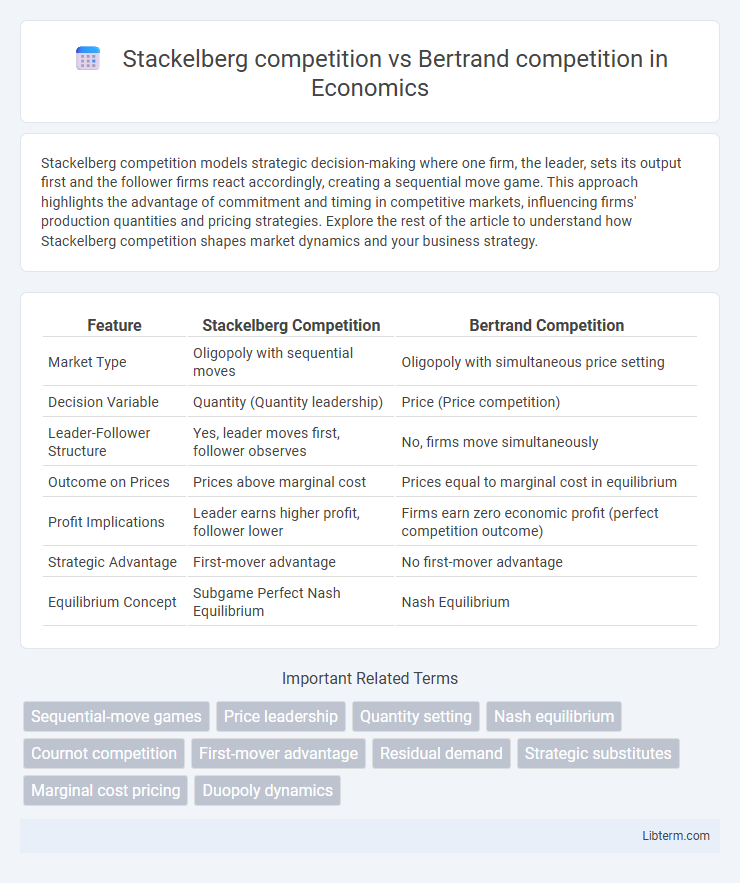

| Feature | Stackelberg Competition | Bertrand Competition |

|---|---|---|

| Market Type | Oligopoly with sequential moves | Oligopoly with simultaneous price setting |

| Decision Variable | Quantity (Quantity leadership) | Price (Price competition) |

| Leader-Follower Structure | Yes, leader moves first, follower observes | No, firms move simultaneously |

| Outcome on Prices | Prices above marginal cost | Prices equal to marginal cost in equilibrium |

| Profit Implications | Leader earns higher profit, follower lower | Firms earn zero economic profit (perfect competition outcome) |

| Strategic Advantage | First-mover advantage | No first-mover advantage |

| Equilibrium Concept | Subgame Perfect Nash Equilibrium | Nash Equilibrium |

Introduction to Oligopoly Market Structures

Stackelberg competition models a strategic oligopoly where firms sequentially decide output levels, with a leader firm moving first and followers reacting, influencing market quantities and prices. Bertrand competition assumes firms compete simultaneously by setting prices, leading to aggressive price undercutting and potentially driving prices down to marginal cost in homogeneous goods markets. These frameworks illustrate distinct firm behaviors in oligopoly markets, highlighting how timing and strategic variables shape competitive outcomes.

Defining Stackelberg and Bertrand Competition

Stackelberg competition involves firms competing sequentially, where the leader firm sets its output first, and the follower firms react accordingly, influencing market equilibrium. In contrast, Bertrand competition models firms competing simultaneously by setting prices, with consumers choosing the lowest-priced option, often driving prices down to marginal cost. These models capture different strategic interactions in oligopolistic markets, highlighting how timing and choice variables impact firm behavior and market outcomes.

