Classical dichotomy divides the economy into real and nominal variables, asserting that changes in the money supply only affect nominal variables like prices and wages without influencing real factors such as output or employment. This concept underpins many classical economic theories by emphasizing the neutrality of money in the long run. Explore the article to understand how classical dichotomy shapes modern economic thinking and policy.

Table of Comparison

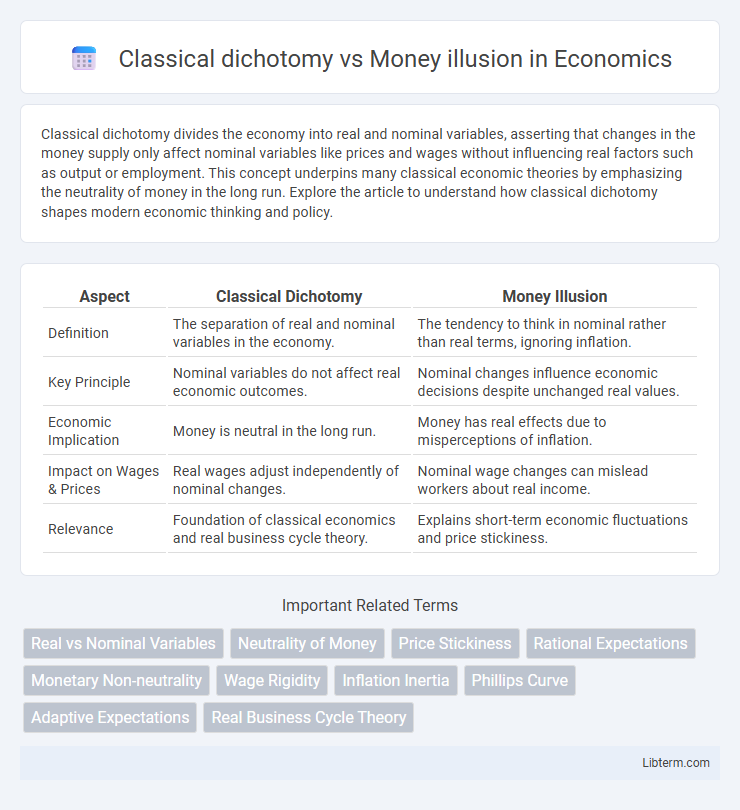

| Aspect | Classical Dichotomy | Money Illusion |

|---|---|---|

| Definition | The separation of real and nominal variables in the economy. | The tendency to think in nominal rather than real terms, ignoring inflation. |

| Key Principle | Nominal variables do not affect real economic outcomes. | Nominal changes influence economic decisions despite unchanged real values. |

| Economic Implication | Money is neutral in the long run. | Money has real effects due to misperceptions of inflation. |

| Impact on Wages & Prices | Real wages adjust independently of nominal changes. | Nominal wage changes can mislead workers about real income. |

| Relevance | Foundation of classical economics and real business cycle theory. | Explains short-term economic fluctuations and price stickiness. |

Understanding the Classical Dichotomy

The classical dichotomy separates real economic variables, such as output and employment, from nominal variables like money supply and price levels, asserting that changes in money supply only affect nominal variables in the long run without impacting real output. Understanding the classical dichotomy is crucial for analyzing why monetary policy may be neutral in the long term, emphasizing that real economic factors determine the real economy independently of monetary influences. This concept contrasts with money illusion, which occurs when individuals confuse nominal changes with real changes, leading to misperceptions about their economic well-being.

Defining Money Illusion

Money illusion occurs when individuals confuse nominal values with real values, failing to account for inflation's impact on purchasing power. Unlike the classical dichotomy, which separates real and nominal variables, money illusion leads people to react to changes in nominal wages or prices as if they directly affected real wealth. This psychological bias distorts economic decision-making by causing consumers and workers to overlook inflation-adjusted values.

