Speculative arbitrage involves exploiting price differences between related financial instruments to generate profit from market inefficiencies. It requires precise analysis and timely execution to capitalize on temporary discrepancies across various markets or assets. Explore the article to understand how speculative arbitrage strategies can enhance your trading outcomes.

Table of Comparison

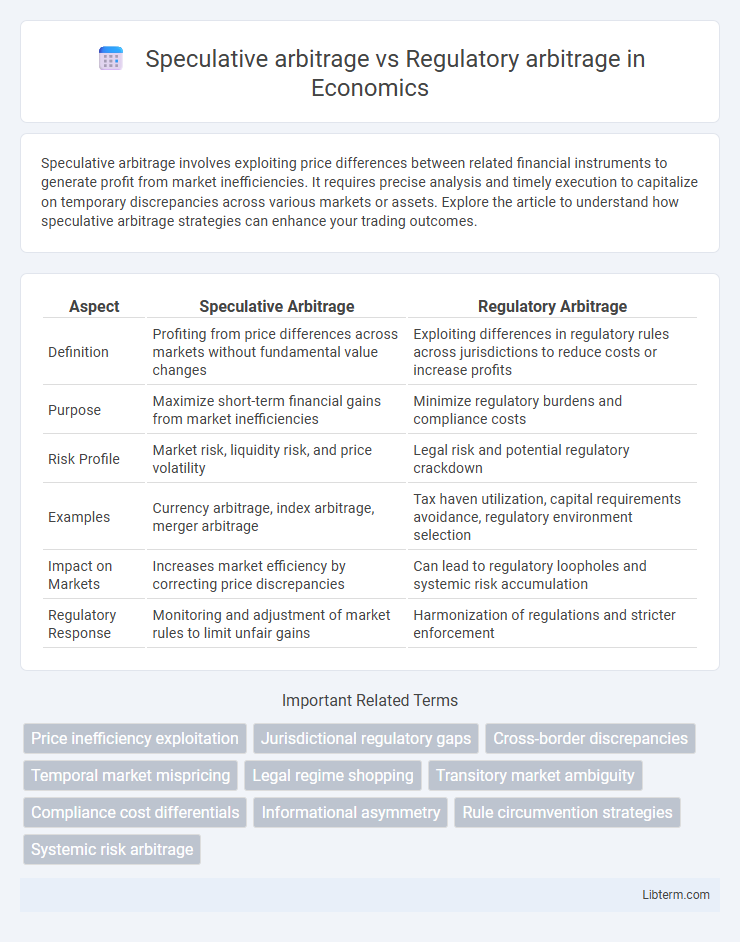

| Aspect | Speculative Arbitrage | Regulatory Arbitrage |

|---|---|---|

| Definition | Profiting from price differences across markets without fundamental value changes | Exploiting differences in regulatory rules across jurisdictions to reduce costs or increase profits |

| Purpose | Maximize short-term financial gains from market inefficiencies | Minimize regulatory burdens and compliance costs |

| Risk Profile | Market risk, liquidity risk, and price volatility | Legal risk and potential regulatory crackdown |

| Examples | Currency arbitrage, index arbitrage, merger arbitrage | Tax haven utilization, capital requirements avoidance, regulatory environment selection |

| Impact on Markets | Increases market efficiency by correcting price discrepancies | Can lead to regulatory loopholes and systemic risk accumulation |

| Regulatory Response | Monitoring and adjustment of market rules to limit unfair gains | Harmonization of regulations and stricter enforcement |

Introduction to Arbitrage in Financial Markets

Arbitrage in financial markets involves exploiting price discrepancies of identical or similar assets across different markets to generate risk-free profits. Speculative arbitrage leverages these opportunities by assuming market risk for potential gains, often involving complex derivatives or cross-asset strategies. Regulatory arbitrage occurs when firms exploit differences in regulations across jurisdictions to reduce costs or evade restrictions, impacting market efficiency and regulatory frameworks.

Defining Speculative Arbitrage

Speculative arbitrage involves exploiting price discrepancies between related assets to profit from anticipated market movements, often relying on forecasts and risk-taking strategies. It contrasts with regulatory arbitrage, which seeks to capitalize on differences in regulatory frameworks to reduce compliance costs or evade restrictions. Speculative arbitrage requires advanced market analysis and tolerance for asset volatility, emphasizing profit from price convergence rather than regulatory gaps.

