Yield represents the return on an investment, typically expressed as a percentage of the initial amount invested or the current market value. Understanding different types of yield, such as dividend yield, bond yield, and yield to maturity, is essential for making informed financial decisions. Explore the rest of this article to learn how mastering yield can enhance your investment strategy.

Table of Comparison

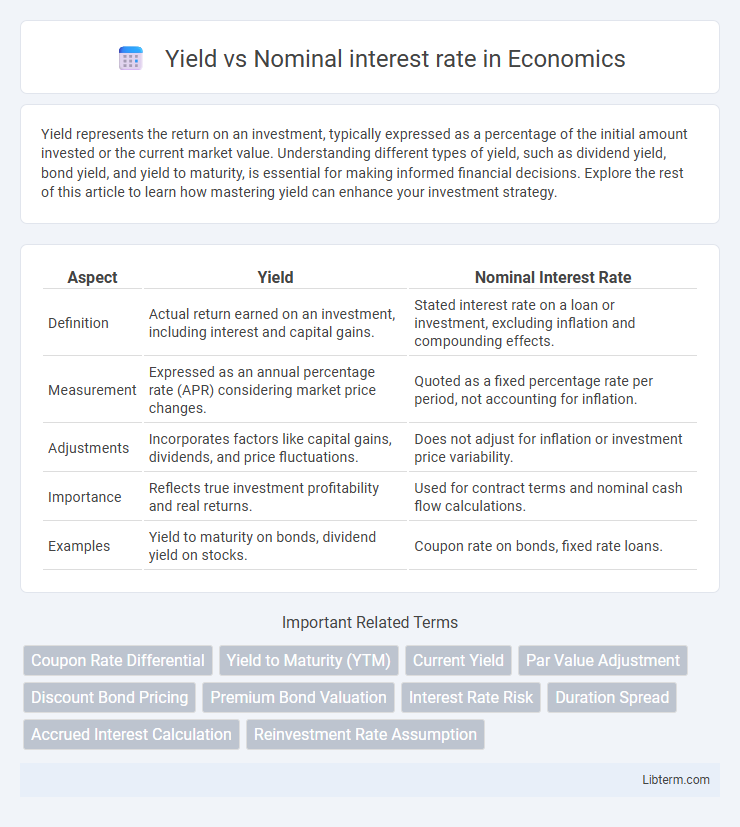

| Aspect | Yield | Nominal Interest Rate |

|---|---|---|

| Definition | Actual return earned on an investment, including interest and capital gains. | Stated interest rate on a loan or investment, excluding inflation and compounding effects. |

| Measurement | Expressed as an annual percentage rate (APR) considering market price changes. | Quoted as a fixed percentage rate per period, not accounting for inflation. |

| Adjustments | Incorporates factors like capital gains, dividends, and price fluctuations. | Does not adjust for inflation or investment price variability. |

| Importance | Reflects true investment profitability and real returns. | Used for contract terms and nominal cash flow calculations. |

| Examples | Yield to maturity on bonds, dividend yield on stocks. | Coupon rate on bonds, fixed rate loans. |

Introduction to Yield and Nominal Interest Rate

Yield represents the actual return on an investment, reflecting interest earned over time, including effects like compounding and market value changes. Nominal interest rate is the stated percentage rate on a loan or investment without adjusting for inflation or compounding. Understanding the distinction between yield and nominal interest rate is crucial for assessing true investment performance and comparing various financial products.

Definitions: Yield vs Nominal Interest Rate

Yield represents the actual return an investor earns from a bond or investment, accounting for factors like coupon payments, purchase price, and time to maturity. The nominal interest rate is the stated annual rate on a bond or loan, not adjusted for inflation or other factors. Yield reflects real profitability, while nominal interest rate serves as a basic reference rate without considering inflation or market fluctuations.

Key Differences Between Yield and Nominal Rate

Yield reflects the actual return on an investment, taking into account interest payments, compounding, and changes in bond price, while the nominal interest rate represents the stated or face value rate without adjustments for market factors. Yield fluctuates based on market conditions and time to maturity, whereas the nominal rate remains fixed as per the initial agreement. Understanding the distinction is crucial for investors assessing true profitability and comparing bond investments effectively.

Components Affecting Yield Calculation

Yield calculation incorporates several components beyond the nominal interest rate, including coupon payments, time to maturity, and market price of the bond. Factors such as accrued interest, reinvestment assumptions, and inflation expectations also significantly impact the yield. Understanding these elements provides a comprehensive picture of an investment's true return compared to the stated nominal rate.

Factors Influencing Nominal Interest Rate

Nominal interest rates are influenced by inflation expectations, the central bank's monetary policy, and the risk premium associated with the borrower. Changes in inflation expectations drive Nominal rates higher to protect lenders from losing purchasing power. Central banks adjust Nominal rates based on economic conditions, while risk premiums reflect the creditworthiness and default risk of borrowers.

Yield Measurement Methods

Yield measurement methods include current yield, yield to maturity (YTM), yield to call (YTC), and yield to worst (YTW), each offering distinct calculations to evaluate bond returns. Nominal interest rate represents the stated annual rate without accounting for compounding or inflation, while yield metrics incorporate market price, time to maturity, and payment schedules to reflect actual investor returns. Yield to maturity is widely regarded as the most comprehensive method, calculating the internal rate of return if the bond is held until maturity.

Real-World Examples: Yield vs Nominal Rate

A bond issued by a corporation offers a nominal interest rate of 5% annually, while inflation runs at 3%, resulting in a real yield of approximately 2%, which more accurately reflects the investor's purchasing power gain. In contrast, government treasury bonds often have nominal rates close to inflation, making their real yields near zero or even negative during periods of high inflation. Investors analyzing these real vs nominal interest rates use the Fisher equation to assess the true profitability of fixed-income investments in real-world economic conditions.

Implications for Investors and Borrowers

Yield measures the actual return on an investment, reflecting interest payments and any changes in the asset's price, while the nominal interest rate represents the stated rate without adjusting for inflation or market fluctuations. Investors prefer yield to assess the true profitability and risk of bonds or loans, as it accounts for real gains or losses, influencing portfolio decisions and risk management. Borrowers focus on nominal rates when evaluating loan costs, but yield consideration is crucial for understanding effective borrowing costs in varying economic conditions.

Yield and Nominal Rate in Different Financial Instruments

Yield represents the actual return earned on a financial instrument, reflecting interest payments and capital gains, while the nominal interest rate is the stated rate without accounting for inflation or other factors. In bonds, the yield can differ significantly from the nominal rate due to market price fluctuations and accrued interest. For savings accounts and loans, the nominal rate indicates the base interest, but the yield incorporates compounding frequency, affecting the effective return or cost.

Conclusion: Choosing Based on Financial Goals

Yield reflects the actual return on an investment after accounting for factors like compounding and market price changes, while the nominal interest rate represents the stated annual rate without adjustments. Investors prioritizing income stability and cash flow should focus on the nominal rate, whereas those seeking total return and growth might emphasize yield. Aligning the choice between yield and nominal interest rate with specific financial goals ensures optimized investment performance and risk management.

Yield Infographic

libterm.com

libterm.com