Real business cycle theory explains economic fluctuations through real shocks, such as changes in technology or productivity, rather than monetary factors. It emphasizes how these shocks impact labor supply decisions and investment, leading to variations in output and employment over time. Discover how this theory reshapes our understanding of economic cycles by exploring the rest of the article.

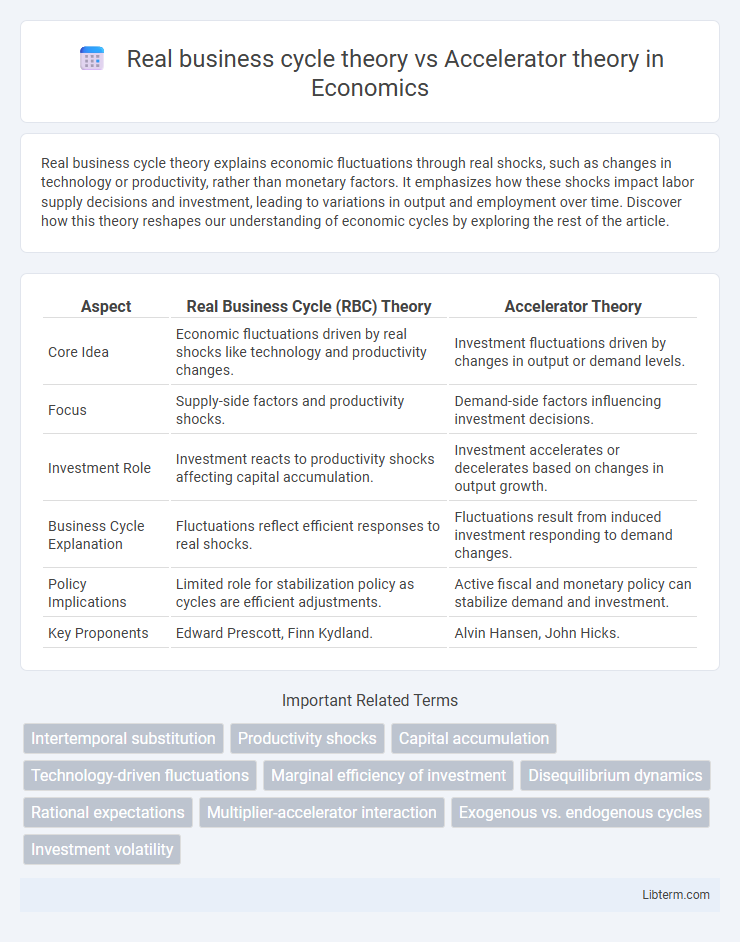

Table of Comparison

| Aspect | Real Business Cycle (RBC) Theory | Accelerator Theory |

|---|---|---|

| Core Idea | Economic fluctuations driven by real shocks like technology and productivity changes. | Investment fluctuations driven by changes in output or demand levels. |

| Focus | Supply-side factors and productivity shocks. | Demand-side factors influencing investment decisions. |

| Investment Role | Investment reacts to productivity shocks affecting capital accumulation. | Investment accelerates or decelerates based on changes in output growth. |

| Business Cycle Explanation | Fluctuations reflect efficient responses to real shocks. | Fluctuations result from induced investment responding to demand changes. |

| Policy Implications | Limited role for stabilization policy as cycles are efficient adjustments. | Active fiscal and monetary policy can stabilize demand and investment. |

| Key Proponents | Edward Prescott, Finn Kydland. | Alvin Hansen, John Hicks. |

Introduction to Real Business Cycle Theory and Accelerator Theory

Real Business Cycle (RBC) theory explains economic fluctuations through technology shocks impacting productivity and labor supply decisions, emphasizing real rather than nominal factors. Accelerator theory highlights investment changes driven by variations in output or demand, where increased production capacity fuels capital formation. Both models analyze business cycles but differ in identifying primary drivers: technology for RBC and demand-induced investment for the accelerator approach.

Core Principles of Real Business Cycle Theory

Real Business Cycle (RBC) theory centers on productivity shocks as the primary drivers of economic fluctuations, emphasizing how technological changes impact labor supply and capital accumulation over time. It assumes markets clear continuously, with agents optimizing intertemporal choices based on real variables without relying on monetary influences. Unlike Accelerator theory, which links investment directly to changes in output demand, RBC theory attributes business cycles to real shocks affecting the economy's production capacity and preferences.