Key Assumptions in Stackelberg vs Bertrand Models

Stackelberg competition assumes firms compete sequentially, with the leader setting output first and the follower observing this decision before choosing its output, emphasizing quantity-setting behavior. In contrast, Bertrand competition assumes firms choose prices simultaneously, leading to price as the strategic variable and often resulting in prices equal to marginal cost under homogeneous products. The Stackelberg model hinges on information asymmetry in timing, while the Bertrand model relies on simultaneous moves with perfect knowledge of demand and cost structures.

Strategic Decision-Making: Quantity vs Price Leadership

Stackelberg competition models strategic decision-making where firms sequentially choose quantities, with the leader firm setting output first and the follower firm reacting optimally to that quantity, emphasizing quantity leadership. In contrast, Bertrand competition assumes firms simultaneously set prices, leading to aggressive price competition where the firm with the lowest price captures the market, highlighting price leadership. The key strategic difference lies in how firms anticipate rivals' decisions: Stackelberg focuses on quantity commitment to influence market share, while Bertrand focuses on price-setting to undercut competitors.

First-Mover Advantage in Stackelberg Competition

Stackelberg competition grants the first mover a strategic advantage by allowing the leader to commit to an output level before the follower, influencing market quantities and prices to its benefit. This commitment enables the leader to capture a larger market share and secure higher profits compared to the simultaneous-move Bertrand competition, where firms compete on price without a temporal advantage. The first-mover advantage in Stackelberg competition fundamentally alters equilibrium outcomes, resulting in higher payoffs for the leader and constraining the follower's optimal response.

Price Wars and Equilibrium in Bertrand Competition

Bertrand competition leads to price wars where firms undercut each other's prices until prices reach marginal cost, resulting in zero economic profits at equilibrium. In contrast, Stackelberg competition involves sequential moves where the leader sets quantity first, avoiding the intense price undercutting seen in Bertrand models. The equilibrium in Bertrand competition is characterized by firms pricing at marginal cost, producing a highly competitive market outcome with minimal firm profitability.

Market Outcomes: Profits, Output, and Prices

Stackelberg competition typically results in higher total industry output and lower prices compared to Bertrand competition, as the leader firm commits to a quantity first, influencing the follower's output decision. In contrast, Bertrand competition models firms competing on price, often driving prices down to marginal cost and eliminating economic profits in equilibrium. Consequently, Stackelberg competition allows the leader to earn higher profits by strategically setting quantities, while Bertrand competitors earn zero economic profits assuming homogeneous products and identical costs.

Real-World Examples: Stackelberg and Bertrand Scenarios

Stackelberg competition is exemplified in industries like automotive manufacturing where a dominant firm, such as Toyota, sets output first, influencing smaller competitors' production decisions. Bertrand competition often occurs in retail gasoline markets where companies like Shell and BP simultaneously compete by setting prices to attract price-sensitive consumers. Real-world scenarios illustrate that Stackelberg models emphasize quantity leadership and follower responses, while Bertrand competition centers on aggressive price-setting strategies among firms.

Implications for Consumer Welfare and Public Policy

Stackelberg competition, characterized by sequential quantity-setting with a leader and follower, often results in higher prices and reduced consumer welfare compared to Bertrand competition, where firms simultaneously set prices leading to more aggressive price competition and lower prices. From a public policy perspective, encouraging market conditions that resemble Bertrand competition can enhance consumer surplus by promoting price competition and deterring monopoly pricing. Regulatory frameworks may need to address barriers to entry and information asymmetries that prevent firms from engaging in Bertrand-like competition, thus fostering markets with greater efficiency and consumer benefits.

Comparing the Limitations and Applications of Each Model

Stackelberg competition is limited by its assumption of a sequential move structure, which may not accurately reflect markets where firms act simultaneously, unlike Bertrand competition that assumes price-setting firms competing simultaneously but struggles with product differentiation and capacity constraints. Stackelberg models apply effectively in industries with clear leader-follower dynamics, such as manufacturing or energy markets, while Bertrand competition is more suitable for markets with homogeneous products and price-sensitive consumers, such as commodity goods. Each model's limitations affect their predictive accuracy, with Stackelberg better capturing strategic commitment effects and Bertrand providing insights into price undercutting and equilibrium in oligopolistic price wars.

Stackelberg competition Infographic

libterm.com

libterm.com