Historical Context of Classical Dichotomy

The classical dichotomy, rooted in 18th and 19th-century economic thought, postulates a clear separation between real and nominal variables, influencing early macroeconomic models such as those by David Ricardo and John Stuart Mill. This concept emerged during a period when economists sought to understand price level neutrality, asserting that monetary factors affect only nominal variables without impacting real economic output or employment. The historical context underscores its role in shaping classical economics, contrasting with the later recognition of money illusion, where individuals incorrectly perceive nominal changes as real changes, thus challenging the classical assumption of perfect monetary neutrality.

Origins and Development of Money Illusion

Money illusion originates from early behavioral economics challenging the classical dichotomy, which asserts that real and nominal variables are separate in the long run. The term gained prominence through Irving Fisher's 1928 work, highlighting how individuals often confuse nominal changes with real value changes, affecting their economic decisions. Subsequent developments explored cognitive biases and psychological factors causing money illusion, contrasting sharply with classical theories emphasizing rational expectations.

Differences Between Real and Nominal Variables

Classical dichotomy separates real variables, such as output and employment, from nominal variables like money supply and price levels, asserting changes in nominal variables do not affect real economic outcomes. Money illusion occurs when individuals confuse nominal values with real values, mistakenly interpreting nominal wage or price increases as real gains. This distinction highlights that real variables reflect actual purchasing power, whereas nominal variables are influenced by inflation or deflation, leading to different economic interpretations and behaviors.

Classical Dichotomy in Modern Economics

The Classical Dichotomy in modern economics asserts that real variables, such as output and employment, are determined independently of nominal variables like the money supply or price level. This separation underpins long-run economic models where money is neutral, implying changes in the money supply solely affect nominal variables and do not influence real economic growth. Empirical studies in New Classical and Real Business Cycle theories reinforce the Classical Dichotomy by emphasizing that monetary policy impacts are temporary and that real factors govern long-term economic fluctuations.

Effects of Money Illusion on Economic Behavior

Money illusion causes individuals to misinterpret nominal changes in wages or prices as real changes, leading to distorted consumption and saving decisions. Unlike the classical dichotomy, which separates nominal and real variables, money illusion blurs this distinction, causing people to react to inflation as if it affected their real purchasing power. This behavior can result in wage rigidities, inefficient labor market outcomes, and suboptimal monetary policy effectiveness.

Critiques of the Classical Dichotomy

Critiques of the Classical Dichotomy emphasize its unrealistic assumption that real and nominal variables operate independently, ignoring money illusion where individuals confuse nominal and real values. Empirical evidence shows that prices and wages often adjust sluggishly, causing nominal shocks to influence real economic outcomes temporarily. Behavioral economics highlights money illusion effects, challenging the Classical Dichotomy's claim of neutral money in short-run economic fluctuations.

Relevance of Money Illusion in Macroeconomic Policy

Money illusion occurs when individuals confuse nominal and real values, leading to misperceptions of purchasing power and wage changes that distort economic behavior. This phenomenon challenges the classical dichotomy, which assumes real and nominal variables are separate and that money only affects nominal outcomes, thus complicating the effectiveness of macroeconomic policy. Policymakers must account for money illusion to better anticipate consumer responses to inflation and wage adjustments, ensuring stabilization efforts impact real economic activity as intended.

Integrating Classical Dichotomy and Money Illusion in Economic Analysis

Integrating classical dichotomy and money illusion in economic analysis enhances understanding of price level impacts on real variables by distinguishing between nominal and real effects while accounting for agents' behavioral biases. The classical dichotomy posits that money is neutral in the long run, separating real and nominal variables, whereas money illusion reveals that individuals often misinterpret nominal changes as real changes, affecting consumption and labor decisions. Combining these concepts allows economists to better model short-run deviations from neutrality and improve policy effectiveness by anticipating how misperceptions influence aggregate demand and real economic outcomes.

Classical dichotomy Infographic

libterm.com

libterm.com