Key Assumptions of the Accelerator Theory

The Accelerator Theory assumes investment is driven by changes in output rather than interest rates, positing a direct relationship between output growth and capital investment. It relies on the premise that firms adjust their investment levels to maintain a desired capital-output ratio, causing investment to fluctuate with changes in economic activity. This theory contrasts with Real Business Cycle Theory, which emphasizes technology shocks and intertemporal optimization by rational agents as primary drivers of economic fluctuations.

Differences in Explaining Economic Fluctuations

Real business cycle theory explains economic fluctuations primarily through technology shocks affecting productivity, emphasizing supply-side factors and rational expectations shaping output and labor variations. Accelerator theory attributes economic fluctuations to demand-side forces, where investment responds directly to changes in output growth, magnifying business cycles via capital accumulation adjustments. The key difference lies in RBC's reliance on real shocks and intertemporal optimization versus the accelerator model's focus on demand-driven investment dynamics influencing short-term economic volatility.

Role of Technology Shocks in Real Business Cycle Theory

Real Business Cycle (RBC) Theory emphasizes technology shocks as primary drivers of economic fluctuations, positing that positive innovations enhance productivity and output, leading to expansions, while negative shocks cause recessions. The RBC framework models these technology shocks as exogenous, persistent, and evolving through stochastic processes, directly impacting labor supply and capital accumulation decisions. In contrast, Accelerator Theory focuses on demand-driven investment changes responding to output variations, largely sidelining the role of technology shocks in explaining business cycles.

Investment Dynamics in the Accelerator Theory

The Accelerator Theory explains investment dynamics by linking changes in output or sales directly to investment levels, suggesting that a rise in demand accelerates capital expenditures to adjust production capacity. Real Business Cycle (RBC) theory attributes fluctuations in investment primarily to technology shocks affecting productivity, emphasizing how these external shocks influence capital accumulation over time. Investment in the Accelerator model responds more immediately to demand variations, whereas RBC theory highlights investment adjustments driven by fundamental changes in production efficiency.

Empirical Evidence and Real-World Applications

Real business cycle (RBC) theory finds empirical support through its explanation of economic fluctuations using technology shocks and productivity changes, with data showing correlations between output and labor productivity over business cycles. Accelerator theory is validated by observed investment behaviors that respond strongly to changes in output and demand, especially in industries with high capital adjustment costs. In real-world applications, RBC models inform long-term policy analysis by emphasizing supply-side factors, while accelerator theory aids in short-term investment forecasting and understanding cyclical capital expenditure patterns.

Policy Implications: Comparative Analysis

Real Business Cycle (RBC) theory emphasizes that economic fluctuations result from technology shocks and suggests limited government intervention, advocating for policies that enhance productivity and allow market forces to self-correct. Accelerator theory focuses on the relationship between investment and changes in output, implying that fiscal policies, such as government spending and investment incentives, can effectively stimulate economic activity during downturns. Comparative analysis reveals that while RBC theory prioritizes supply-side productivity improvements, accelerator theory supports demand-side fiscal measures to smooth business cycles.

Strengths and Limitations of Both Theories

Real Business Cycle (RBC) theory strengths include its foundation on microeconomic principles and its ability to explain economic fluctuations through technology shocks, offering a rigorous, data-driven approach that accounts for long-term growth and productivity changes. However, RBC theory's limitations lie in its often unrealistic assumptions of perfectly competitive markets and its inadequate explanation of short-term demand-driven fluctuations and monetary policy effects. Accelerator theory excels in capturing the role of investment dynamics responding to changes in output, providing intuitive insights into business cycle amplification, but it struggles with oversimplifying investment decisions and ignoring external shocks and structural factors influencing economic activity.

Conclusion: Synthesizing Insights and Contemporary Relevance

Real Business Cycle (RBC) theory explains economic fluctuations through technology shocks and productivity changes, emphasizing supply-side drivers, while Accelerator theory attributes investment dynamics primarily to demand-side changes, linking output variations to capital formation. Synthesizing insights reveals that modern macroeconomic analysis benefits from integrating RBC's microfoundations with the Accelerator's emphasis on demand-induced investment cycles for a more comprehensive understanding. This fusion enhances contemporary policy relevance by addressing both technological innovation impacts and demand fluctuations within economic stability frameworks.

Real business cycle theory Infographic

libterm.com

libterm.com