Understanding Regulatory Arbitrage

Regulatory arbitrage involves exploiting differences in regulatory frameworks across jurisdictions to minimize compliance costs and maximize financial gains, often by relocating assets or operations to regions with more favorable rules. This practice can lead to significant cost savings but also raises concerns about regulatory loopholes and systemic risks, especially in the banking and financial sectors. Understanding regulatory arbitrage requires analyzing how firms strategically navigate complex legal environments to optimize operations without breaching regulations.

Key Differences Between Speculative and Regulatory Arbitrage

Speculative arbitrage involves exploiting price discrepancies across markets to generate profits through rapid buying and selling, emphasizing market-driven opportunities and risk-taking strategies. Regulatory arbitrage focuses on leveraging differences in regulatory frameworks between jurisdictions or sectors to minimize compliance costs or capital requirements, prioritizing legal and policy loopholes over market inefficiencies. Key differences lie in speculative arbitrage's profit-driven market exploitation versus regulatory arbitrage's cost-driven avoidance of regulatory constraints.

Mechanisms of Speculative Arbitrage

Speculative arbitrage exploits price inefficiencies across financial markets by rapidly buying undervalued assets and selling overvalued ones, aiming for profit without regulatory constraints. This mechanism relies on advanced algorithms, high-frequency trading, and real-time data analysis to identify and capitalize on fleeting discrepancies in asset prices. Unlike regulatory arbitrage, which circumvents rules to reduce costs or taxes, speculative arbitrage centers on market timing and liquidity to generate returns efficiently.

Strategies Employed in Regulatory Arbitrage

Regulatory arbitrage strategies involve exploiting differences in regulatory frameworks across jurisdictions by shifting assets, liabilities, or business operations to regions with more favorable rules to minimize compliance costs and maximize profitability. Firms often engage in regulatory capital arbitrage by structuring financial products or entities to reduce capital requirements without altering economic risk. Another key strategy includes regulatory reporting arbitrage, where companies selectively apply accounting standards or disclosure practices to create regulatory advantages.

Risks and Rewards: Speculative Arbitrage

Speculative arbitrage involves high-risk trading strategies that exploit market inefficiencies, often leading to substantial rewards but exposing investors to significant volatility and potential losses. This approach leverages price discrepancies across assets or markets, requiring advanced analysis and rapid execution to capitalize on fleeting opportunities. While the upside can be lucrative, the unpredictable nature of speculative markets increases financial risk and demands rigorous risk management.

Risks and Rewards: Regulatory Arbitrage

Regulatory arbitrage involves exploiting differences in regulations between jurisdictions to reduce compliance costs or gain competitive advantages, which can yield substantial financial rewards. However, this practice carries significant risks, including regulatory backlash, increased scrutiny, and potential legal penalties as governments harmonize rules or close loopholes. Firms engaging in regulatory arbitrage must balance the short-term gains against long-term reputational damage and evolving regulatory landscapes that may erode those benefits.

Case Studies: Real-World Examples

Speculative arbitrage in the 2008 financial crisis involved hedge funds exploiting price inefficiencies by short-selling mortgage-backed securities, generating substantial profits amid market turmoil. Regulatory arbitrage was exemplified by the 2010 BP Deepwater Horizon spill, where the company leveraged gaps in environmental regulations to minimize safety investments, resulting in catastrophic consequences. These case studies highlight how speculative arbitrage capitalizes on market dynamics for profit, whereas regulatory arbitrage exploits legal loopholes to reduce compliance costs, often at significant societal risk.

Future Trends in Arbitrage Practices

Speculative arbitrage leverages price discrepancies across markets for profit, while regulatory arbitrage exploits differences in legal frameworks to reduce costs or evade restrictions. Future trends indicate an increased reliance on advanced AI algorithms and blockchain technology to identify and execute arbitrage opportunities with greater speed and precision. Emerging global regulatory harmonization efforts may diminish regulatory arbitrage advantages but simultaneously create novel cross-jurisdictional speculative arbitrage strategies.

Speculative arbitrage Infographic

libterm.com

libterm.com